The Compass

Sanjula Jain, Ph.D. | March 5, 2023The COVID-19 Pandemic Amplified Feelings of Mistrust in and Frustration with the U.S. Healthcare System

Key Takeaways

-

Americans’ trust in the healthcare system had begun to wane before the COVID-19 pandemic, but the pandemic has exacerbated and deepened those feelings of mistrust.

-

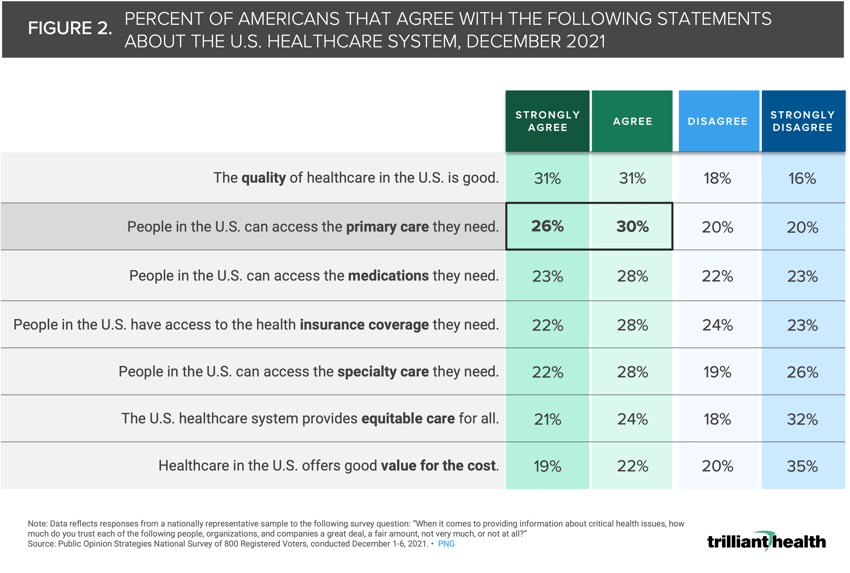

Fifty-six percent of Americans agree or strongly agree that individuals can access the primary care they need, suggesting that the observed declines in routine volume are likely driven in part by other reasons (e.g., fear, high deductibles, provider availability, system mistrust).

-

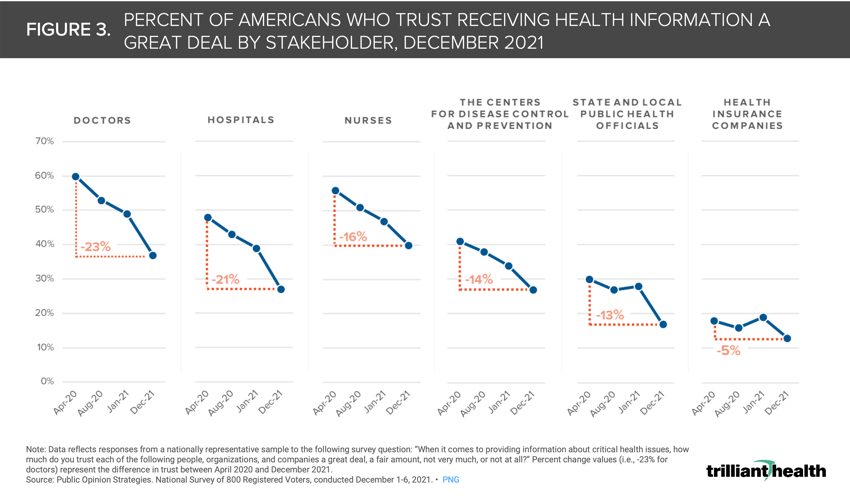

Of all health economy stakeholders, health insurance companies have long engendered the least amount of trust from consumers, with fewer than 20% of Americans trusting health plans. However, consumer trust in physicians and hospitals deteriorated more than any other part of the healthcare system during the pandemic, declining 23% and 21%, respectively, from April 2020 to December 2021.

