Research

Increased Patient Volumes for Select Skin Conditions Align With Evolving Dermatologic Treatment Patterns

August 25, 2024Key Takeaways:

- From 2021 to 2023, dermatitis patient volumes varied, with atopic dermatitis seeing a notable 7.8% increase, while unspecified and allergic contact dermatitis decreased by -5.7% and -4.9%, respectively.

- Infectious skin conditions, such as impetigo, showed a sharp rise (32.0%), underscoring the increasing burden of bacterial skin infections.

- Topical corticosteroids remain essential for managing both acute (e.g., unspecified dermatitis) and chronic conditions (e.g., atopic dermatitis), though the majority of patients (65.3%) required only one prescription fill, indicating effective short-term management.

The skin, as the body's largest organ, plays a pivotal role in overall health, yet skin conditions remain an underrecognized burden, affecting millions worldwide. Over the past decade, the global prevalence of dermatologic diseases has risen significantly, elevating skin disorders to the fourth most common cause of nonfatal disease burden.1 In the U.S., one in four Americans (84.5M) are impacted by skin disease.2 This change reflects a combination of genetic, lifestyle and environmental factors. The focus on developing new therapeutic approaches to address both acute and chronic skin disorders has become more widespread.

Notably, the market for topical treatments has evolved and is projected to reach $238.4B by 2033.3 From over-the-counter (OTC) products designed to combat acne and eczema to prescription medications targeting chronic conditions like psoriasis, the demand for skincare services and treatment is high.

Background

Dermatology is one of the broadest medical specialties, requiring providers to manage a wide spectrum of skin disorders that range from infectious and autoimmune disorders to neoplastic, genetic and traumatic conditions. Dermatologists must be proficient in a dynamic clinical landscape with rapidly evolving treatment innovations (e.g., monoclonal antibodies, corticosteroids, antibiotics and chemotherapeutic agents).

The market for topical skin treatments has grown in response to changing dermatologic demand for both medical treatments, such as retinoids and corticosteroids, and consumer products, including products for anti-aging to inflammatory conditions, driven in part by pharmaceutical advancements and growing consumer awareness about skin health. The dermatology pharmaceutical market is projected to reach $64B by 2027, a compound annual growth rate of 12.9%.4 This growth is largely attributed to treatments for both common skin diseases, such as acne, atopic dermatitis and psoriasis, and rare and previously untreatable conditions.

Because of the increasing demand for and development of novel dermatologic treatments, we sought to examine recent trends in the prevalence of skin conditions and explore how the treatment landscape has evolved.

Analytic Approach

We leveraged our national all-payer claims database to analyze patient utilization of health services attributed to select skin conditions between 2021 and 2023. We then analyzed diagnostic patterns and prescription fill frequency of topical corticosteroids.

