The Compass

Sanjula Jain, Ph.D. | October 16, 2022Characterizing the Patient Populations of New Entrants | Part 3: Walmart

Key Takeaways

-

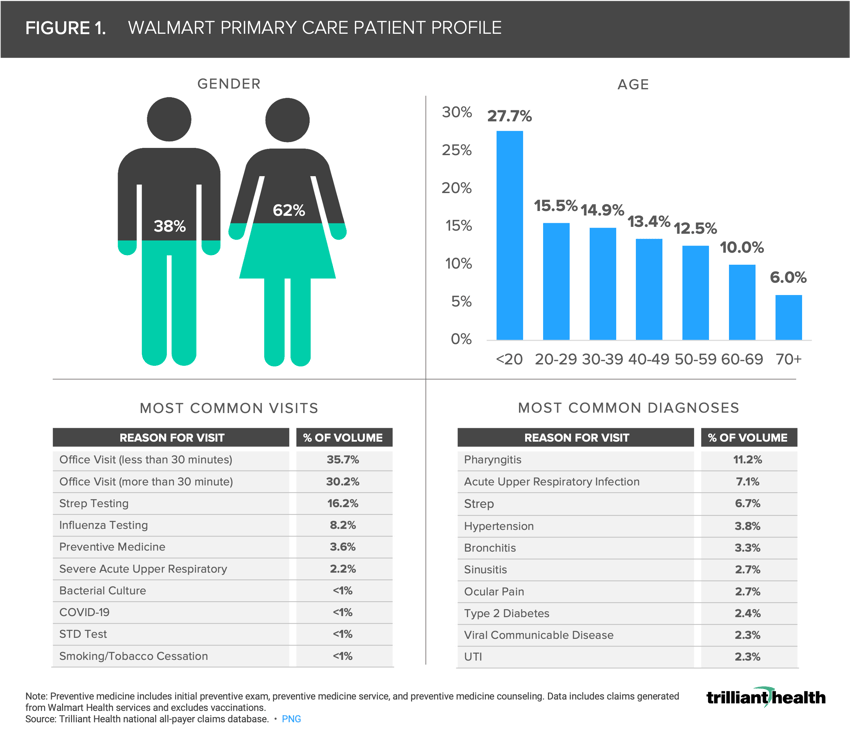

Of the patients receiving healthcare services via Walmart, 43% are younger than 30 years old and 62% are female.

-

Walmart stays loyal to its “everyday low prices” slogan by offering health services at a significantly lower price than other retail entrants.

-

An integrated approach to healthcare allows Walmart patients to receive coordinated care by an interdisciplinary team of professionals, ranging from pharmacists and physicians to nutritionists.

In parts one and two of our “Characterizing the Patient Populations of New Entrants” series, we analyzed care patterns at CVS Health and Walgreens, to begin to understand their respective patient populations and care delivery capabilities.1,2 In the third edition of the ongoing series, we take a deeper dive into Walmart and its expansion into the primary care market.

Background

Walmart opened its first pharmacy in 1978 and operates more than 5,000 pharmacies today.3 In 2019, Walmart expanded its healthcare offering with the launch of Walmart Health, which includes primary and urgent care, laboratory, x-rays and diagnostics, counseling, dental, optical, and hearing services, with transparent pricing for each service.4 Consistent with its “everyday low prices” slogan, Walmart Health is significantly less expensive than CVS Health and Walgreens. For example, a flu test at CVS Health costs between $70 and $100, while patients at Walmart Health only pay $20.5,6 Operating inside Walmart retail stores, Walmart Health locations include a broad continuum of primary care services. For example, a Walmart Health patient who is diagnosed with diabetes will be connected to an on-site nutritionist to accompany the patient through the Walmart grocery department and provide guidance on lifestyle care-management strategies for their chronic condition. Walmart continues to expand its footprint and services offerings, targeting a broader demographic population than its competitors that includes younger patients who are likely to be more price-sensitive or underinsured, as well as Medicare beneficiaries, particularly in rural areas.7

