The Compass

Sanjula Jain, Ph.D. | May 11, 2023[SPECIAL EDITION] While the Public Health Emergency Is Over, the Data Suggest Patients and Providers Will Not Return to the “Status Quo”

The expiration of the World Health Organization’s global health emergency last week and the U.S. Public Health Emergency (PHE) today, May 11, 2023, offers an opportunity to reflect on the profound ways in which the pandemic changed how healthcare was sought by patients and delivered by providers. Political and regulatory responses to the pandemic catalyzed the adoption of certain capabilities that were well-established, if infrequently utilized, like telehealth. Likewise, the pandemic created the opportunity to consider and/or adopt policies and processes that would otherwise have been unimaginable.

The following commentary is a curation of noteworthy findings from our research during the PHE that illustrate how healthcare evolved—and did not evolve—over the last three years. Understanding the difference between trends that will proliferate and those that will dissipate in the post-pandemic health economy is foundational for stakeholders focused on innovation and transformation.

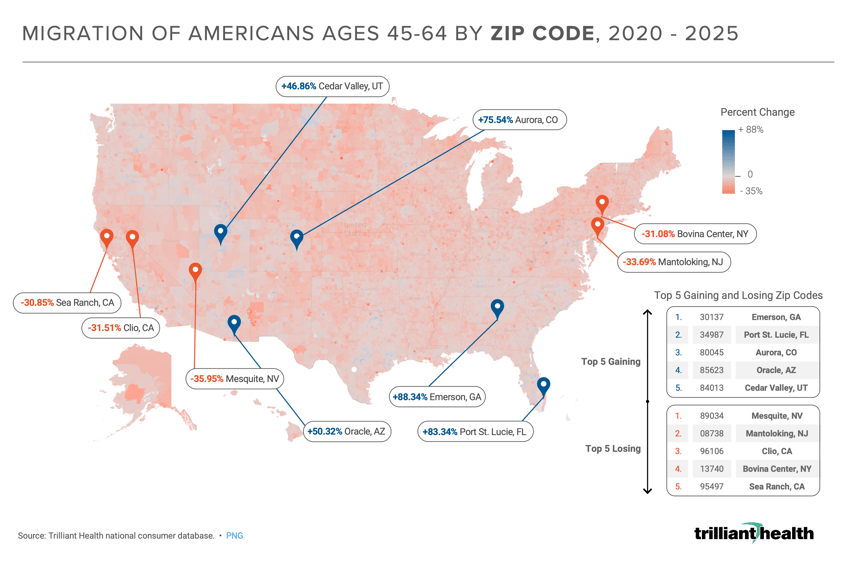

Migration patterns will permanently alter supply and demand for healthcare services.

Given shifts in priorities and growing acceptance of remote work, many Americans either temporarily or permanently relocated during the pandemic, which is a harbinger of changing healthcare demand. As the demographic makeup of a geographic area changes, so does the mix of healthcare service demand, the need for certain provider specialties, and patient preferences. 2020-2025 migration predictions reflect Americans ages 45-64 leaving areas of the Northeast and West at a high rate and migrating to states such as Florida, Colorado, and Georgia. The migration of this commercially insured age cohort is especially noteworthy, given their clinical need for healthcare services and higher reimbursement rates than Medicare.

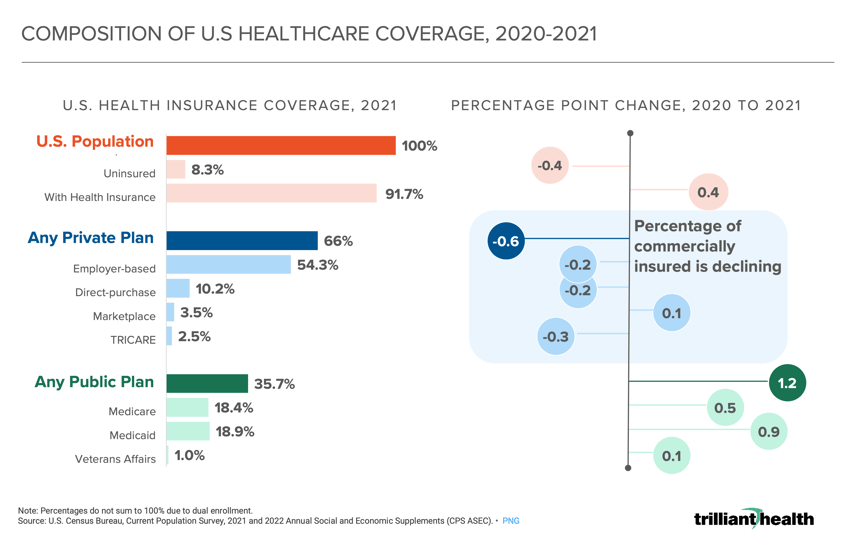

Share of commercially insured patients will continue to decline but share of uninsured will likely rise.