Findings

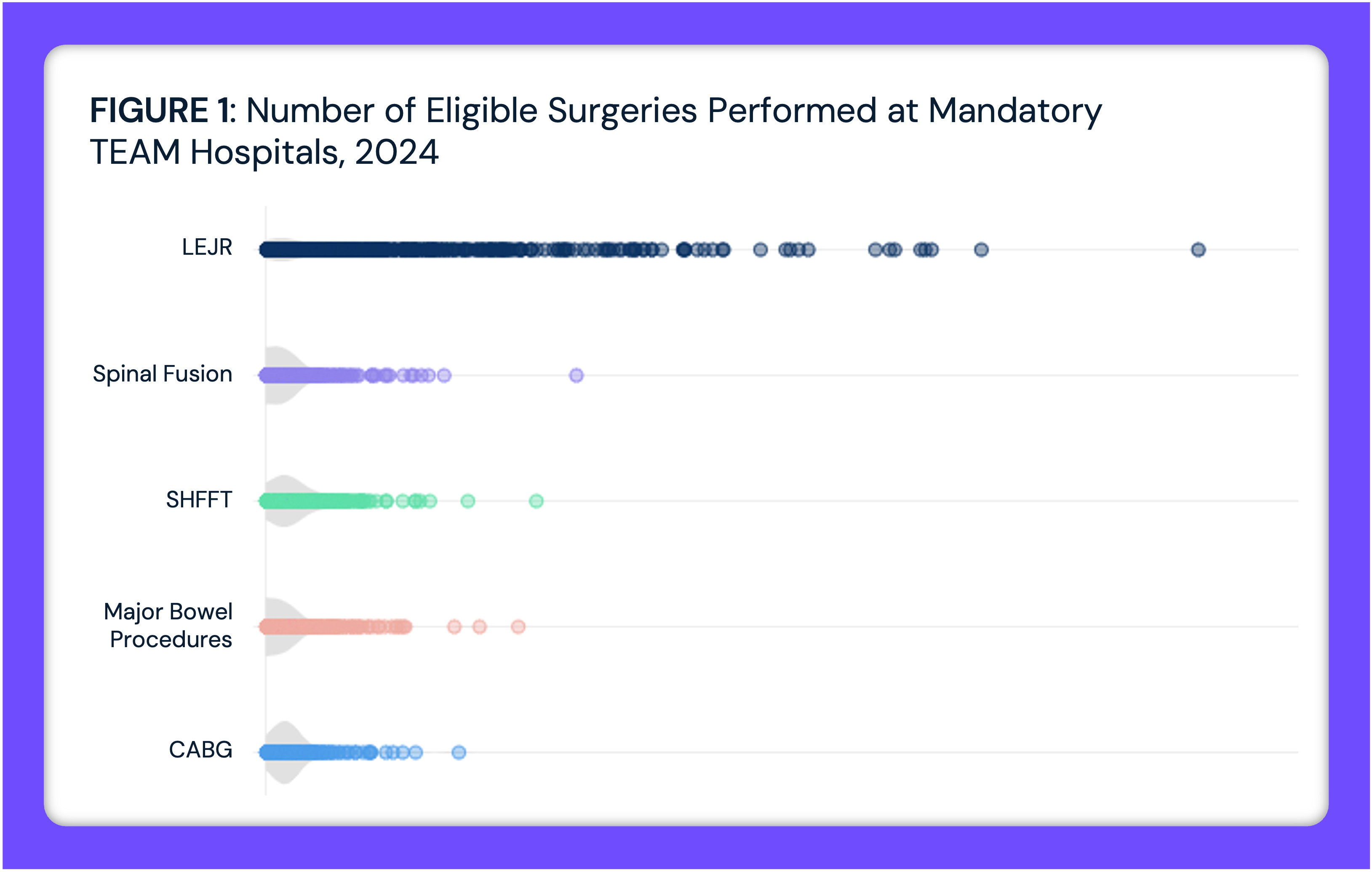

Between 2021 and 2023, patient volume for various skin conditions shifted notably. Dermatitis and eczema conditions saw mixed trends: atopic dermatitis increased by 7.8%, while unspecified contact dermatitis and allergic contact dermatitis decreased by -5.7% and -4.9%, respectively (Figure 1). Infectious skin diseases, such as local skin infections and impetigo, rose sharply, with impetigo seeing a 32.0% increase in patient volume. Chronic conditions like psoriasis grew by 5.7%.

Given the growing market for topical skin treatments and the increase in patient volumes for conditions such as dermatitis and rashes, we examined the most prevalent conditions prompting topical corticosteroid prescriptions and assessed the frequency with which patients fill and refill these prescriptions. In analyzing the most common skin conditions resulting in a topical steroid prescription, the data show a mix of acute and chronic skin conditions. Unspecified dermatitis and rash (14.8%) and other nonspecific skin eruptions (10.6%), both often acute, account for the highest shares (Figure 2). Atopic dermatitis and psoriasis, which are more chronic in nature, represent 9.9% and 5.4% of prescription volume, respectively. Acute conditions like cellulitis and acute lymphangitis (3.7%) and skin changes due to nonionizing radiation (3.8%) also play a substantial role in topical steroid prescribing.

