Research

While Originally Intended for Consumers, Health Plan Price Transparency Will Ultimately Promote Value-Based Competition

May 21, 2023 12:01:00 AMNegotiated rates for in-network providers have long been the most closely guarded trade secret of health insurers, protected by confidentiality clauses and antitrust regulations. Historically, this information asymmetry has been enforced by the Federal government, with the Sherman Act forbidding disclosure of negotiated rates for healthcare services among other things.1 CMS’s Transparency in Coverage initiative, especially health plan price transparency requirements, is changing all of that.

The advent of true price transparency intersects with growing healthcare unaffordability in the U.S. Addressing unaffordability at scale requires bending the cost curve. As our research has demonstrated, healthcare CPI has consistently outpaced inflation since 2001 despite flat to declining demand over the same period.2,3 Effectively harnessing price transparency data would mark a major milestone in effectively addressing affordability and constrain the total cost of care in the U.S.

Background

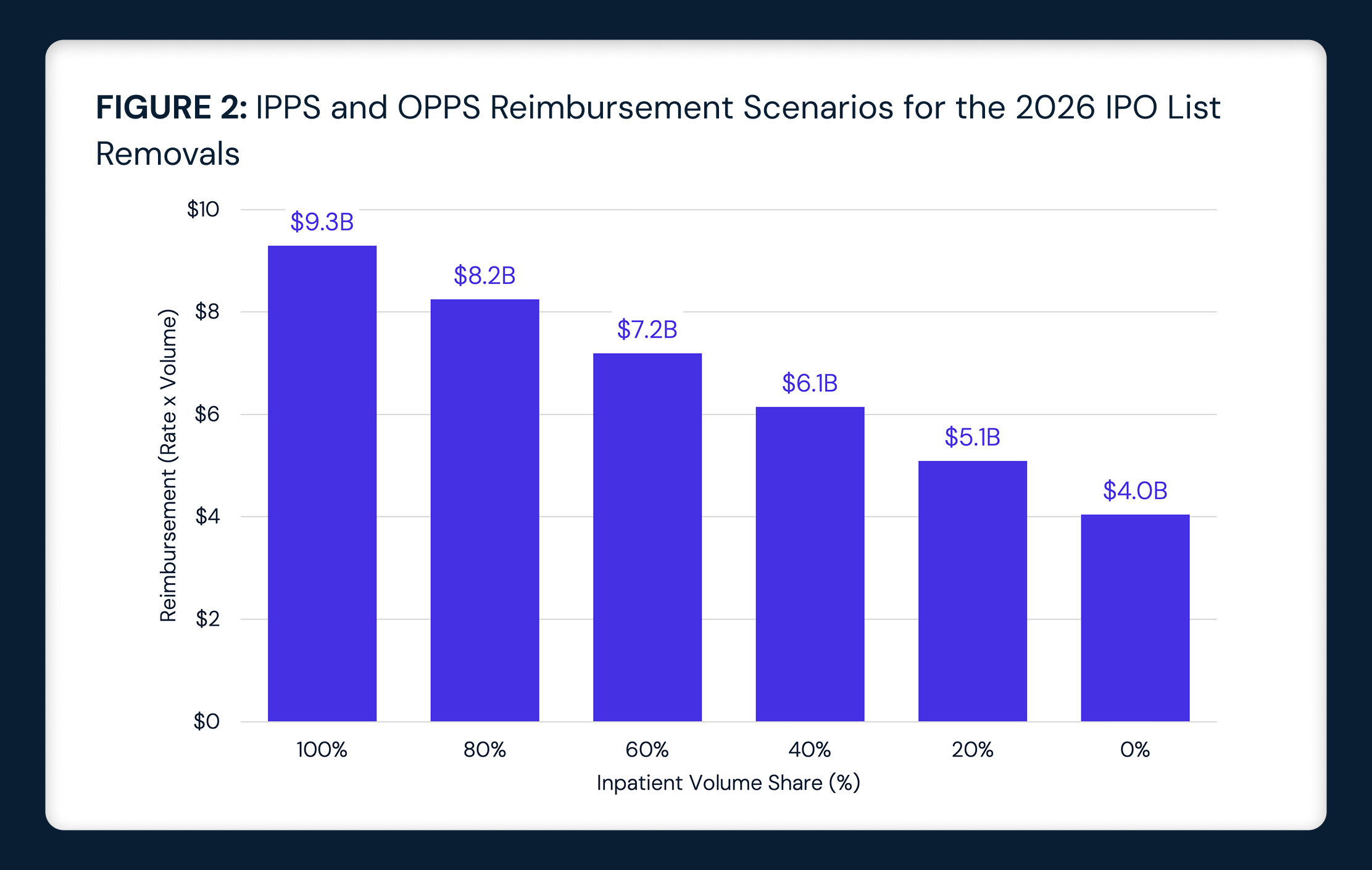

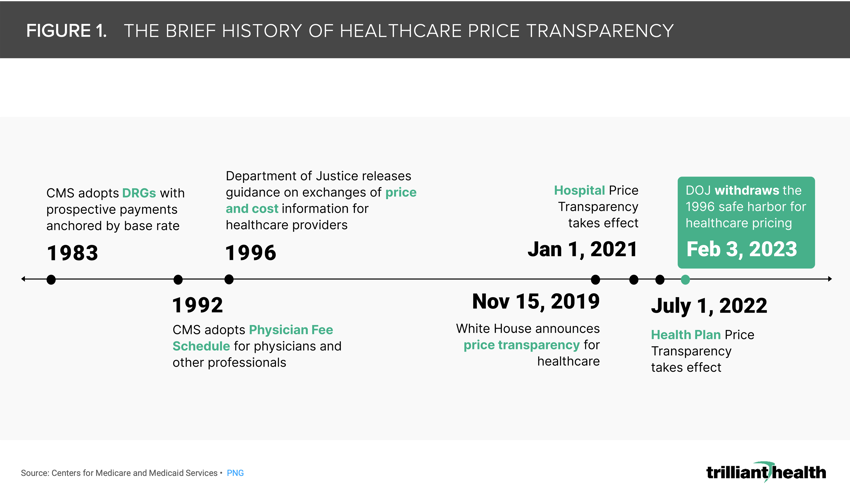

Between 2019 and 2020, CMS finalized rules that require hospitals and health plans release publicly available cost information for a broad set of healthcare services (Figure 1).4,5 Health plan price transparency is starkly different from hospital price transparency, for which requirements are limited to “standard charges” for 70 CMS-designated “shoppable services” and 230 hospital-selected items from chargemasters with more than 40,000 items. In contrast, health plan price transparency includes all covered items and services between the plan or issuer and in-network providers.

