The Compass

Sanjula Jain, Ph.D. | April 30, 2023Life Science Investments Signal a Continued Focus on Oncology and Immunology

Key Takeaways

-

While biopharmaceutical companies typically invest and make acquisitions in therapeutic areas in which they have an established market presence, changes in burden of disease (e.g., cancer) can also influence M&A decisions.

-

In April 2023, Pfizer announced a $43B acquisition of oncology-focused biotechnology company, Seagen—an amount that exceeds the aggregate price of all the company’s acquisitions since 2019.

-

While there is no singular trend observed across the entire industry, it is clear that oncology, immunology and rare disease continue to be therapeutic areas where companies have identified significant market opportunity (i.e., oncology accounted for the largest dollar value and the highest number of transactions across three major biopharmaceutical companies in the last year and a half).

In the first four months of 2023, the biopharmaceutical industry has announced several high-value mergers and acquisitions (M&A), primarily in oncology and immunology. In 2022, there were life sciences 258 deals (-30% from 2021) totaling $158.5B (-41% from 2021).1 While some key industry participants are focusing on expanding core assets, other acquisitions expand capabilities in therapeutic areas where companies do not have existing products.

Background

The biopharmaceutical industry is uniquely positioned to leverage data to inform strategy. The combination of clinical trial data, payer partnerships, health economics and outcomes research business units, and substantial investments in data assets and sizeable research and development budgets enables valuable insights and, in many cases, first-mover advantage. Visibility into M&A, investments, exits, and strategic partnerships throughout the health economy provides insight into imminent clinical, technological, and operational changes. But to what extent do stakeholders like health plans and health systems track, process, and act on these signals from other health economy stakeholders like biopharmaceutical manufacturers? Are there data trends across the biopharmaceutical landscape that are meaningful signals for what future care delivery needs may entail?

While biopharmaceutical companies typically invest and make acquisitions in therapeutic areas in which they have an established market presence, changes in burden of disease (e.g., cancer) can also influence M&A decisions. Specifically in oncology, our previous research revealed an increase in the share of new patients associated with oncology providers nationally (+1.9 percentage points) from 10.7% in Q1 2017 to 12.6% in Q1 2022, with some regional oncology providers seeing percentage increases significantly higher than the national average.2 We also found that the share of younger new patients seeing oncology providers is increasing.3 Despite the stable trends in new cancers and decreasing cancer death rates leading up to 2019, the COVID-19 pandemic introduced unknown consequences and new challenges in curbing cancer incidence (e.g., reduced access to routine care, fewer preventive screenings). Additional evidence of the evolving disease burden can be gleaned from tracking real-time provisional cancer-related mortality and demand for medical goods and services specific to cancer.4,5

While these initial demand- and supply-related findings specific to oncology care delivery are revealing, biopharmaceutical industry growth strategies, which are informed by real-world evidence, often signal emerging changes in disease burden.

Analytic Approach

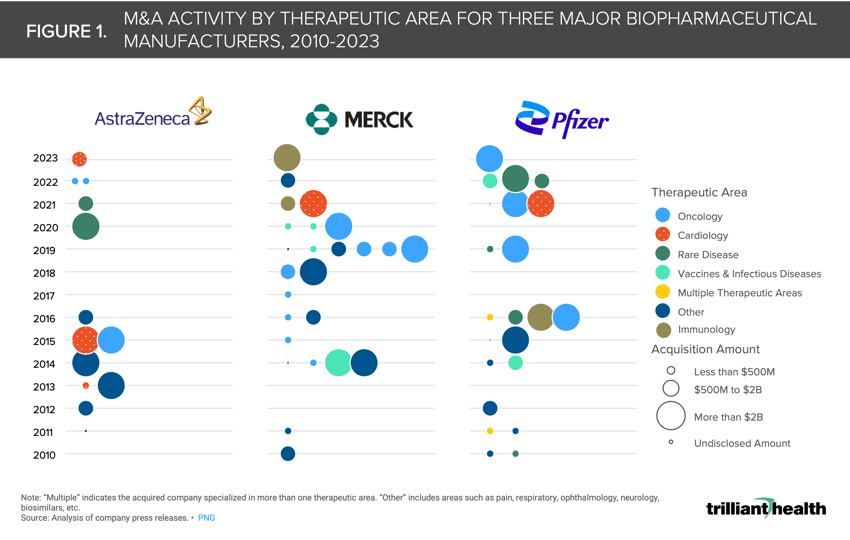

To better understand the longer-term M&A trends in the biopharmaceutical industry, we used publicly available data to analyze the M&A activity of Merck, Pfizer, and AstraZeneca, each of which has overlapping therapeutic areas of focus (e.g., cardiology, oncology and vaccines), between 2010 and 2023 to characterize investments across therapeutic areas.

Findings

In April 2023, Pfizer announced a $43B acquisition of oncology-focused biotechnology company, Seagen—an amount that exceeds the aggregate price of all the company’s acquisitions since 2019 (Figure 1). Following the announcement, Pfizer CEO Albert Bourla indicated that the company would also launch as many as 10 drugs in 2023, including five vaccines, two oncology products, and two immunoinflammation products.6 The imminent loss of exclusivity for several key products is also a driving force of Pfizer’s investment in the oncology space.

Last year, Merck issued a statement of intent to prioritize innovation in cardiology, building upon the acquisition of Acceleron, a cardiovascular-focused pharmaceutical company, for $11.5B in 2021. Since then, Merck shifted its focus back to bolstering its immunology and oncology business lines with a $10.8B acquisition of Prometheus Biosciences, an immunology-focused biotechnology company. Between 2013 and 2016, AstraZeneca prioritized its cardiovascular and respiratory business lines before shifting focus to rare disease, notably with its $39B acquisition of Alexion Pharmaceuticals in 2020, the largest life sciences deal that year. However, the company has been expanding its oncology and cardiology business units with smaller-dollar-value transactions in 2022 and 2023.

While there is no singular trend observed across the entire industry, oncology, immunology, and rare disease continue to be therapeutic areas of significant interest to biopharmaceutical companies. Notably, oncology accounted for the largest dollar value and the highest number of transactions across these three major biopharmaceutical companies across 2022 and the start of 2023.

Logic suggests that capital market activities by established stakeholders with robust data and analytics capabilities are useful to identify emerging trends, and monitoring activity in different sectors of the health economy allows stakeholders to identify product, service line, and partnership opportunities to inform investments in growth strategies. Recent M&A transactions in the biopharmaceutical industry suggest that those companies anticipate a material and enduring change in the clinical burden of disease and market opportunity in oncology and immunology, the demand for which is of interest to numerous other stakeholders in the health economy.

Interested in accessing additional curated insights relevant to the future trajectory of the health economy? Compass+ is a subscription-based platform that provides data- and policy-oriented analyses, executive briefings, strategic planning guides and trend tracking dashboards powered by our national all-payer claims database.

For more information, connect with sanjula.jain@trillianthealth.com.

Thanks to Katie Patton for her research support.

- Specialty Care

- Life Sciences

- Disease Burden

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+