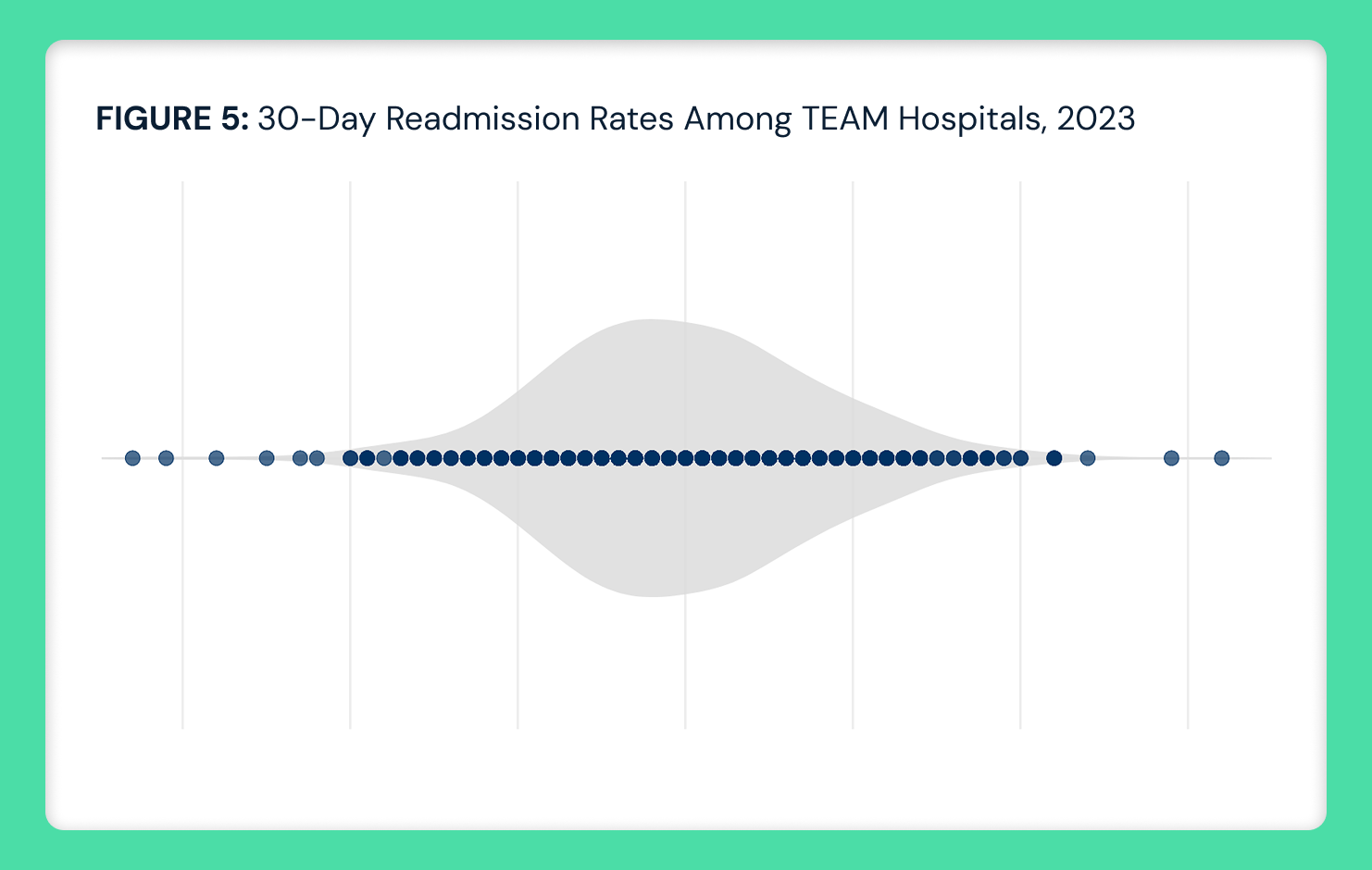

The distribution of patients by the number of unique topical corticosteroid prescription fills shows that the majority of patients (65.3%) filled only one prescription in 2023, indicating that many cases may be effectively managed with minimal treatment (Figure 3). A smaller proportion (18.7%) filled two prescriptions, while 7.4% filled three prescriptions. The number of patients filling four or more prescriptions substantially drops, with only 3.2% of patients filling six or more prescriptions, suggesting that more chronic or refractory conditions requiring extended treatment are less common.

Conclusion

In analyzing dermatologic trends between 2021 and 2023, the data reveal an evolving landscape of both acute and chronic skin conditions that influence topical corticosteroid use. While conditions like unspecified dermatitis and rashes dominate prescription volumes, chronic diseases such as atopic dermatitis and psoriasis also play a significant role. With most patients filling only a single corticosteroid prescription in 2023, it is likely that many cases are managed effectively with short-term treatment, rather than widespread chronic use. However, a smaller subset of patients with chronic or refractory conditions may require ongoing care, reflective of the share of patients filling six or more topical corticosteroid prescriptions.

Additionally, dermatologists play a crucial role in the early detection and diagnosis of various cancers, particularly skin cancers such as melanoma, basal cell carcinoma and squamous cell carcinoma. They often represent the entry point or first contact in a broader cancer diagnostic patient journey.

Together, these findings emphasize the importance of continued innovation and the development of targeted treatments to meet the diverse and evolving needs of dermatology patients.

Thanks to Austin Miller and Katie Patton for their research support.

- Studies

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)