Hospital price transparency alone provides an incomplete picture. Beyond the uneven compliance by health systems with posting the data, the limited nature of the reported data—300 codes out of ~40,000 items on a typical hospital chargemaster—makes it clearly inadequate to inform consumers or health economy stakeholders. In contrast, the breadth and depth of the health plan rate data provide granular insight into the actual cost of specific healthcare services delivered by specific providers and entities.

Many commentators and analytics firms have publicly lamented the challenges of leveraging health plan price transparency data, and most data analytics experts would not consider the data to be “easily accessible.” The machine-readable file sizes alone present a barrier for standard computing power. Additionally, other limitations of health plan price transparency data are inherent to its self-reported nature and lack of an auditing process. The health plan price transparency files contain billions of “phantom rates,” meaning that health plans have posted thousands of negotiated rates for payment codes for every individual provider, regardless of whether they perform the service. For example, a health plan will post rates for cardiology services to the NPI of a physical therapist. The files also represent rate information for a point in time, rather than longitudinally. Even so, these data offer insights that were neither possible nor legal until now.

An abundance of the research conducted thus far has been focused on hospital price transparency, primarily due to the accessibility of the files despite the incomplete nature of the data. What hospital price transparency cannot provide is an understanding of the total cost of care, whether for a market, a facility, a provider group or a patient cohort. With health plan price transparency, total cost of care is no longer conceptual. As a result, the robust availability of negotiated rates will allow for competition to rely more on value (i.e., quality relative to price).