While commercially insured Americans account for the majority of profitable revenue across health economy stakeholders, the share of commercially insured Americans dropped 0.6 percentage points from 2020 to 2021. Under the Families First Coronavirus Response Act (FFCRA), Medicaid programs were permitted to continuously enroll beneficiaries through the duration of the declared PHE. With the expiration of the PHE, states have undertaken coverage redeterminations, which will result in a predicted 5.3M-14.2M Americans losing Medicaid coverage.1 It is likely that a significant proportion of individuals who were covered by Medicaid during the pandemic will not qualify for or be able to afford commercial insurance. As a result, the payer mix of almost every healthcare provider will be negatively impacted.

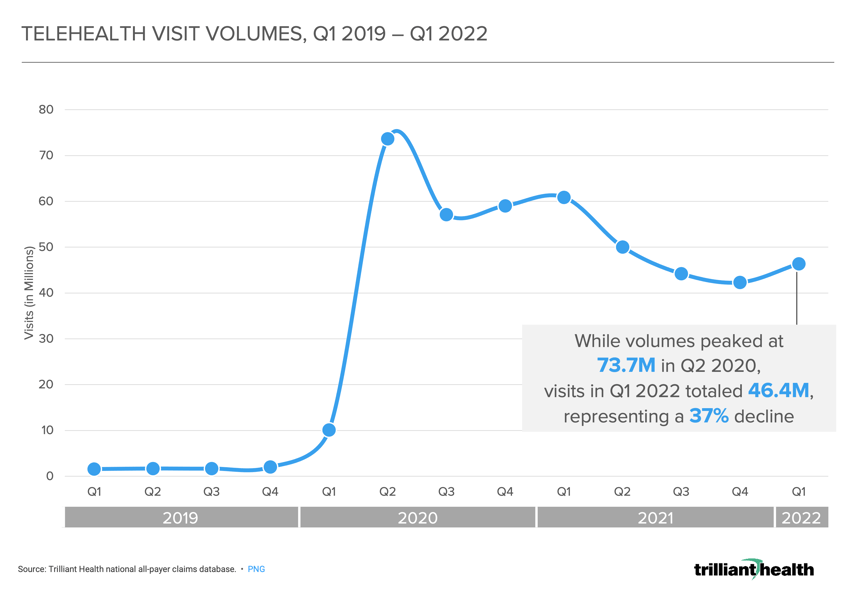

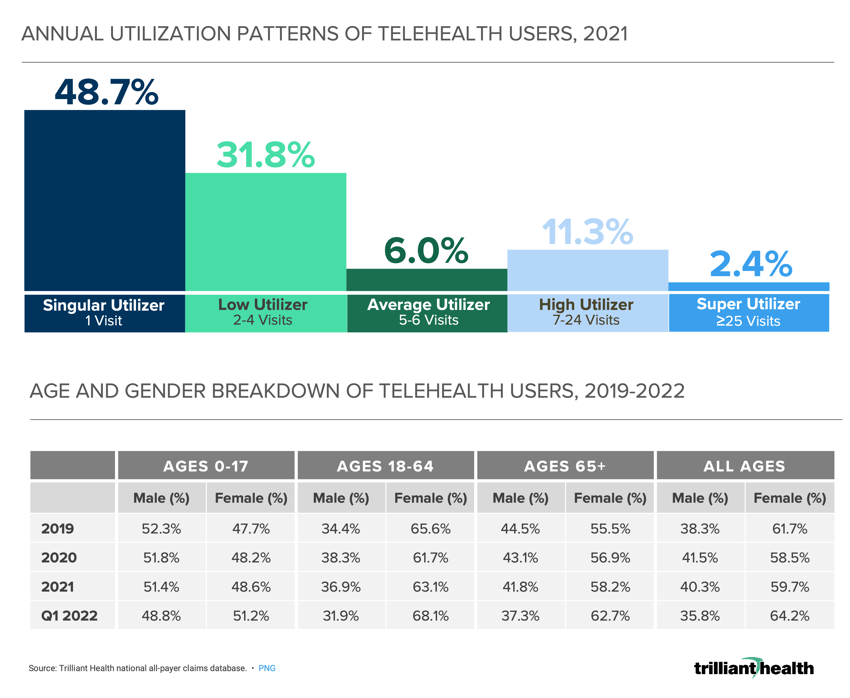

When given the choice, Americans prefer in-person care for most indications.

During the height of the pandemic, most Americans were compelled to utilize virtual care for the majority of their healthcare needs, resulting in the temporary and artificial forced adoption of telehealth among both patients and providers. However, telehealth utilization began to taper well before the end of the PHE. While volumes peaked at 73.7M in Q2 2020, visits in Q1 2022 totaled 46.4M, representing a 37% decline, notwithstanding PHE-related provisions to address payment parity for providers. Additionally, consistent utilization of virtual