The Compass

Sanjula Jain, Ph.D. | June 18, 2023National Distribution Reveals Variation in Quality, Financial and Competitive Performance Among Renowned U.S. Hospitals

Key Takeaways

-

Of five select “renowned” hospitals, Cleveland Clinic is the only hospital with another “renowned” hospital (Johns Hopkins) as one of its ten most similar peer hospitals.

-

These renowned hospitals’ performance metrics and rank order change when analyzing them at the peer group and national levels.

-

Several renowned hospitals rank highest in their peer groups in the Quality (Mayo Clinic and NYU Langone) and Financial (Cedars-Sinai) Indexes.

As previously written, effective benchmarking is essential for developing evidence-based strategies to compete in healthcare’s negative-sum game. “Vanity” rankings are somewhat useful for marketing, but the subjective nature of these rankings offers almost nothing in terms of strategic insights for health system executives grappling with financial and operational challenges. Logically, performance improvement strategies should stem from objective and more comprehensive evidence-based benchmarks.1

Evidence-based benchmarking requires “apples to apples” comparisons, thus requiring that every hospital must first identify its “true” peer group. Historically, health economy stakeholders have practiced aspirational benchmarking and considered their peers to be those listed in U.S. News and World Report Honor Roll hospitals or similar “Top 100” rankings.

To facilitate accurate benchmarking, the 2023 SimilarityIndex™ | Hospitals allows stakeholders to identify a hospital’s group of empirically similar hospitals (“true peers”) and then compare the performance of the peer group nationally across Quality, Financial, Competitive and Price Indexes.

Understanding national rank alone is insufficient

All existing hospital benchmarking sources exclusively compare facilities nationally, rather than identifying peer groups. For hospital executives, understanding how their organization “stacks up” nationally is often interesting and occasionally important, but never actionable without objective and relevant benchmark hospitals.

U.S. News and World Report has consistently identified a small cohort of “Best Hospitals” over the years. As of July 2022, the top five “Honor Roll” hospitals are:

-

Mayo Clinic (Rochester, MN)

-

Cedars-Sinai Medical Center (Los Angeles, CA)

-

NYU Langone Hospitals (New York, NY)

-

Cleveland Clinic (Cleveland, OH)

-

Johns Hopkins Hospital (Baltimore, MD)

The current ratings and rankings lack comparative elements, which lead hospitals, health systems and other stakeholders in the health economy to make arbitrary and incomplete parallels between a particular hospital and some of the nation’s most renowned hospitals.

For example, while Cedars-Sinai Medical Center is ranked second by U.S. News & World Report, receives five stars from CMS, and rates among the top 50 U.S. hospitals according to Healthgrades, it has a “C” Hospital Safety Grade from the Leapfrog Group, and ranks 2,494 of the nation's most socially responsible hospitals by the Lown Institute.2,3,4,5,6 How were those “grades” compiled and are they equally important? The variation across existing hospital “benchmarks” and “raters” reinforces the need to redefine benchmarking based upon objective data and mathematical principles rather than national benchmarking based on subjective data and interpretation (i.e., “perceived prestige”). While Cedars-Sinai Medical Center is undoubtedly one of the nation’s top healthcare facilities, its “true peers” and performance across quality, financial and competitive metrics likely vary compared to its perceived peers.

Analytic Approach

As an illustrative example, we identified five renowned U.S. hospitals from the 2022 Honor Roll list and then leveraged SimilarityIndex™ | Hospitals to identify the ten most similar hospitals (“true peer group”) for each renowned healthcare facility. We then examined these hospitals on the national distribution of all 2,299 U.S. hospitals included in the analysis for the Quality, Financial and Competitive Indexes, as well as within each hospital’s unique peer group of 50 hospitals. To view the full list of each hospital’s 50 peers, visit SimilarityIndex™ | Hospitals. National index results are displayed as a percentile score (an average of each underlying metrics percentile ranking). For more information on the metrics underlying each Index, please reference our detailed methodology.