With our ability to query and understand our health plan price transparency dataset, we have started to understand the vast discrepancies in price in comparison to limited differences in quality across the U.S. for comparable services.

Analytic Approach

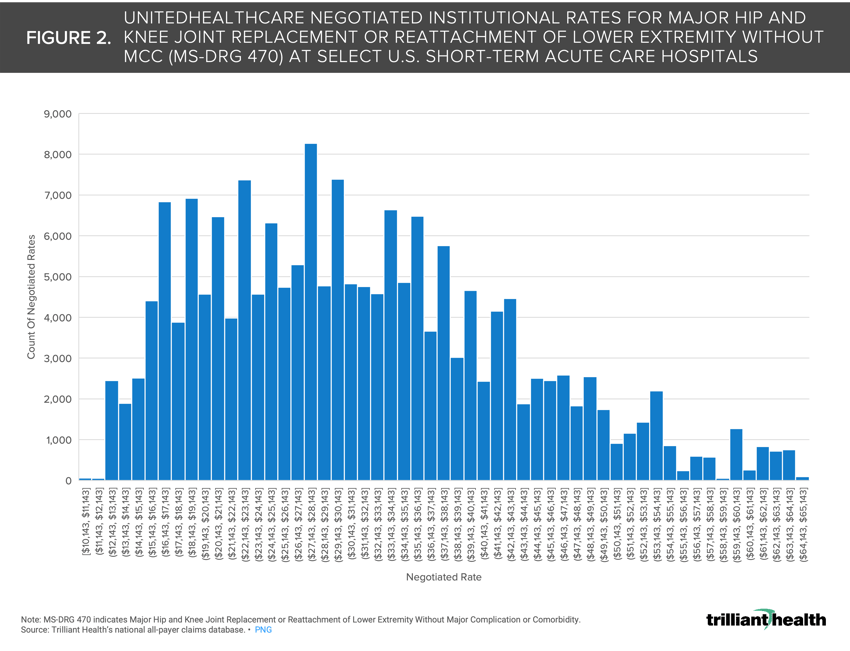

Leveraging our national all-payer claims database, Provider Directory, and our Health Plan Price Transparency dataset, we identified UnitedHealthcare institutional negotiated rates for MS-DRG 470 (i.e., Major Hip and Knee Joint Replacement or Reattachment of Lower Extremity Without Major Complication or Comorbidity). We selected UnitedHealthcare due to its national presence representing almost 50M covered lives.5 To compare rates at similar sites of service, we examined negotiated rates at a subset of 1,608 short-term acute care hospitals. We limited the range of negotiated rates based on Medicare reimbursement for MS-DRG 470 to avoid outliers, leveraging Medicare reimbursement to help standardize the range.

Findings

There is substantial variation in the negotiated institutional rates for MS-DRG 470 from UnitedHealthcare at U.S. short-term acute care hospitals. The negotiated rates range from $10,143 to $64,956 (Figure 2). While the median rate is $29,644, the most common rate is $27,650.

This level of variation in negotiated rates for a singular MS-DRG among a singular national payer—even with outliers excluded—is notable. Several factors (e.g., market competition, provider supply and state and local policies) can influence rate negotiations between a provider and a health plan. While analyzing the variation among a single payer provides important insights, analyzing all the payers operating in a given market will be crucial for negotiating power to shift towards value. For example, if a large employer knew what all providers in a market are paid and could access provider-level quality metrics, their negotiating leverage would increase, thus enabling them to design networks and benefits for specific providers at a lower cost for patients.

Health plan and hospital price transparency initiatives were designed to inform consumers about healthcare costs. However, the tools and resources resulting from these initiatives have been anything but consumer friendly. While consumers may be able to leverage this information in the future, health plan transparency requirements today instead hold the power to transform rate negotiation, forever changing how providers, payers, employers, and third-party administrators operate, and the negotiation dynamics between them.

Health plan price transparency should force health economy stakeholders to compete on cost and quality and access and convenience, which the rest of the economy knows are the elements of value.

Thanks to Matt Ikard, Colin Macon and Katie Patton for their research support.

- Cost of Care

- Private Insurance

- Quality & Value

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)

.png)