The Compass

Sanjula Jain, Ph.D. | August 14, 2022Telehealth Demand Continues to Decline, Posing Challenges for Telehealth Providers and Policymakers

Key Takeaways

-

59.2% drop in telehealth visit volumes from April 2020 to April 2022; suggesting that expanded availability of virtual care options has not shifted widespread consumer preferences.

-

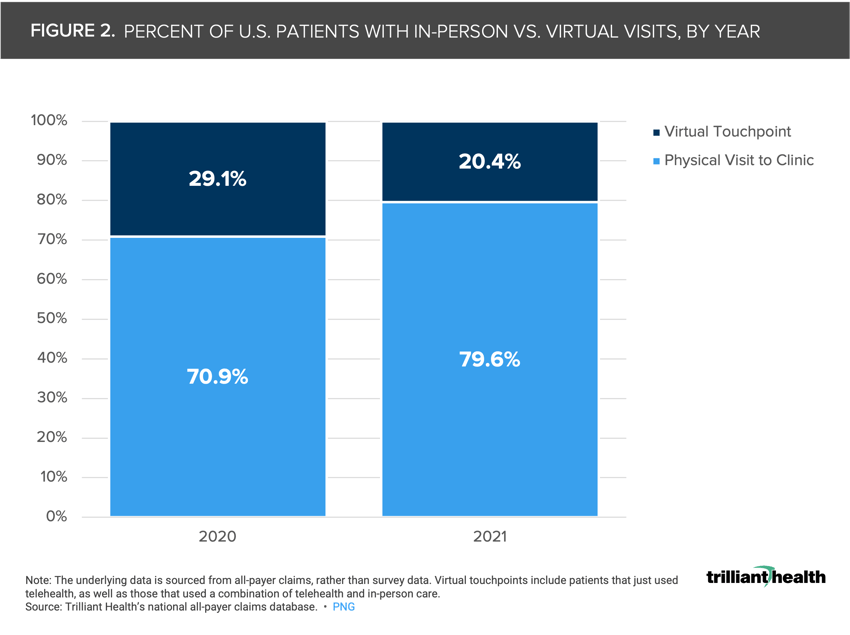

Consistent with other countries’ consumer preferences, almost 80% of Americans solely pursued in-person care in 2021.

-

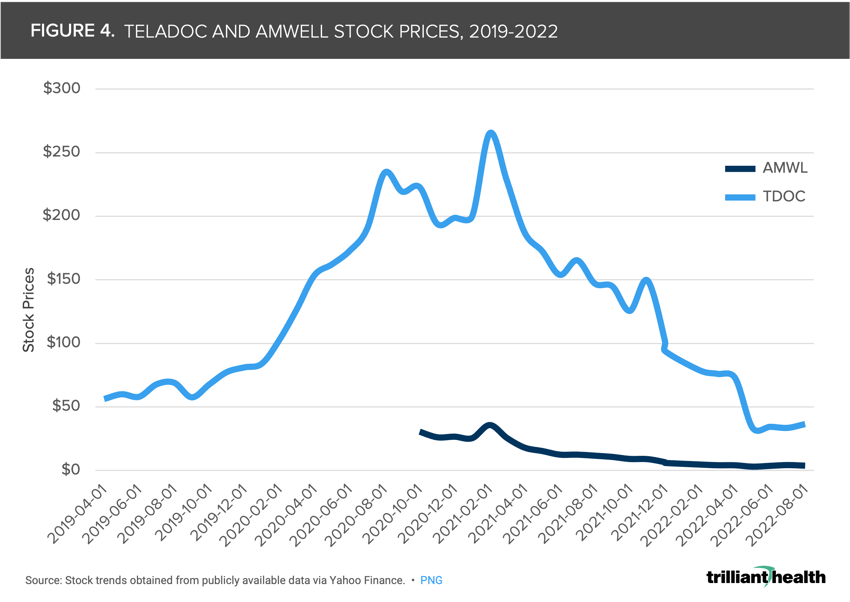

Wall Street also lacks enthusiasm about telehealth growth prospects, as evidenced by Teladoc’s and Amwell’s stock prices.

