The Compass

Sanjula Jain, Ph.D. | November 24, 2024Trend 7 of 8: Lower-Cost Care Settings Can Offer Better Value

You are currently viewing the public version of Studies. To unlock the full study and additional resources, upgrade your subscription to Compass+.

Cycle of Innovation Influences Rate of Care Migration Outside the Hospital

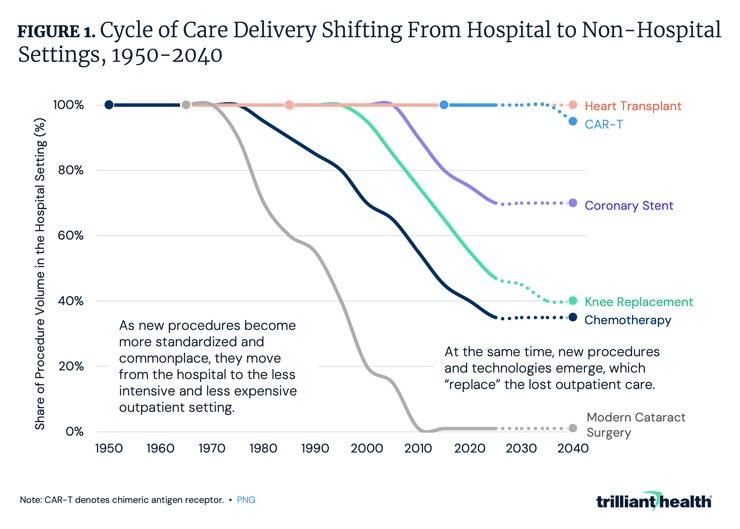

New treatment paradigms often start in the hospital setting. Over time, technology and innovation (e.g., new tools, payment reform) can enable these treatments to transition to outpatient or alternative settings, improving accessibility and reducing costs. Common procedures that increasingly are performed in outpatient settings – joint replacements, coronary stents, chemotherapy, etc. – originated in exclusively inpatient settings (Figure 1). This migration of care to lower-acuity settings is a catalyst for a broader trend in healthcare toward decentralization and consumer-focused care.

Historically, however, as innovation reduces the need for traditional inpatient care, novel complex procedures, such as CAR-T cell therapy, emerge to fill the gap, sustaining the demand for hospital-based services. This “cycle of innovation” raises important questions: will this pattern continue and will future advancements disrupt or reinforce the existing dynamic, especially as the healthcare system grapples with resource constraints and shifting consumer expectations?

As Procedures Are Removed from the IPO List, ASC Volumes Will Increase

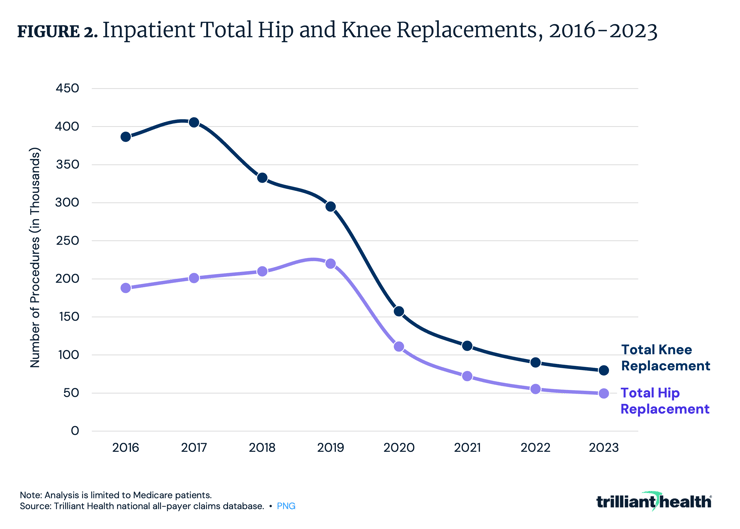

The Inpatient Only (IPO) list is a group of services for which Medicare will only reimburse if performed in an inpatient setting, and the removal of procedures from the IPO list has a substantial impact on inpatient volume. After total knee replacements were removed from the IPO list in 2018, inpatient volume declined by 17.9% from 2017 to 2018 (Figure 2). Similarly, inpatient volume for total hip replacements declined by 35% in the year following their removal from the list in 2020. As surgical procedures are removed from the IPO list, the number of surgeries performed in ASCs and other outpatient settings will increase.

