In today's Special Edition of The Compass, we have curated all our previous content about Amazon’s entry into the healthcare market. We hope that these articles will help every stakeholder in the health economy begin to understand the implications of today's news and begin to formulate strategies to compete:

- Winning a Losing Game, Part IV: Thinking About Customers – and Pricing – Like Amazon

- Beware Amazon and the other Sirens of Telehealth

- As Supply Increases, Consumer Loyalty is at Risk

- Amazon’s Expanding Healthcare Footprint Uniquely Positioned to Meet Consumer Preferences in New Markets

- Retailers’ Relatively Lower Prices and Brand Loyalty Will Disrupt the Urgent Care Market

- Characterizing Patients Without a Primary Care Relationship

- The Return to “Normal” Primary Care Utilization Among Females Ages 20-49 Varies by Market

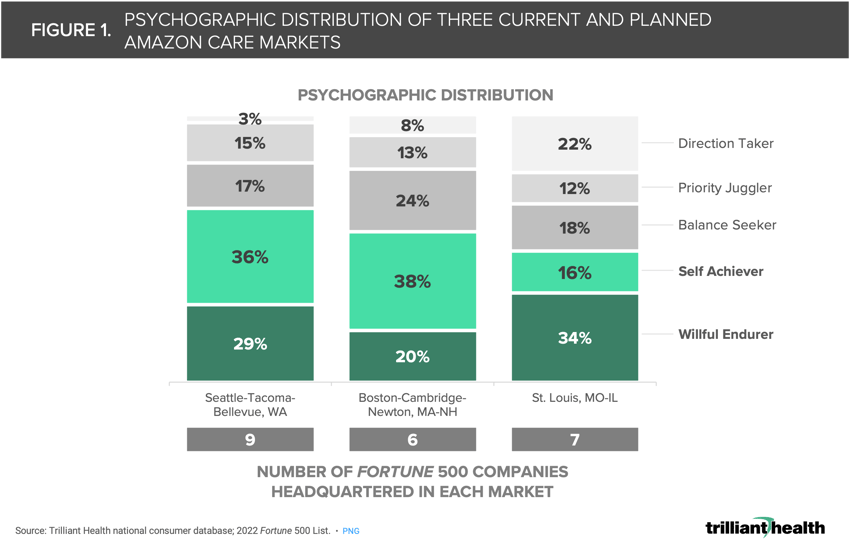

While Amazon’s pilot for Amazon Care was focused on a direct-to-consumer model, the company has since announced plans to focus on employer partnerships. While Amazon selected markets that are similar in employer composition (i.e., number of Fortune 500 companies), its success hinges upon use of services by employees within each employer. Ultimately, employees are consumers, and their behaviors vary by market.

Psychographics play a considerable role in understanding which consumers will be more inclined to use Amazon Care services in comparison to primary care services through One Medical (Primary Care). Given the virtual nature of Amazon Care, it will likely be received best among both Self Achievers and Willful Endurers, who are more likely to use telehealth. Willful Endurers live in the “here and now” and are more likely to obtain care in urgent care settings. Self Achievers are most proactive about wellness and stay on top of health issues with regular medical checkups, health screenings, and research.

Amazon Care has announced plans to expand its in-person and tele-enabled healthcare services in over 20 markets by the end of 2023. In comparison, One Medical’s primary care presence currently spans 16 markets across 12 states, with planned expansion into three additional markets (Dallas, Miami, and Milwaukee). Although many markets overlap between the two entities, Amazon’s acquisition of One Medical only expands its geographic healthcare reach and solidifies its brick-and-mortar presence in healthcare.

Amazon Care has announced plans to expand its in-person and tele-enabled healthcare services in over 20 markets by the end of 2023. In comparison, One Medical’s primary care presence currently spans 16 markets across 12 states, with planned expansion into three additional markets (Dallas, Miami, and Milwaukee). Although many markets overlap between the two entities, Amazon’s acquisition of One Medical only expands its geographic healthcare reach and solidifies its brick-and-mortar presence in healthcare.