The Compass

Sanjula Jain, Ph.D. | November 20, 2022Individuals are Consumers and How They Navigate the Health System Varies

Key Takeaways

-

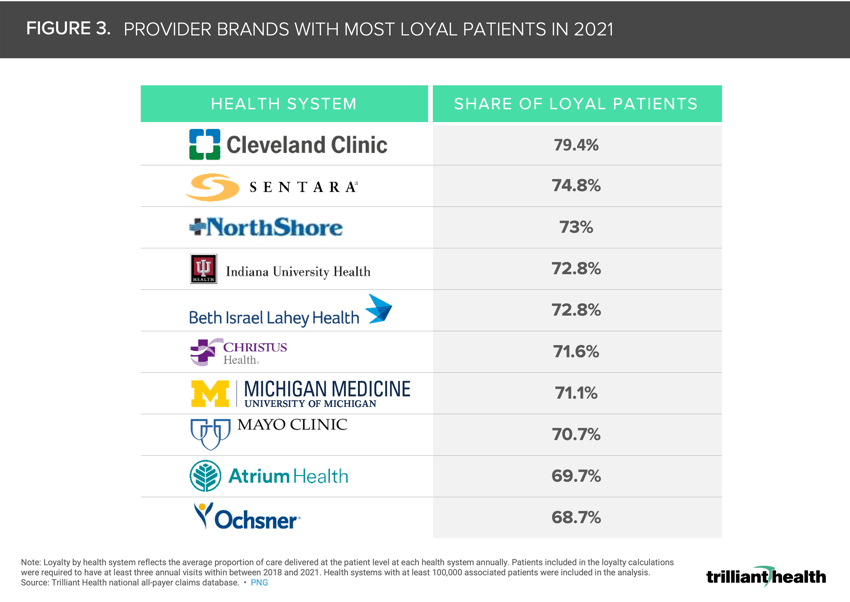

In comparison to pre-pandemic utilization, men and women have returned to care at different rates and in different settings, with men disproportionately using urgent care (+71.6%) and women returning to care in non-hospital outpatient settings at a higher volume (+11.8%).

-

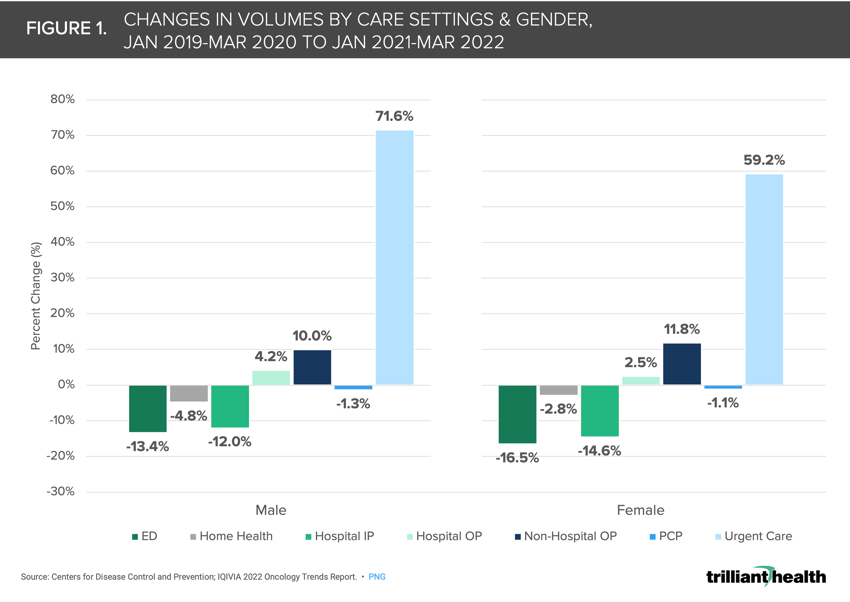

Consumers in competitive and moderately concentrated markets tend to visit a greater number of provider brands -- 4.57 and 4.43 respectively -- than those in highly concentrated markets (4.14 provider brands).

-

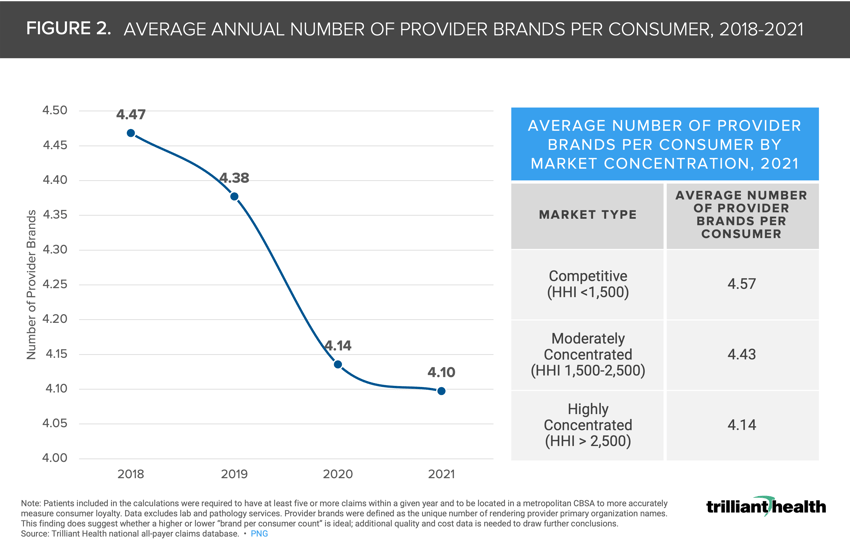

Among large health systems, Cleveland Clinic had the largest share of “loyal” patients at 79.4%.

