The Compass

Sanjula Jain, Ph.D. | August 28, 2022Mismatch Between the Supply of Virtually Enabled Providers Serving the Employer Market and Employee Demand

Key Takeaways

-

The number of virtually enabled healthcare companies entering the employer market is outpacing demand.

-

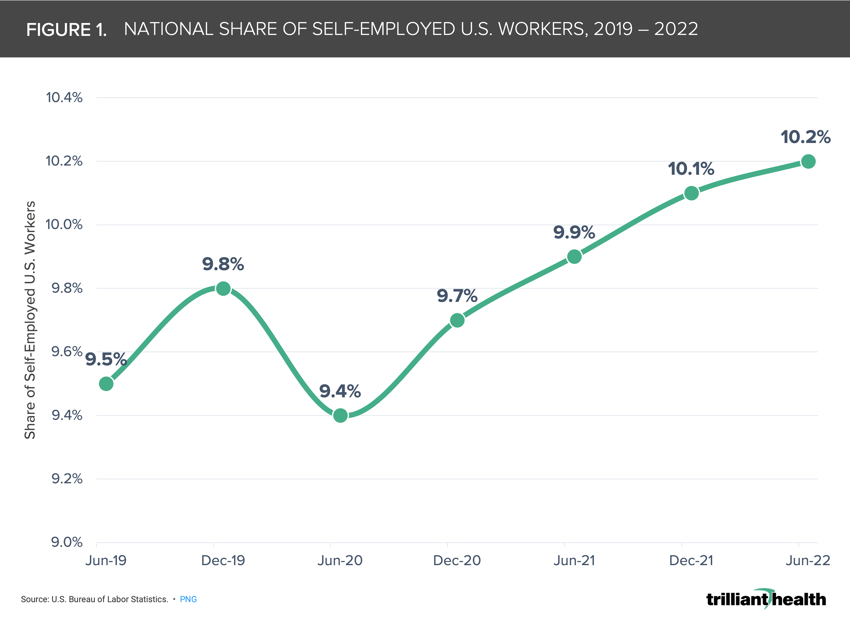

In addition to the declining number of commercially insured individuals, 10.2% of U.S. workers were self-employed as of June 2022, the highest proportion since 2008.

-

Amazon’s announcement to end operations of their virtually enabled platform, Amazon Care, may further signal the increasing difficulty of penetrating the employer-based insurance market for healthcare services.

Prior to the pandemic, large employers (e.g., Apple, Haven) were increasingly taking interest in managing employees’ health costs through expanded benefits. In parallel, the supply of employer-focused virtually enabled companies increased, galvanized by the artificial spike in telehealth demand at the pandemic’s onset.1 Given the pandemic temporarily – and in some cases permanently – shifted employee behaviors and individual preferences, it is important to study emerging supply and demand dynamics to understand the:

-

Downstream impacts on the employer-sponsored insurance (ESI) market; and

-

Potential opportunities for providers competing in the employer market.

Waning Demand for Employer-Based Services

The pandemic undoubtedly altered the state of America’s workforce, particularly through the Great Resignation.2 In May, 11.3M jobs were open and the rate at which workers quit their jobs rose from 1.6% in April 2020 to 2.8% in June 2022.3 Whether individuals are leaving their jobs due to lack of meaningful work or workplace flexibility, inadequate compensation, or pursuit of nontraditional roles, approximately 47M individuals quit their jobs in 2021.4,5,6

This exodus is compounded by the fact that 63% of workers delayed routine checkups and screenings over the last two years, despite an increase in care access (e.g., telehealth) and health benefits. Overall demand for healthcare services remains flat to declining, and the loss of ESI will only present additional barriers in returning to routine care.7

The question remains whether the Great Resignation will have a sustained impact on the ESI market, especially as the overall share of commercially insured Americans declines as a higher proportion of the U.S population ages into Medicare and excess mortality in younger age cohorts rise.8,9 Medicaid enrollment has also increased amid the pandemic, growing by 17M enrollees (23.9%) between February 2020 and April 2022.10 In addition, more workers are leaving traditional employment arrangements and becoming self-employed. In June 2022, 10.2% of U.S. workers (16.8M individuals) were self-employed, the highest proportion since 2008 (Figure 1).11 Self-employed individuals rely on the individual market for coverage, which saw record enrollment in 2022 (14.5M enrollees), in part due to federally funded premium subsidies which are now extended through 2025.12,13

