Studies Archive

Growth in Alternate Site Infusion Providers Raises Questions Around Cost of Care and Access

June 4, 2023Key Takeaways

-

Chemotherapy treatments provided by alternate site infusion providers (e.g., pharmacy- and home-based settings) have increased, with 25% growth in outpatient chemotherapy treatment from 2014 to 2020.

-

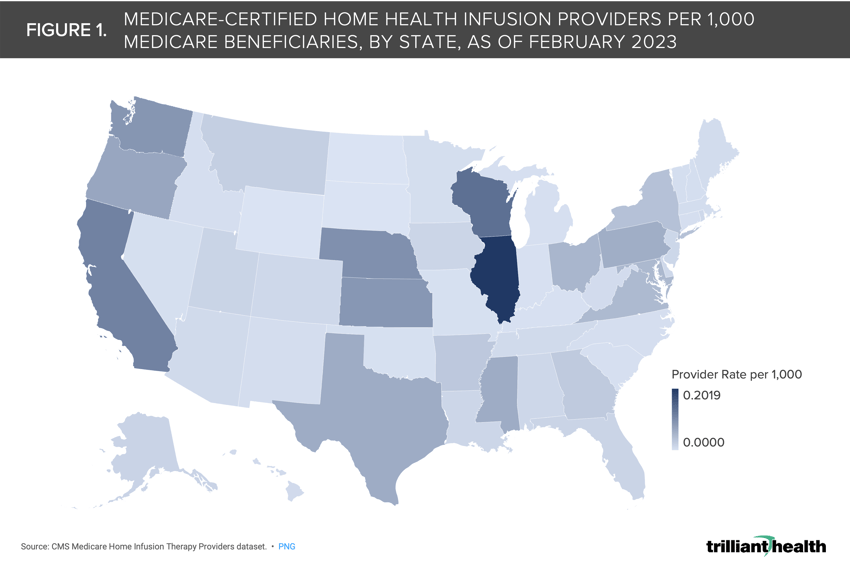

North Dakota, South Dakota, Wyoming, Indiana, Kentucky and Oklahoma have the lowest concentration of Medicare-certified home health infusion providers, whereas Oregon, Kansas, Washington, Nebraska, California and Illinois have the highest concentration.

-

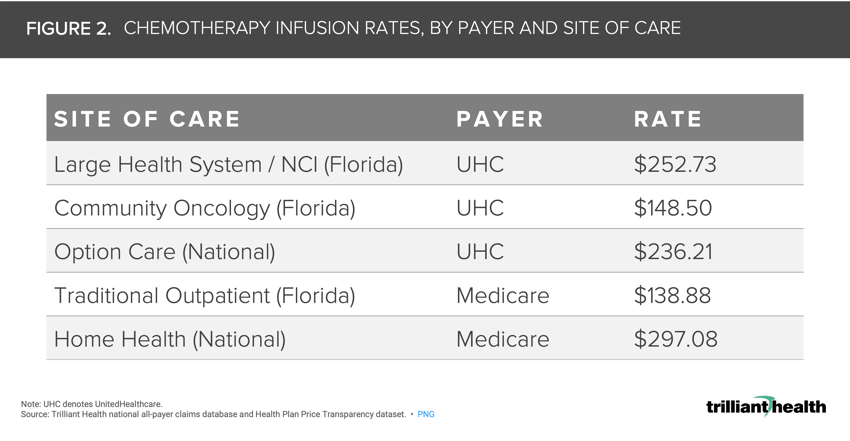

Chemotherapy infusion costs at select Florida-based facilities vary by payer type and site of care. Of these specific sites, while the UHC negotiated rate for community oncology chemotherapy infusions is only 6.5% higher than the Medicare rate ($148.50), the NCI rate is 81.9% higher ($252.73).

Our previous research has described the increasingly diverse options for receiving primary and low-acuity care.1 Similarly, patients have an increasing number of options to access specialty care—specifically chemotherapy infusions—in the form of alternate site infusion therapy providers.

Cancer patient preferences, reimbursement structures and typical sites of care will inevitably evolve alongside the changing treatment paradigm. However, research on the equitable distribution of non-traditional infusion settings and impacts on cost of care is limited.