Walmart recently announced a 10-year partnership with UnitedHealth Group to provide value-based preventive care for Medicare-eligible consumers, offering dietary guides, cancer screenings, and primary care visits through multiple Medicare Advantage plans.8 Walmart’s commitment to providing quality care for underserved areas and populations is evidenced by its recent launch of the Walmart Healthcare Research Institute, which would help increase access to studies and clinical trials for older adults, rural residents, women, and minority populations.9

In 2021, Walmart increased its healthcare presence through the acquisition of MeMD, now known as Walmart Health Virtual Care, a multi-specialty telehealth provider offering primary, urgent, and behavioral health services.10,11 “Walmart Health Virtual Care is an important element of Walmart Health, and today’s significant milestone brings us one step closer to delivering our mission to increase access to quality healthcare and deliver it to customers when, where and how they want it,” said David Camouche, M.D., Walmart’s senior vice president of omnichannel care.12

On a smaller scale, Walmart and Oak Street Health (Oak Street) have teamed up to expand Oak Street’s primary care model in Dallas-Fort Worth, Texas. Similar to Walmart Health’s intent to bring quality healthcare to underserved areas and populations, Oak Street seeks to increase its network of care for the Medicare population.13 Walmart represents a small part of Oak Street’s business, yet the partnership reflects a joint mission of bringing primary and preventive care to populations in need.

Analytic Approach

To better understand who seeks healthcare services at Walmart and why, we leveraged our national all-payer claims database to identify medical services accessed at Walmart locations across a sample of six states. We examined Walmart Health services-associated claims from Walmart locations from 2019 to the present. Among this patient panel, we characterized age, gender, as well as the most common reasons for medical visits.

Findings

The average patient seen by Walmart is 31 years old, which is 17.1 years younger than Walgreens and 7.5 years younger than CVS. Consistent with CVS and Walgreens, Walmart’s patient population is majority female (62.4% female: 37.6% male).

The most common diagnoses among Walmart patients are pharyngitis (11.2%), acute upper respiratory infection (7.1%), strep (6.7%), and hypertension (3.8%). The reasons for seeking care at Walmart differ from both Walgreens and CVS patient panels. While preventive medicine accounts for double-digit amounts of volume at CVS and Walgreens (39.7% and 17.5%), preventive medicine at Walmart accounts for just 3.6% of volume, behind strep and influenza testing (16.2% and 8.2%).

The entrance of retailers like Amazon, CVS, Walgreens, and Walmart in the healthcare market coupled with the evolving preferences of healthcare consumers for convenient and affordable care present notable challenges for traditional healthcare providers. First, despite significant expansion in healthcare access points over the past five years, preventive and primary care volumes have yet to return to pre-pandemic levels.14 While Walmart Health has announced impressive initiatives like fully integrated care under one roof and preventive services for people 65 and above with UnitedHealth Group, the impact of such services won’t be quantifiable until more patients participate. Second, the proliferation of new primary care entrants will likely disrupt traditional referral relationships between primary care and specialist physicians and between physicians and hospitals. Third, as Americans increase the number of providers from whom they seek primary care services, the more challenging care coordination will be.

Walmart hopes to distinguish itself from other retail entrants through a commitment to bringing quality healthcare to underserved populations with transparent pricing. Will Walmart’s large and loyal customer base embrace Walmart’s healthcare offerings or maintain pre-existing relationships with other providers? Will consumers, despite the new entrant’s supply of services, continue to delay care? Will rural Americans be more amenable to receiving care at Walmart than urban Americans? Will Walmart’s low and transparent pricing increase the utilization of preventive services in the Medicaid population? Can retailers permanently shift the state of the primary care physician and established patient relationships?

Thanks to Megan Davis and Austin Miller for their research support.

- Primary Care

- New Entrants

- Healthcare Consumerism

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+