In our most recent analysis examining consumer loyalty to provider networks, we found that most health systems lack strong loyalty. Of the health systems included in the analysis, no system delivered inpatient care to more than 21% of the consumers in their primary market. In addition, overall consumer loyalty to a specific system ranged from 42% to 70.8%.

Market characteristics influence how all consumers make decisions, including their healthcare decisions. Competition and provider supply are two core factors influencing why consumers may “split” their healthcare across brands in a market. Understanding these dynamics can better inform strategies designed to increase consumer loyalty for splitters and non-loyal patients and attract new patients to the health system.

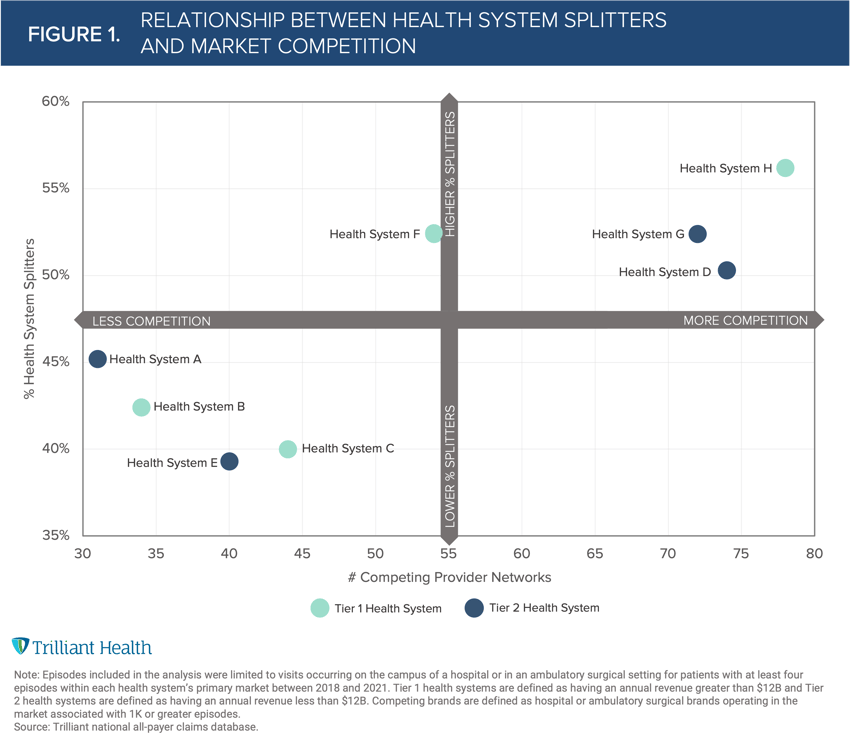

To explore the association between market competition and consumer loyalty, we analyzed the splitter populations of the four health systems previously studied. Consumers with 30-70% of care attributed to a single provider network are defined as splitters. Within each of the health system’s primary market, we identified the number of competing brands, defined as hospital or ambulatory surgical provider networks, associated with 1K or more episodes.

Our analysis suggests that the amount of competition in a market is correlated with the percentage of splitters, regardless of the size of the network (Figure 1). For example, although Health Systems D, G and H have significantly different revenue, each competes in a market with more than 70 competitors.

For a health system to “convert” splitters into loyal consumers, they must first acknowledge the external market environment. It also cannot be assumed that health systems operating in less competitive markets inherently have a highly loyal consumer base. While competition is one factor that can contribute to consumer choice, an individual’s psychographic profile also plays an important role. For example, Priority Jugglers are motivated by perception of brand quality and proximity of sites of care. Therefore, to retain this consumer type, provider networks must maintain a high standard of care and offer robust, convenient services to compete with traditional provider brands, but also with retail entrants that have existing consumer loyalty competing for primary, urgent, and virtual care (e.g., Walmart, CVS).

Thanks to Kelly Boyce and Katie Patton for their research support.