The drastic increase in telehealth use at the pandemic’s onset in 2020 led health economy stakeholders to rapidly expand telehealth capacity without having a clear picture of what future demand would be, who utilizes telehealth, where utilization is concentrated, or how patients prefer to access healthcare services.

The U.S. House of Representatives recently voted to extend certain Medicare telehealth provisions that were initially authorized during the declared COVID-19 public health emergency (PHE), most of which eliminated long-standing limitations on telehealth utilization.1 The proposal, which is now pending in the Senate, raised privacy and fraud concerns for some.2 With Congress now in the August recess and midterm elections in less than 90 days, it is unclear whether the Senate will act on the legislation in the near term. Notably, the proposal was passed even though many key questions about telehealth have yet to be addressed, such as:

-

Which beneficiaries (e.g., demographics, geography, psychographics) utilize telehealth most frequently?

-

For which service types is telehealth most commonly used, and how will service mix change beyond the PHE?

-

For which services is telehealth most clinically appropriate?

-

What is the clinical value and long-term impact on health outcomes derived from telehealth services?

Assuming that the PHE will eventually expire, which would result in an end to the Medicare telehealth provisions, and permanent extensions have not yet been enacted, we wanted to revisit a few key data signals underlying future demand.

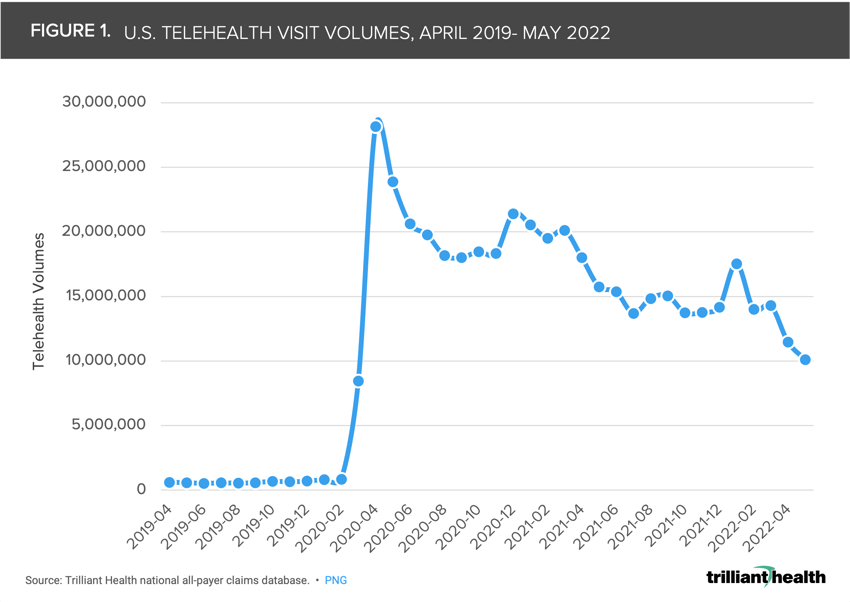

Signal 1. Telehealth demand over time

Our previously published national, longitudinal analysis of the ways in which Americans used telehealth from March 1, 2020 through November 30, 2021 concluded that current telehealth supply exceeds consumer demand.3 U.S. telehealth utilization reached its peak volume in April 2020. Since then, volumes primarily declined month-over-month, except for visit spikes in December 2020 and January 2022 (Figure 1). While visit volumes remain well above pre-pandemic levels, April 2022 visit volumes were 59.2% below that of April 2020.

Signal 2. Consumer preference

As the U.S. Congress considers long-term implications of telehealth expansion, it is important to remember that much of the current utilization (a key indicator for projecting future demand) data suggest that merely facilitating access (e.g., expanding audio-only telehealth, changing payment incentives) does not guarantee adoption.4,5