services is concentrated among a small subset, with 80.5% of telehealth patients having between one and four visits in 2021. In contrast, fewer than 3% of telehealth patients fit the “Super Utilizer Category” of having 25 or more telehealth visits. With the notable exception of behavioral telehealth, telehealth has proven to be a complement to in-person care, rather than a substitute, and future growth will likely be limited to specific use cases.

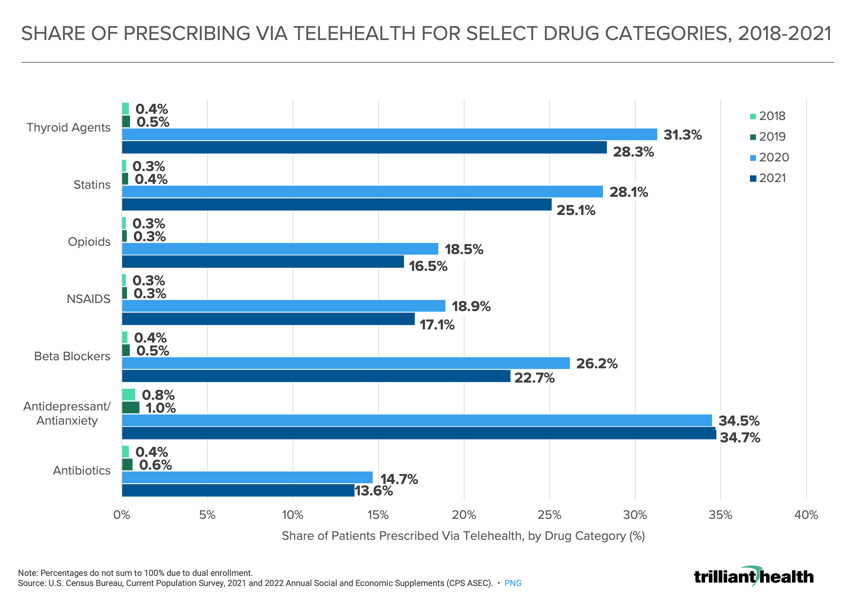

Telehealth-enabled prescribing is up, and regulators are concerned by these trends.

As part of the PHE, HHS authorized prescribing of controlled substances via telehealth without requiring an initial in-person visit. Tele-prescribing increased across drug classes during the PHE, not just for controlled substances. In 2020 and 2021, approximately 35% of antidepressants and antianxiety drug prescriptions were associated with a telehealth visit compared to just 1% in 2019. While the Drug Enforcement Agency had proposed to halt tele-prescribing for controlled substances at the end of the declared PHE, the department decided on May 9 to extend the exception until November 2023 after receiving nearly 40,000 public comments.2 Prior to the COVID-19 pandemic, less than 2.0% of stimulants were prescribed via telehealth, but as a result of relaxed restrictions, that proportion reached 39.4% in 2021.3 Whether the temporary tele-prescribing provisions remain beyond November—and whether they should—is an open question.