Findings

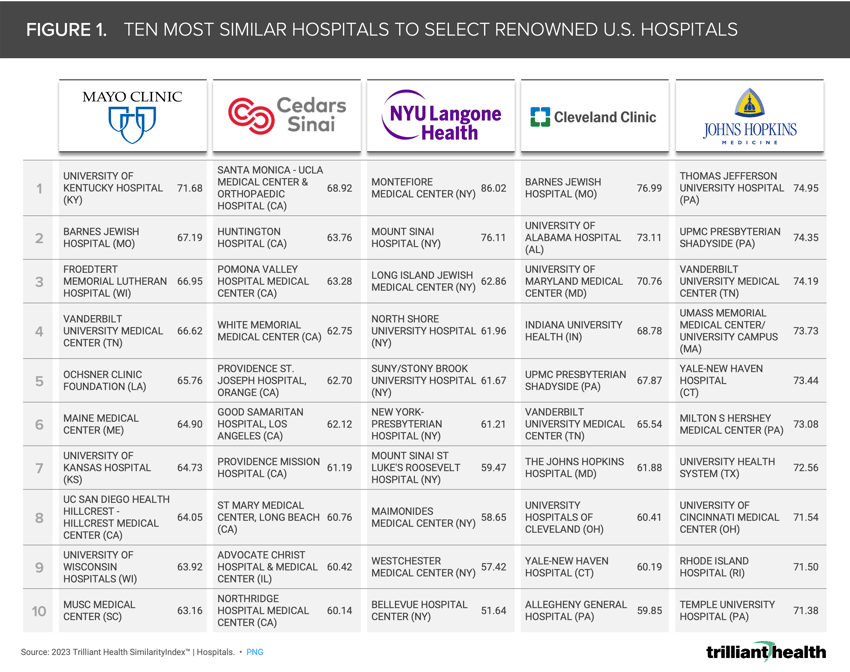

The mathematical principles applied in SimilarityIndex™ | Hospitals reveal that these hospitals have distinct peer groups that are quite different from the Honor Roll list. Of these five hospitals, Cleveland Clinic is the only hospital with another “renowned” hospital – Johns Hopkins – as one of its ten most similar peer hospitals (Figure 1). NYU Langone and Cedars-Sinai, which are located in New York City and Los Angeles, respectively, have peer groups that are concentrated in their respective metropolitan areas, revealing the impact of distinct market characteristics of NYC and LA in determining benchmark peers.

