Counterpoint

Hal Andrews | July 4, 2023The Mythical Pricing Power of Monopoly Health Systems

Last July, I wrote about the fallacy of using the Herfindahl-Hirschman Index for healthcare antitrust.

Over the years, much has been written about how monopolistic hospitals and health systems bully payers into providing premium rates, which has increasingly served as the basis for aggressive antitrust enforcement by Federal and state government. The Congressional Budget Office (CBO) describes the problem this way:

“The high prices that commercial insurers pay for hospitals’ and physicians’ services result from several factors, primarily the market power of providers and the limited sensitivity of consumers and employers to those prices.”1

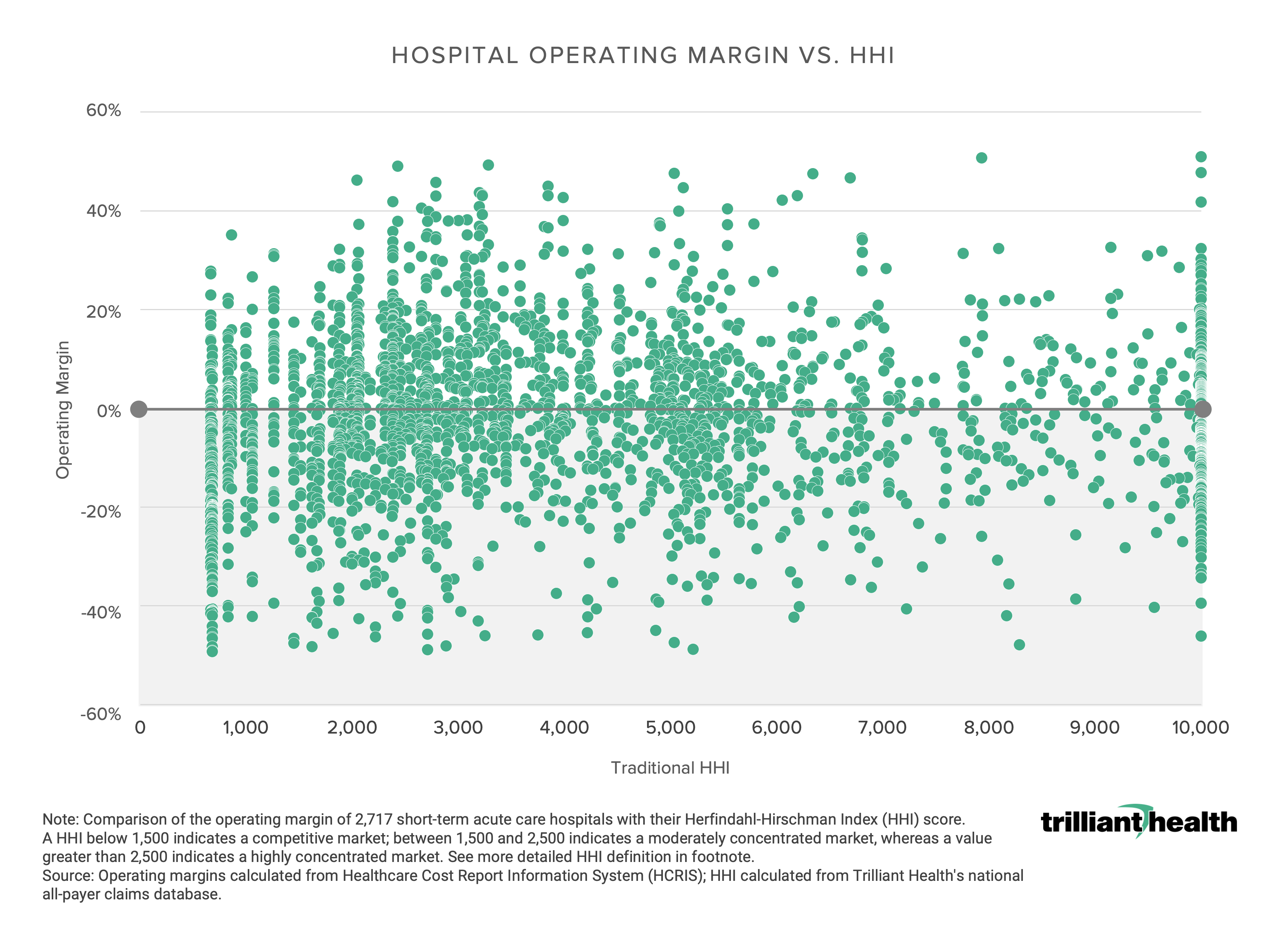

In last year’s Trends Shaping the Health Economy, we utilized data from the Healthcare Cost Report Information System (HCRIS) to question that narrative:

Prior to the advent of health plan price transparency pursuant to the Centers for Medicare & Medicaid Services’ (CMS) Transparency in Coverage initiative, it was not possible to know whether the assertions by the CBO and many others were true. In last month’s Counterpoint, I promised to share more analysis of this narrative, because if those assertions are inaccurate, the implications for antitrust enforcement are staggering.

