Studies Archive

Despite the Return to Pre-Pandemic Activities and Increasing Care Delivery Options, Routine Healthcare Utilization Remains Down

August 21, 2022Key Takeaways

-

Despite an overall return to pre-pandemic activities (e.g., travel) and the increase in new provider entrants (e.g., retail care), routine care volumes are lagging below pre-pandemic levels.

-

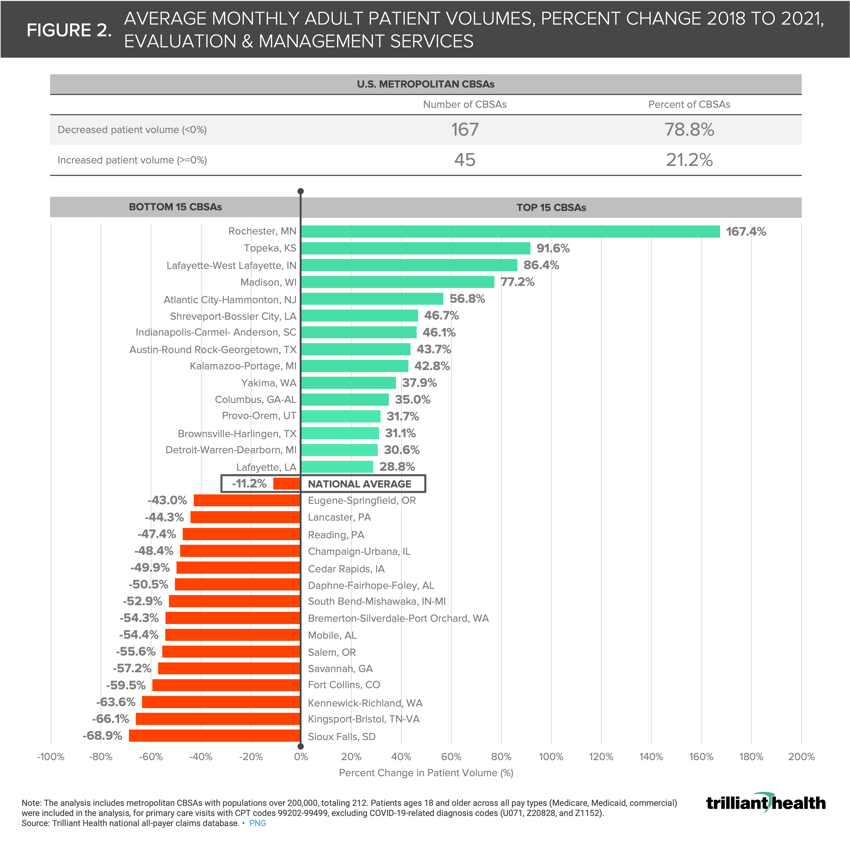

From 2018 to 2021, average patient volume for routine care was down 11.2%.

-

The percent change of average monthly patients from 2018 to 2021 ranges from -68.9% (Sioux Falls, SD) to +167.4 (Rochester, MN).

Much of our research this year has focused on utilization trends and the implications of delayed care stemming from the COVID-19 pandemic. It is evident that COVID-19 has fundamentally changed where, how, and how often Americans receive routine medical care, which has materialized differently across health economy stakeholders:

-

Providers: Sustained declines in patient volumes, increased variation in care delivery options (e.g., retail care, direct-to-consumer telehealth) revenues, and operating margins; 1

-

Payers: Potentially sicker future patient pools, risk adjustment changes, and increasing premium levels;2

-

Patients: Reduced recommended preventive care, more options for routine care, signals for worsening patient acuity;3,4

-

Pharma: Changes in medication adherence and potentially greater noncompliance as affordability concerns grow and new Medicare price negotiation and spending limits.5

In our analyses, we generally define routine care as evaluation and management (E&M) visits, not associated with COVID-19-specific diagnosis codes, with primary care providers.

A substantial number of surveys and polls have been conducted to ascertain whether Americans across ages and coverage arrangements have delayed care since 2020. 6,7,8,9 Although these surveys and polls offer useful information regarding the overall status of delayed care in the U.S., several limitations (i.e., small sample sizes, not representative of the U.S. or specific geographies, limited timeframes) and unanswered questions remain (e.g., has healthcare utilization “returned to normal” in any part of the country?). To address this research gap, it is necessary to study secular, macro-economic trends, and local market data.