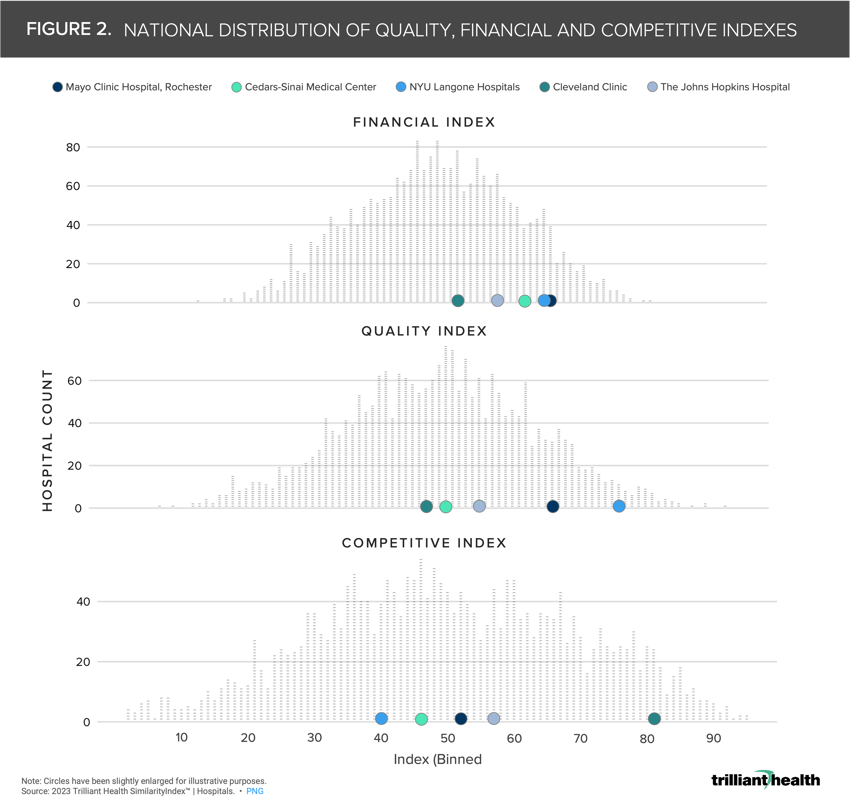

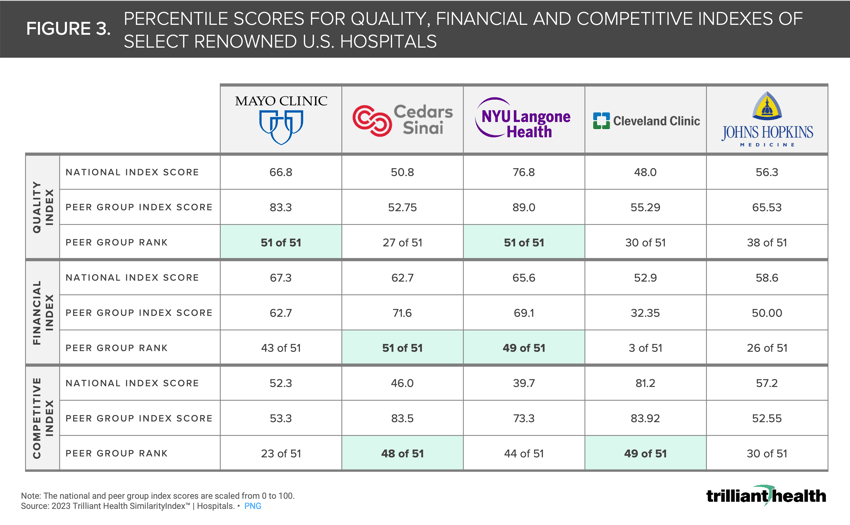

These hospitals’ performance metrics and rank order change when analyzing them at the peer and national levels (Figure 2). For example, while Cedars-Sinai ranks highest in its 50-hospital peer group in the Financial Index with a percentile score of 71.6, its national Financial Index percentile score is 62.7 (Figure 3). Several of these hospitals rank highest in their peer groups in the Quality (Mayo Clinic and NYU Langone) and Financial (Cedars-Sinai) Indexes. Conversely, hospitals like the Cleveland Clinic and Johns Hopkins have a peer group percentile score that is lower than their national score on Financial performance.

While many well-known hospitals such as Mayo Clinic, Cleveland Clinic and Cedars-Sinai may be reputational peers, they are not actionable or relevant peers for each other, much less the thousands of other acute care hospitals that frequently cite them as peers. Although several of these “top” hospitals are ranking at the top of their peer groups, several are below the top quartile for national Quality, Financial and Competitive Indexes.

The national and peer index scores provide more tangible considerations for how much a single hospital can and should improve across metrics. Hospitals should first be thinking about how to improve their performance within their peer group, focusing on whether there are strategies utilized by their peers that could be adopted.

Accounting for factors such as services rendered, bed size and market characteristics is critical for identifying true hospital peers. Equipped with a mathematically defined peer group, national and peer-level index scores, and rank order across several key metrics, healthcare executives should challenge themselves to evaluate their hospitals of interest in a new way.

In subsequent research, we will examine the ways in which markets are critical in understanding peer groups and the relationship between Quality and Price (i.e., value for money).

Use SimilarityIndex™ | Hospitals to select a benchmark hospital of your choice to index.

- Cost of Care

- Quality & Value

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+