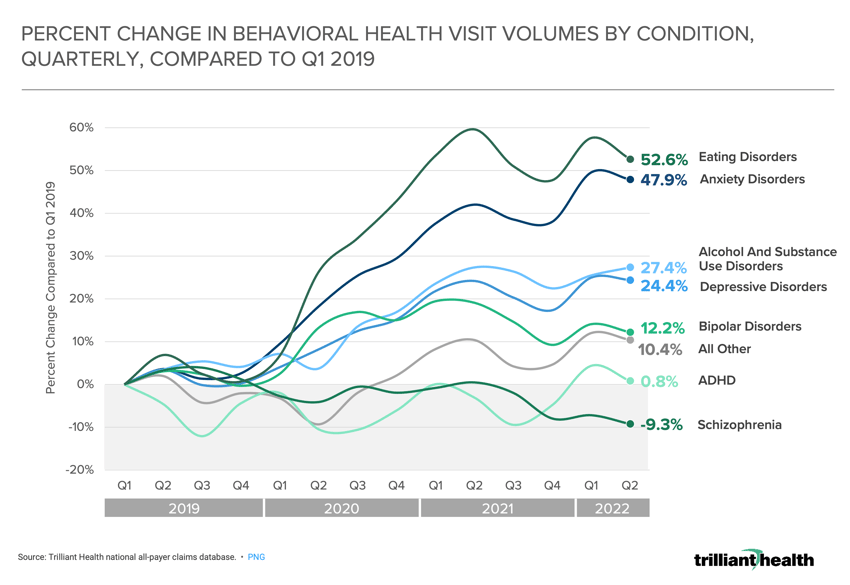

The pandemic further exacerbated America’s mental health crisis.

It is well established that the behavioral health (including mental health) status of Americans—from elementary school students to Medicare beneficiaries—has declined since the onset of the COVID-19 pandemic. While behavioral health patient volumes have increased, care utilization patterns have remained relatively constant, as has the persistence of gaps in care. However, the rate of change in behavioral health demand has varied by condition. Visit volumes for eating disorders (+52.6%), anxiety disorders (+47.9%), alcohol and substance use disorders (+27.4%), depressive disorders (+24.4%) and bipolar disorders (+12.2%) have all consistently trended higher since 2019. Demand for behavioral health services continues to exceed the currently inadequate supply; if this trend persists, the principles of economics suggest that prices will increase. This will inherently increase the economic burden facing the U.S. healthcare system, which is already fast approaching 20% of GDP.

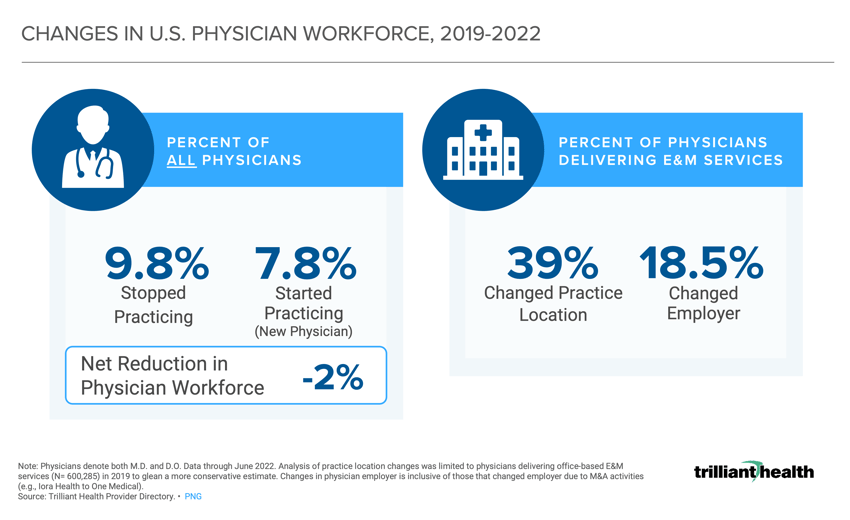

Provider burnout will magnify the long-standing physician supply shortage in 2023.

The national healthcare labor shortage stemming from pandemic-related burnout, the Great Resignation, and an aging provider workforce is not likely to improve in 2023 and beyond. The net number of physicians starting and stopping practice from 2019 to 2022 resulted in a 2.0% workforce reduction. Among practicing physicians delivering E&M services, 18.5% of physicians changed employer organization or type (e.g., hospital, new entrant). The pandemic effect compounded with long-standing burnout resulted in 9.8% of physicians “retiring.” While the effects of the pandemic have exposed the severity of workforce challenges, provider burnout has been increasing for a litany of societal, cultural, organizational, and personal and patient safety (e.g., violence against healthcare workers) reasons. Curbing the workforce shortage will be contingent on changes to residency programs, incentives from employers, and actions to improve working conditions for healthcare providers at all levels of specialization.