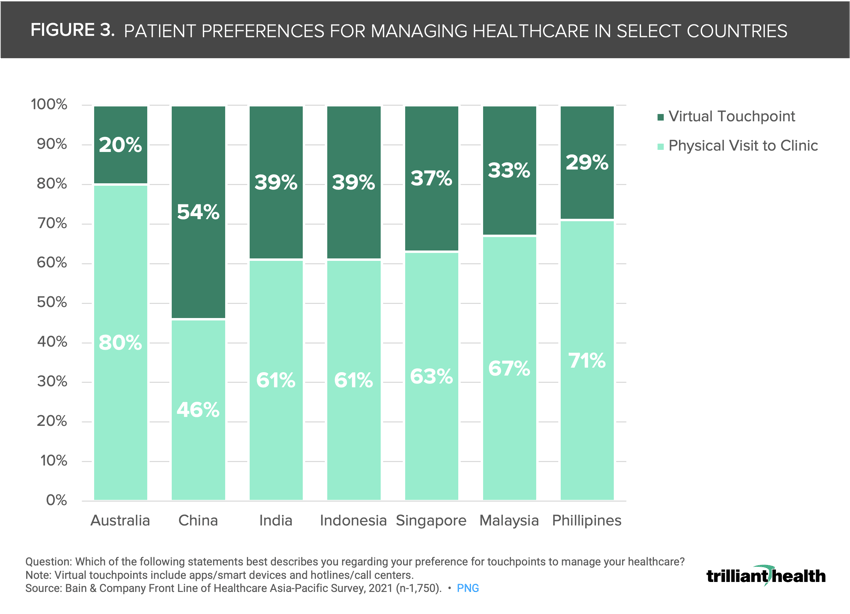

We see comparable trends in other countries that similarly adjusted telehealth policies and regulations in response to COVID-19. For example, Brazil adopted the Brazilian General Data Protection Law to accommodate telehealth while regulating the processing of personal data.6 India, similarly, implemented the Telemedicine Practice Guidelines in 2020, which outlines and expands telehealth practice parameters for medical professionals.7 Like the U.S., many countries experienced a pandemic-induced increase in telehealth utilization, and most consumers do not prefer telehealth as a mode of care.

While international data availability makes comparative analysis difficult, we know that (1) approximately one-quarter of Americans used telehealth at least once between 2020 and 2021, with utilization concentrated to a particular user type (i.e., females, commercially insured, located in suburban areas, behavioral health use cases); and (2) with the exception of behavioral health, when given the choice, most Americans prefer in-person care (Figure 2). Moreover, even as it relates to telehealth use within the Medicare population, we see similar user attributes (e.g., females).8 Initial qualitative data reveal a similar preference for physical over virtual visits in countries such as Australia, India, Singapore, Malaysia, and the Philippines (Figure 3). In fact, in select countries, such as Australia, consumer preference for physical visits is higher now than in 2019. Conversely, preference for virtual care among Chinese consumers increased from 2019 to 2021.9

Signal 3. Telehealth supply

Signal 3. Telehealth supply

Beyond utilization trends, additional market data suggest future demand is unlikely to match the current growth in telehealth supply. During the pandemic, many brick-and-mortar healthcare providers launched their own telehealth capabilities.10 Amazon’s recent $3.9B acquisition of One Medical presents further competition for companies like Teladoc, as the merger would supply both in-person and virtual healthcare services.11 Wall Street also lacks enthusiasm about telehealth growth prospects, as evidenced by Teladoc’s and Amwell’s stock prices (Figure 4).

Patients may want to continue their care exclusively with an established primary care provider, given their access to past medical history and the stability of an established relationship.12 Long-term, Gen Z poses a significant barrier to virtual-first healthcare, as 62% prefer to communicate with their provider in-person.13 The declining demand for telehealth as evidenced by utilization, consumer preferences, and stock prices explains the waning focus on investments in telehealth companies as more healthcare returns to provider offices. The month-to-month variation in telehealth visit volumes coincide with major pandemic milestones, such as the FDA endorsement of Pfizer and Moderna vaccines and the emergence of the Omicron variant. Changes in telehealth demand require a quantitative analysis of both the supply of telehealth services and historical telehealth volumes.

Telehealth demand has yet to level out, which poses important questions for health economy stakeholders. Direct-to-consumer telehealth providers will have a staunchly different mindset than traditional providers and health systems. These stakeholders need to know not only why they are losing vs. retaining certain patients, but who those consumers are. Health systems, alternatively, require a service line-specific approach, to determine which points in a patient’s journey (e.g., follow-up visits to bariatric surgery) are not only most clinically appropriate but also appealing to their patient population. Are health systems ready to accommodate the changes in consumer care preferences?14

Thanks to Katie Patton, Kelly Boyce, and Megan Davis for their research support.

- Virtual Care

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+