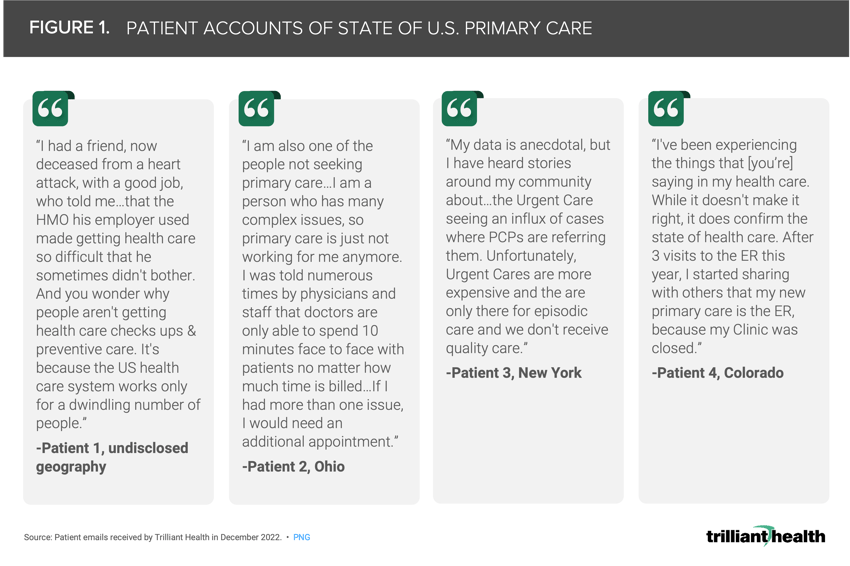

In December of last year, I authored an article for STAT First Opinion on the implications of deferred primary care in the wake of COVID-19.1 Surprisingly, a number of consumers reached out directly to me in response to share their personal patient journeys, most of which described their challenges in accessing primary care. For me, it was impossible not to connect their personal experiences to the survey data I had reviewed about the waning trust and growing frustration patients have in the broader U.S. healthcare system (Figure 1).

Background

Americans’ trust in the healthcare system had begun to wane before the COVID-19 pandemic, but the pandemic has exacerbated and deepened those feelings of mistrust. In a 2019 article in the American Journal of Managed Care, industry leaders discussed how confidence in the medical system had fallen more than 50% from 1975 (80% of Americans) to 2019 (38% of Americans).2 This magnitude of decline was greater than all other major U.S. institutions, including Congress and the media. It is likely that any progress made in garnering community trust prior to 2020 was reversed substantially with the onset of the pandemic.

Regaining consumer trust in the healthcare system post-pandemic is increasingly a focus in the C-suite, with an emphasis on the importance of remedying historical inequities in order to repair relationships with patients and community organizations and addressing patient perceptions of the “too big to care” mentality of ever-expanding health systems.3,4,5,6

No single factor has accelerated the fracturing trust in the healthcare system, which means that there is no single solution to the problem. The COVID-19 pandemic introduced new threats to trust such as conflicting messages from established institutions, untested treatments reported in research publications, concerns about political interference in public health recommendations, development and deployment of novel preventive and therapeutic treatments on a previously unimaginable timeline, inequitable access to care for disadvantaged communities and the spread of inaccurate information on social media, to name a few.7 In parallel, policy initiatives focused on price transparency, surprise billing, affordability of care and provider supply inadequacy have impacted consumer perception of America’s system of care. The convergence of these things, introduced into a society with 24/7 access to information, only exacerbated already declining trust in the healthcare institution.

Every stakeholder in the health economy, from individual clinicians to health systems to pharmaceutical companies, should be focused on initiatives to improve trustworthiness, with a sober acknowledgement that applying those principles systematically require time, resources and commitment from leadership.8,9

Survey-Based Findings on Trust

As our past research has revealed, declines in routine care utilization have continued in the post-pandemic era, but limited access alone does not explain this trend.10,11,12 Fifty-six percent of Americans agree or strongly agree that individuals can access the primary care they need, suggesting that the observed declines in routine volume are influenced by fear, high deductibles, provider availability and system mistrust (Figure 2).

Of all health economy stakeholders, health insurance companies have long engendered the least amount of trust from consumers, with fewer than 20% of Americans trusting health plans. However, consumer trust in physicians and hospitals deteriorated more than any other part of the healthcare system during the pandemic, declining 23% and 21%, respectively, from April 2020 to December 2021. This finding is in marked contrast to a 2019 survey conducted by Pew Research Center that revealed that 74% of consumers were generally positive towards physicians.13

No health economy stakeholder group (i.e., individual providers, major health systems, academic institutions, health insurers, local health agencies, life sciences, federal agencies) have been immune to the trend of waning American trust and general dissatisfaction with U.S. healthcare. The downstream impacts are already manifesting through flat patient volumes, particularly for preventive care, which is beginning to manifest in early signs of worsening acuity. The combination of declining consumer trust in an increasingly unaffordable healthcare system is yet another foreboding sign for the health status of Americans and the financial health of America. The root causes of patient discontent are different for every health economy stakeholder, and understanding those issues in detail will be essential to developing effective solutions for re-engagement.

Thanks to Katie Patton for her research support.

- Primary Care

- Healthcare Consumerism

- Quality & Value

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+