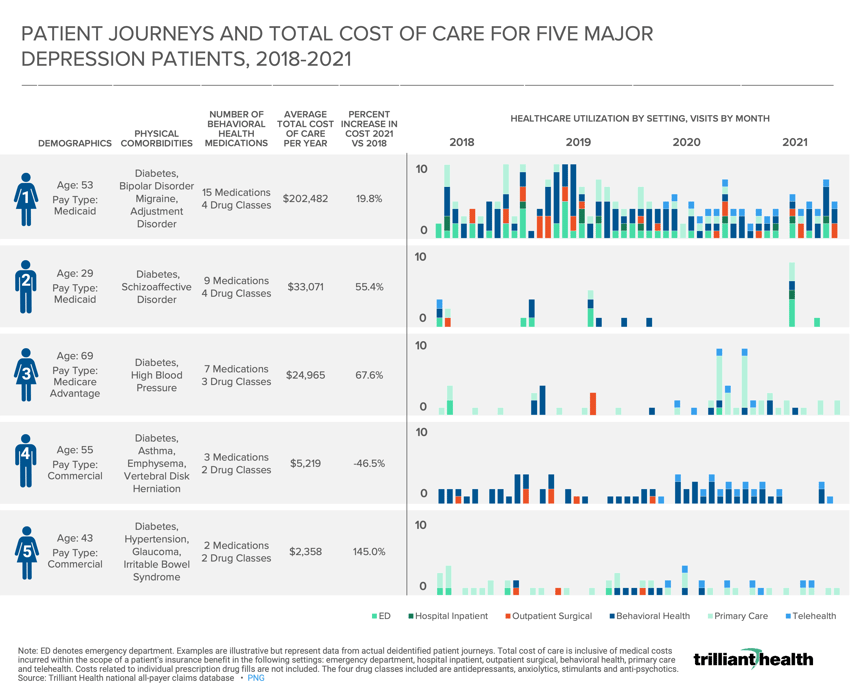

Fragmentation in care delivery and risk costs are disincentivizing Americans from seeking care.

Patient care behaviors were forcibly changed during the pandemic as access to care was limited by COVID-19 care, provider availability, and rising healthcare costs. In analyzing patient journeys for a subset of behavioral health patients, we found that total cost of care increased for four of the five patients, by upwards of +145% from 2018 to 2021 as just one example. Over the past few years, retailers (e.g., CVS) and technology companies (e.g., Amazon) have expanded their presence in healthcare with the goal of providing lower-cost low-acuity, or “commodity-like” services. And while much of this new supply includes primary care services, utilization has been artificially inflated by COVID-19 related care rather than necessary and routine primary care (i.e., preventive screenings). Lower prices from unintegrated healthcare providers inevitably increases fragmentation and friction in the patient care journey, which ultimately drives up total cost of care. Integrating retail, virtual and other new entrants into the established healthcare system will require partnerships and building stronger referral patterns as the diffusion of responsibility for who owns the patient relationship grows.

Certain healthcare behavior changes catalyzed by the pandemic—and thus resulted in forced adoption—will not sustain long-term growth (e.g., telehealth). However, certain negative changes will persist despite the PHE ending, most notably the unstable and insufficient healthcare workforce. And finally, certain features of the health economy, like suspension of Medicaid eligibility determinations, will no longer be allowed without the declared PHE.

In many ways, the end of the PHE will inaugurate a new era of uncertainty in healthcare. There will never be a return to a “pre-pandemic norm” despite visit volumes across the system leveling out. Operators, policymakers, financers and advocates are now faced with defining a new definition of success U.S. healthcare, which in the interim will be focused on ensuring patients can access and pay their premiums, cost sharing, and drug costs, and that providers—both small- and large-scale—can remain financially viable.

For more perspectives on select data featured in this commentary and additional PHE data trends from our research, read these recent articles from The Wall Street Journal:

- New Entrants

- Virtual Care

- Behavioral Health

- Cost of Care

- Healthcare Workforce

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+