Between 2019 and 2023, the share of ASC-eligible surgeries delivered at ASCs increased by 7.0 percentage points, reaching 50.3% of eligible procedures in 2023.1 Notably, readmissions, post-surgical complications and costs for total joint replacements are lower in outpatient settings compared to inpatient settings, indicating higher value for lower-acuity patients who do not require inpatient care.2

Urgent Care Growth Is No Longer COVID-Dependent

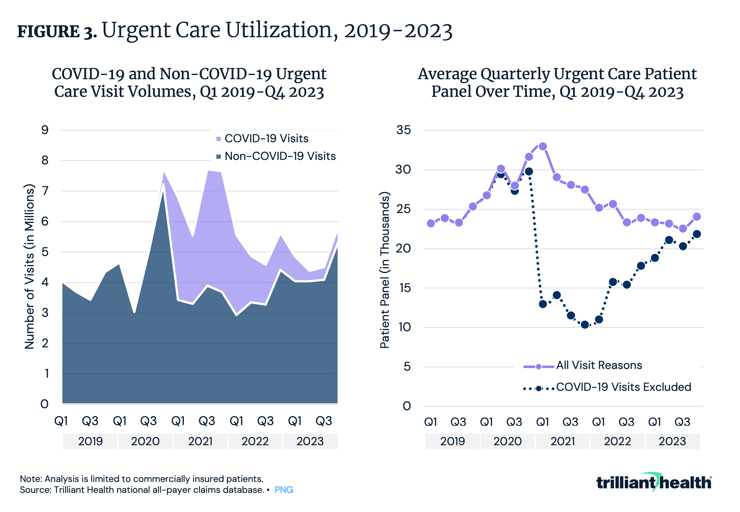

Once considered a “disruptor” in redirecting low-acuity and non-emergent care, urgent care facilities have evolved and matured to the point where many consider urgent care to be a “traditional” provider setting. Between Q1 2019 and Q4 2023, urgent care volumes increased by 44.6% in aggregate and 32.5% with COVID-19 related visits removed (Figure 3). While average quarterly patient panels at U.S. urgent care centers for all visit reasons spiked in Q4 2020, they declined over the following quarters.

Behavioral Health Remains the Most Frequent Application of Virtual Care

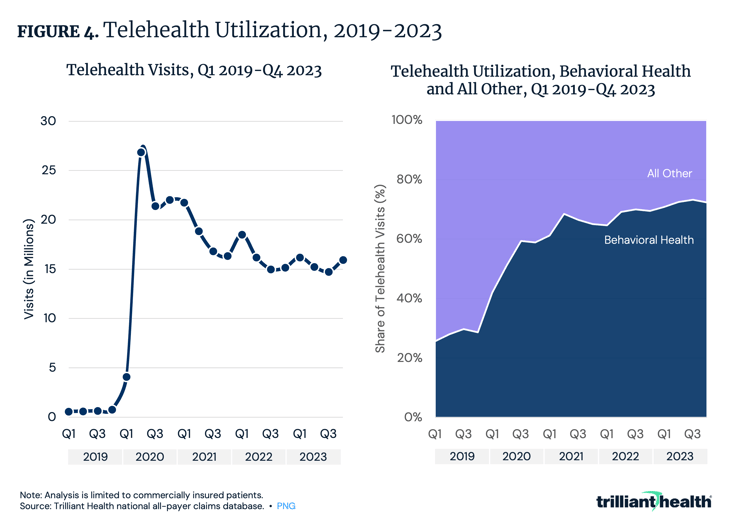

The substantial increase in telehealth utilization at the pandemic’s onset in 2020 catalyzed a rapid expansion of telehealth capacity throughout the health economy, but without evidence of future demand or an understanding of the patient preferences of likely telehealth customers. Telehealth for the treatment and management of behavioral health conditions has increased consistently since 2019, a trend not seen in any other clinical application of virtual care. Compared to Q1 2020, the share of telehealth for behavioral health reasons increased from 42.0% to 72.3% in Q4 2023 (Figure 4). Overall telehealth utilization declined by 40.5% in the same period. As behavioral health demand continues to grow, telehealth can serve to bridge the gap in supply, potentially offering more cost-effectiveness in terms of direct and indirect costs.

Upgrade to Compass+ to continue reading the full study.

- Virtual Care

- Behavioral Health

- Health Reform

- Cost of Care

- Featured

- Healthcare Consumerism

- Medicare & Medicaid

- Quality & Value

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+