Growing Supply of Employer-Focused Companies

Growing Supply of Employer-Focused Companies

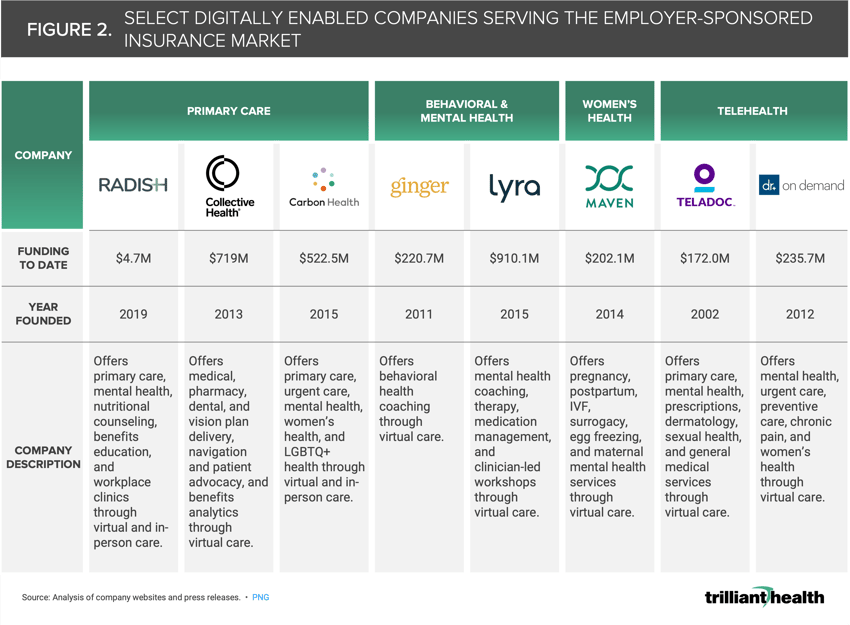

Despite shifts in coverage among employees, as of 2022, there are hundreds of virtual health companies looking to succeed in the ESI market, offering services ranging from primary care, mental health, and addiction, to care management services. While many of these companies were operational prior to the pandemic, most did not see increased investments until 2020 and 2021, as venture capital and private equity set their sights on virtual health (Figure 2).

Much of the temporary spike in telehealth demand at the height of the pandemic motivated investments in and the formation of new virtual care entrants. However, previous research suggests that telehealth is only a true substitute for behavioral health services, suggesting platforms offering behavioral health services may have more success in the employer market.14

Much of the temporary spike in telehealth demand at the height of the pandemic motivated investments in and the formation of new virtual care entrants. However, previous research suggests that telehealth is only a true substitute for behavioral health services, suggesting platforms offering behavioral health services may have more success in the employer market.14

Demand for virtually enabled services and the size of the ESI market will continue to shape the growth of this industry. Amazon’s recent announcement that it will be ending operations for Amazon Care at the end of 2022 serves as a timely example, citing the service is unsustainable and not a long-term solution for their customers (i.e., employers).15 Employees are consumers, and the success of these competing providers will hinge on their ability to cater to individual consumer preferences. For example, psychographics play a considerable role in understanding which consumers will be more inclined to use virtual care services.16,17 Understanding who and where those consumers are is pivotal to effectively penetrate the ESI market.

Finding success in the employer market has always been challenging and evidenced by the dissolution of Haven, the joint employer venture by Amazon, J.P Morgan, and Berkshire Hathaway. Companies like Walmart have acknowledged the complexities of employment churn stemming from the pandemic, which has already resulted in changes to their employee benefits strategies moving forward.18

The exodus of workers over the last two years altered the U.S. payer mix, which was already in flux due to the aging population, but notably in the employer market. Understanding the ever-changing coverage landscape is critical to ensure that all Americans, despite employment status, have access to the services they need. What will be the Great Resignation’s sustained impact on the ESI, and will that influence the viability of the oversupply of new entrants? Amazon is an organization that relies on data, leading it to make the evidence-based decision that Amazon Care was not viable for the employer market. But if Amazon sees the need to shift its strategy in the ESI market, what does that signal to others attempting to penetrate the market?

Thanks to Megan Davis and Katie Patton for their research support.

- New Entrants

- Virtual Care

- Private Insurance

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+