Previously, we discussed the what, when, and where associated with historic and forecasted U.S. healthcare demand.1 It is equally important to understand who is accessing healthcare, how they utilize different care settings, and why they make those decisions. The emergence of new entrants in healthcare (e.g., Amazon, Walmart) is accelerating increasing healthcare consumerism. Earlier this week, Amazon launched Amazon Clinic, a self-pay direct-to-consumer healthcare marketplace platform, only weeks after shuttering its Amazon Care initiative, an employer-focused offering.2,3

Many new entrants, particularly those with a retail background, compete with traditional providers for lower-acuity services based on price and location, allowing patients to act more like consumers in accessing care.4,5,6,7,8 Healthcare providers who understand the psychology underlying a consumer’s decision-making process are better equipped to earn their loyalty and route patients to both an appropriate and preferred setting of care.

How Individuals Access the Healthcare System Varies

Individuals navigate the healthcare system uniquely based on personal preferences and health status, which negates a one-size-fits-all (e.g., assuming all Medicare beneficiaries will interact similarly with providers). By analyzing specific segments of the population (e.g., age and gender cohorts), we can assess how different patient cohorts access the healthcare system and understand behavioral changes in the wake of the COVID-19 pandemic.

Our analysis reveals that in comparison to pre-pandemic utilization, men and women have returned to settings of care at different rates, with men disproportionately using urgent care (+71.6%) and women returning to care in non-hospital outpatient settings at a higher volume (+11.8%) (Figure 1). Across all age and gender cohorts, hospital inpatient volumes decreased significantly compared to pre-pandemic (between -16.1% and -10.1%), while hospital outpatient volumes increased slightly (between 2.1% and 4.2%), in part due to patients opting for non-hospital settings to avoid contracting the virus.9 Moreover, the reasons behind the variable return to care do not align with the pre-pandemic status quo. Factors including fear, high deductibles, lack of provider loyalty, and consumer preferences contribute to post-pandemic variations in care.

Patients Are Increasingly Making Healthcare Decisions Like Consumers

Patients Are Increasingly Making Healthcare Decisions Like Consumers

More patients are acting as consumers when making decisions about their health. With an abundance of virtual, retail, and tech-enabled entrants, patients can essentially “shop” for providers to choose where they will receive care, from whom, through what modality, and at what price. Providers must acknowledge the differences in consumer choices by understanding the psychology behind the decision-making process (i.e., psychographics).10,11 For example, Direction Takers, characterized by the belief that physicians are the best source of health information and are more inclined to seek care in traditional care settings (e.g., clinic-based primary care). In contrast, Willful Endurers tend to avoid the healthcare system and opt for urgent care or retail clinics as their preferred sites of care. Providers who recognize the influence of consumer psychology in accessing healthcare will be better equipped to attract and engage with consumers. Of course, as healthcare consumers are presented with more options, the more challenged providers will be to maintain loyalty and coordinate care.12,13

While the average number of provider brands that each patient sees in a year decreased from 4.47 to 4.10 from 2018 to 2021, which is primarily attributed to patients avoiding care during the pandemic, consumers continue to “split” their care across provider brands as more care options become available (Figure 2). Notably, consumers in competitive markets (i.e. more options) tend to visit a greater number of provider brands (4.57) than those in highly concentrated markets (4.14).

From a health system perspective, patient loyalty varies significantly. Healthcare consumers are classified into one of three categories based on the amount of a patient’s care attributable to a single provider network. “Loyal” healthcare consumers receive more than 70% of their care from a single provider network, “splitters” receive 30-70%, and those “not loyal” attribute less than 30% of their care to a single provider network.14 Among large health systems with the most loyal patients, patient loyalty ranges from 68.7% at Ochsner Health System to 79.4% at Cleveland Clinic (Figure 3).

From a health system perspective, patient loyalty varies significantly. Healthcare consumers are classified into one of three categories based on the amount of a patient’s care attributable to a single provider network. “Loyal” healthcare consumers receive more than 70% of their care from a single provider network, “splitters” receive 30-70%, and those “not loyal” attribute less than 30% of their care to a single provider network.14 Among large health systems with the most loyal patients, patient loyalty ranges from 68.7% at Ochsner Health System to 79.4% at Cleveland Clinic (Figure 3).

Patients are increasingly making healthcare decisions like consumers and how they interact with the healthcare system varies by population segment. Identifying who is utilizing healthcare services, how they’re accessing care, and why provides an indicator for future demand, demonstrated in part through changes in pre- and post-pandemic channels of care. Each population segment, whether measured by age or gender, illustrates the variation in care which must be acknowledged and understood by providers that are optimistic about retaining patient loyalty. Stakeholders in already competitive markets must be prepared for increased competition from new entrants as consumers in these markets have less loyalty to more provider brands. If platforms like Amazon Clinic’s marketplace structure are successful, the dynamics of traditional healthcare delivery will only fragment further.

This analysis is part of our deep-dive series into the 2022 Trends Shaping the Health Economy.

- Healthcare Consumerism

- Patient & Provider Loyalty

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+