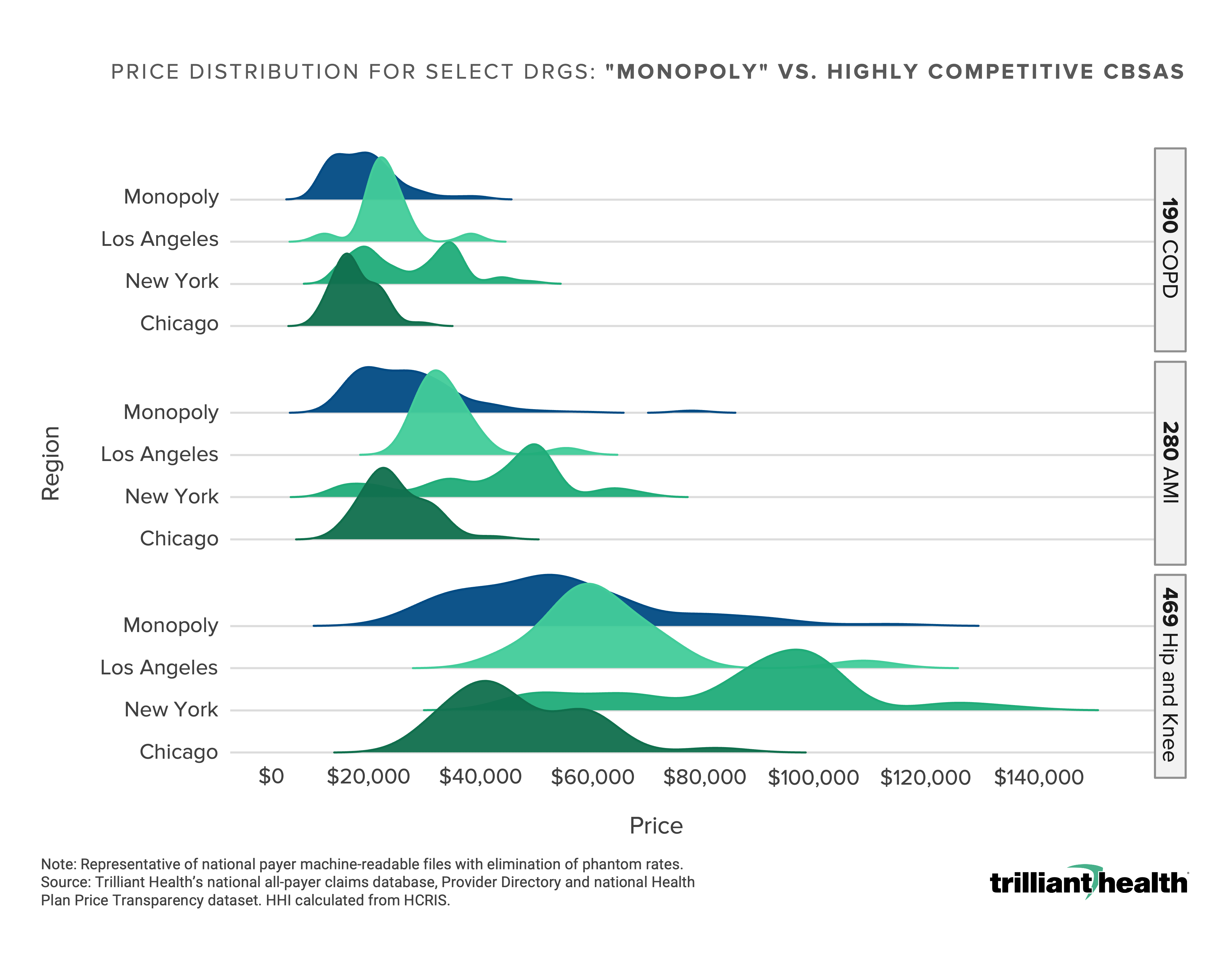

To find out, we compared the negotiated price for three common DRGs – COPD (190), AMI (280) and joint replacement (469) – for all Core-Based Statistical Areas with an inpatient HHI score of 10,000, referred to below as “monopoly markets,” to the range of negotiated price for those DRGs in the three most competitive hospital CBSAs in the U.S. – New York, Los Angeles and Chicago.

As I wrote in last month’s Counterpoint,

“Health plan price transparency reveals a startling spread in pricing for healthcare services that begs for explanation, not rationalization or justification. As a result, health plan price transparency should inaugurate an era of unprecedented and frenzied competition to win the hearts and minds of the payer that keeps the current U.S. healthcare system afloat: the employer. If it does, the winners in healthcare’s negative sum game will be those who deliver value for money.”

Whatever the explanation is for the startling spread in pricing for healthcare services, it is not attributable to the supposed power of “monopoly” hospitals and health systems.

The U.S. healthcare system undoubtedly has both a price and a cost problem, but the cost problem is characteristic of every market. The cost problem could be partially remediated by the elimination of redundant “centers of excellence” in many markets that have too much hospital infrastructure, whether St. Louis or Sioux Falls…or Washington, D.C., which in turn would reduce nurse staffing constraints, among other things. Given what health plan price transparency reveals about pricing in “monopoly” markets, perhaps the Federal government should actively encourage hospital consolidation to eliminate duplicative costs.

On the other hand, the CBO is correct about the “limited sensitivity of consumers and employers to those prices.” How could it be otherwise when revealing negotiated rates within a market was historically deemed a violation of the Sherman Act?

In Delaware, directors and officers of corporations owe a fiduciary duty of care to the corporation and its stockholders, which requires them “to make informed business decisions” based on “the information that is material to the decision” and “to review the information critically.” 2,3

Because health benefit costs are a material expense for every corporation that provides them, the advent of health plan price transparency implicates the fiduciary duty of care for directors and officers – especially chief financial officers – to “make informed business decisions” about health benefit costs using health plan price transparency data.

A well-known healthcare executive is fond of saying that “hospitals are the parasitic host of the rest of the health economy.” More accurately, the employer is. The commercially insured patient is the lifeblood of the U.S. healthcare system, the sole raison d’etre for health insurance brokers and benefits consultants and TPAs and payers, the sine qua non that allows state governments to underinvest in Medicaid programs, and the customer without which hospitals would otherwise be insolvent.

Can you defend your rate to the employers you serve?

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)