Background

Chemotherapy treatments provided by alternate site infusion providers (e.g., pharmacy- and home-based settings) have increased, with 25% growth in outpatient chemotherapy treatment from 2014 to 2020.2,3 Industry analysts anticipate that both the ambulatory and home infusion market in the U.S. will grow consistently over the next five years, particularly for chemotherapy treatment.4,5

While diversification in setting of care has the potential to increase access and improve patient satisfaction, many community oncologists have expressed concerns about the ability to retain oversight of a patient’s treatment and care journey.6 Further, patient advocates and industry groups have warned against the lack of robust data on the safety and quality of alternate site chemotherapy infusions—particularly home infusion.7,8

Although the supply of alternate site providers is increasing, more research is needed to examine the distribution of these sites across the U.S., and understand service costs compared to traditional outpatient settings.

Analytic Approach

Leveraging the CMS Medicare home health infusion provider database, as of February 2023, we calculated the rate of Medicare home health infusion providers per 1,000 Medicare beneficiaries by state.

We then used our Health Plan Price Transparency dataset and the Medicare Physician Fee Schedule to compare the chemotherapy infusion costs across different sites of care based on rates from UnitedHealthcare (UHC), as a proxy for commercial health insurance, and Medicare.

To compare rates regionally, we identified sites of care to include a large Florida-based National Cancer Institute (NCI), a Florida-based community oncology practice, Option Care infusion centers and Medicare home infusion.

Specifically, we analyzed the negotiated rate for intravenous chemotherapy, 1st drug (CPT code 96413) for in-facility infusions; and in-home intravenous chemotherapy for an established patient (HCPCS code G0070) for home infusions.

Findings

The median Medicare-certified home health infusion provider rate was 0.013 per 1,000 Medicare beneficiaries (Colorado) and the average rate was 0.031 per 1,000 beneficiaries (Figure 1).

North Dakota, South Dakota, Wyoming, Indiana, Kentucky and Oklahoma have the lowest concentration of Medicare home health infusion providers, whereas Oregon, Kansas, Washington, Nebraska, California and Illinois have the highest concentration.

Prior research has demonstrated that commercial rates for the same service often vary significantly even within a state.9 The negotiated rates for home health, alternate site and traditional outpatient chemotherapy infusion undoubtedly range significantly across markets and health plans.

Chemotherapy infusion costs—not taking into account the specific drug—varied by payer type and site of care. Under Medicare, the traditional outpatient rate—inclusive of community oncology and NCIs—is $138.88, and the home infusion rate is 2X that at $297.08 (Figure 2).

However, while the UHC negotiated rate for community oncology chemotherapy infusions is only 6.5% higher than the Medicare rate ($148.50), the NCI rate is 81.9% higher ($252.73). Additionally, the alternate site infusion rate at Option Care is 70.1% higher than the Medicare rate.

This variation in negotiated rates reinforces the need to understand differences in quality and value across sites of care.

If both supply and demand for alternate site chemotherapy infusion continue to grow, health system-owned and third-party entrant alternate site infusion providers are likely to benefit. Conversely, physician-owned practices could face increased competition leading to increased consolidation among independent oncology providers.

Additionally, if alternate site infusion therapy settings do not expand equitably across markets—as evidenced by the lack of Medicare-certified home health providers in states like Wyoming and North Dakota—access to these providers will be limited for certain populations (i.e., rural and underserved populations).

Historically, payment structures have not kept pace with shifting patient preferences, and patients often are routed to the most cost-effective settings of care. As more quality and safety information is gathered around treatment administration at alternate site infusion therapy providers, it is possible benefit structures will evolve if results and costs are favorable.

Several recent data points suggest that the incidence of cancer is likely to increase in the next decade, which should prompt health economy stakeholders to consider how treatment paradigms must evolve in response.10,11,12 More research is needed to determine the impact on treatment cost and patient outcomes of alternate site chemotherapy infusions. Those insights will inevitably impact reimbursement and the rate at which these services continue to grow.

Thanks to Katie Patton, Kris Enloe and Cindy Revol for their research support.

- New Entrants

- Specialty Care

- Cost of Care

- Private Insurance

- Medicare & Medicaid

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)