Background

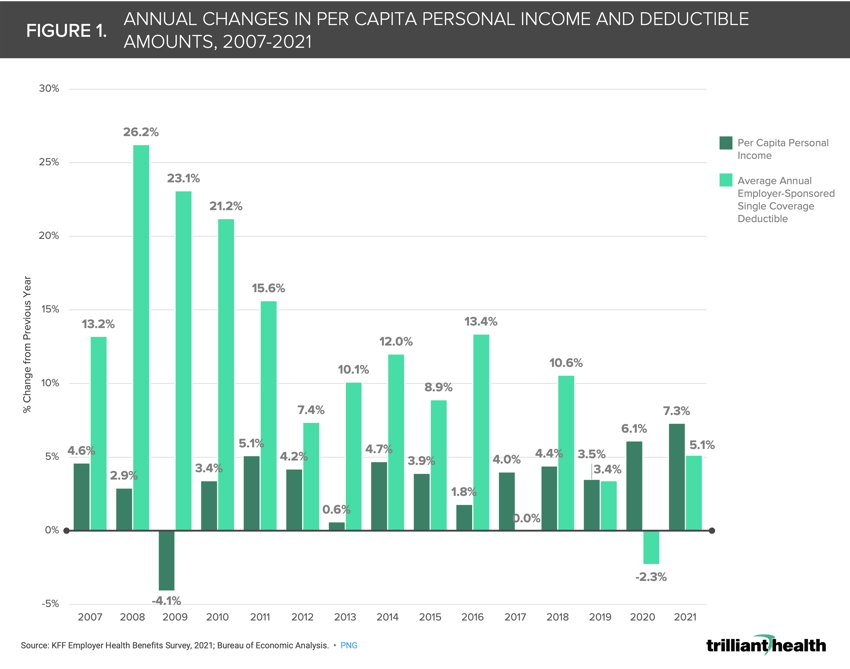

At the macro level, recent inflation is an obvious justification for the current state of healthcare utilization. Even so, it is logical that consumers struggling to afford groceries and gas might delay seeking care except in the most emergent situation. This rationale, however, is also susceptible to assuming consumers will revert to historical patterns of seeking healthcare services when inflation subsides. The cascading impact of rising deductibles is more likely the macro trend impacting care volumes given that deductibles in the employer market have consistently increased at a faster rate than average income levels in the last 15 years (Figure 1).

Finally, the declining trust in public health over the course of the pandemic is likely impacting volume trends in some manner.10

Finally, the declining trust in public health over the course of the pandemic is likely impacting volume trends in some manner.10

The interaction of macro factors with local market trends is essential to understand any regional variability in the return to routine “pre-pandemic” healthcare utilization. Healthcare is local, therefore the rate in which patients are “coming back” to the healthcare system will vary across markets.

Analytic Approach

Given the gap in understanding geographic variation of COVID-related delayed care, we analyzed patient volumes at the market (CBSA) level to understand the extent to which patients are seeking routine care as compared to the pre-pandemic levels. To exclude testing and treatment for COVID-19, we analyzed E&M visits, not associated with COVID-19-specific diagnosis codes, with primary care providers (i.e., “routine care”) for patients ages 18 and older across all pay types in metropolitan CBSAs with a population over 200K in 2018 and 2021.11 We then calculated the percent change in average monthly patient volumes from 2018 to 2021.

Findings

Of the 212 CBSAs included in the analysis, the percent change of average monthly patients from 2018 to 2021 ranges from -68.9% (Sioux Falls, SD) to +167.4% (Rochester, MN), averaging -11.2% nationally (Figure 2). Said another way, over 160% more patients in Rochester, MN pursued routine medical care each month in 2021, compared to 2018, whereas monthly patient volumes were almost 70% below pre-pandemic levels in Sioux Falls, SD. Just 45 CBSAs saw increased or unchanged average monthly patient volumes in 2021, with the remaining 167 CBSAs seeing lower overall patient volumes.

As Figure 2 demonstrates, most metropolitan markets are not experiencing a return to routine care, even though Americans continue to resume other activities like travel and returning to in-office work.12 Providers and payers alike need to also understand why individual patients are continuing to delay care.13 Who is still delaying due to rising healthcare costs and inflation? What frustrations and vulnerabilities exist within the healthcare system among patients who have continued delaying medical care? What are the preferred care delivery settings among patients who have delayed medical care? What messages will increase consumer willingness to re-engage with healthcare providers?

Additionally, all providers, both traditional healthcare providers (i.e., health systems) and new entrants (e.g., CVS, One Medical), must address new challenges for care coordination for patients who remain reluctant to seek routine care in the wake of the pandemic. Prior research showed a slight national uptick in primary care volumes for females ages 20-49, though there was still wide geographic variation.14 It is likely that decisions about seeking routine care vary across patient cohorts (e.g., gender, ages, pay type, race and ethnicity, and psychographic profiles), which should be explored in the future.

Despite the increasing convenience of healthcare, patients have yet to fully “come back.” Without incentives in place for patients across the health economy, the downstream shift in disease burden will have dire consequences for morbidity and mortality.

Thanks to Kelly Boyce, Austin Miller, and Katie Patton for their research support.

- Primary Care

- New Entrants

- Healthcare Workforce

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)