The Compass

Sanjula Jain, Ph.D. | January 3, 2025The 24 Data Stories That Defined 2024

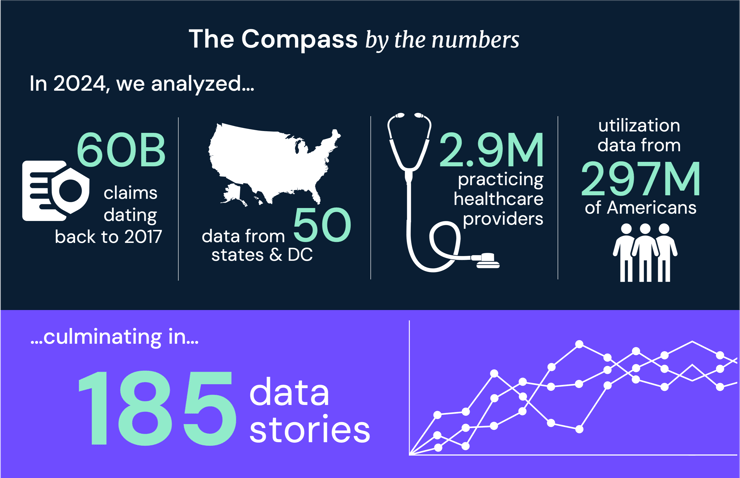

The $4.5T U.S. health economy produces more data than any other sector, which stakeholders often struggle to synthesize into actionable insights. Since our first issue in May 2021, my goal for The Compass has been to create data-driven analyses that allow stakeholders to understand the trends that define the health economy.

With healthcare spending rising, the health status of Americans declining and trust in the healthcare system eroding, improving the speed and quality of decision making for all healthcare stakeholders has never been more critical. As stakeholders prepare for 2025, understanding the data trends that defined 2024 is essential.

The 2024 health economy was defined by both new and enduring trends, ranging from rising rates of early-onset cancer, to retailers like Walmart shuttering their virtual and primary care services, to rising costs for employer-sponsored insurance, to a contracting healthcare workforce. Even so, understanding these trends and associated data points is insufficient to inform effective strategy. Healthcare data is often fragmented, hindering stakeholders’ ability to analyze topics effectively or understand how they influence the broader health economy. Context is essential to uncover actionable insights and drive meaningful change.

I encourage you to use these data stories as a “reading list” to prepare for 2025. The data stories that define 2025 will differ from those that defined 2024, just as those that defined 2024 differed from some that shaped 2023. Even so, one trend is unchanged – the current trajectory of the health economy is unsustainable. Each story is an opportunity to reflect, learn and prepare for the challenges and opportunities the new year will bring.

Pro Tip: To explore the original research and gain a clearer,

more nuanced understanding for each data story, click on the associated link.

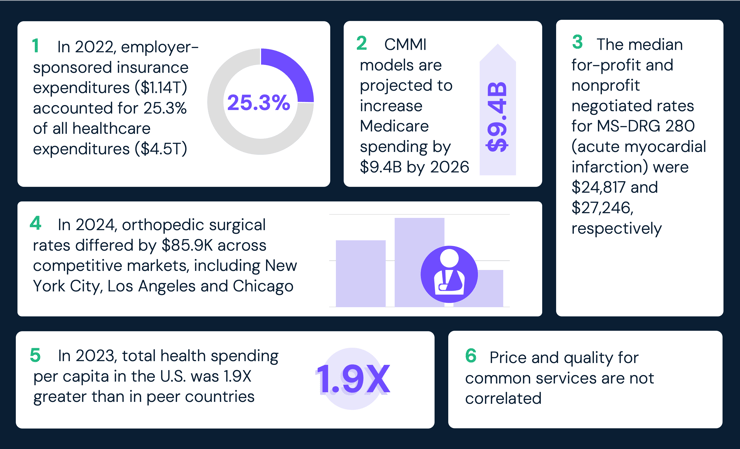

In 2022, health expenditures reached a record $4.5T, but America has little to show for this massive investment in terms of better health outcomes. The drivers of rising costs in healthcare are complex, but include wasteful spending, misaligned incentive structures and a lack of focus on value. How does price variation reflect the value delivered? To what extent is spending influenced by inefficiencies or misaligned incentive structures?

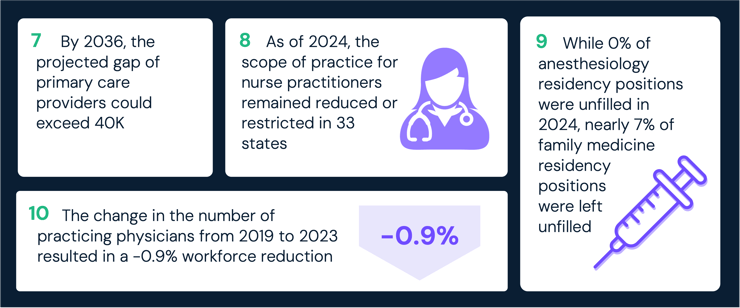

Competition is intensifying for a smaller number of physicians, evidenced by the widening gaps in the supply of primary care physicians (PCPs) and surgeons, and the extent to which allied health providers can offset shortages is unclear. To what extent are traditional providers still competing with new entrants for the clinical workforce? To what extent have regulatory and administrative burdens become a deterrent to becoming a physician or practicing until retirement?

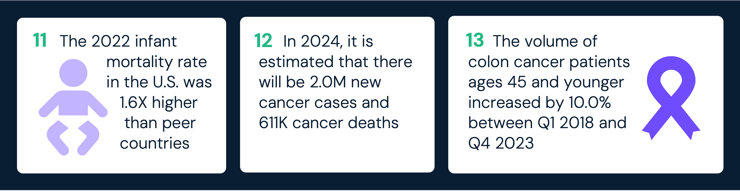

The physical and mental health status of Americans is declining, particularly for younger adults who represent most of the commercially insured market, driven in part by declining primary and preventive care utilization. A sicker population will have economic implications, as patients requiring more frequent, costly and complex services are a further catalyst for continuously increasing health expenditures. How can providers ensure that patients receive timely preventive care? Can payer business models – which have historically depended on a relatively healthy, young population to offset the costs of utilization by older and sicker populations – survive as the population becomes increasingly sicker at younger ages?

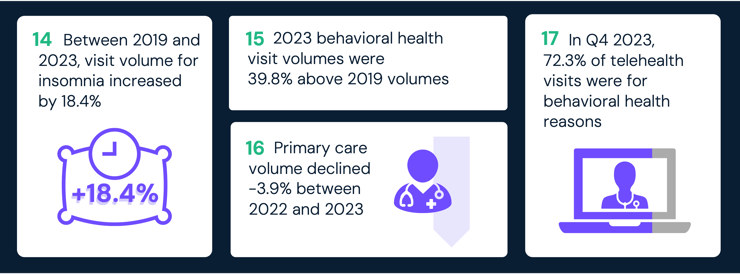

Despite an inadequate supply of providers, demand for behavioral health services has grown year-over-year since 2019. Reduced levels of primary care, coupled with increasing demand for behavioral health services, will inevitably contribute to greater morbidity and mortality. How can we better support the growing need for behavioral health providers? How are untreated behavioral health conditions impacting the overall health status of Americans? What strategies can be implemented to address the underlying stressors contributing to the behavioral health burden facing Americans?

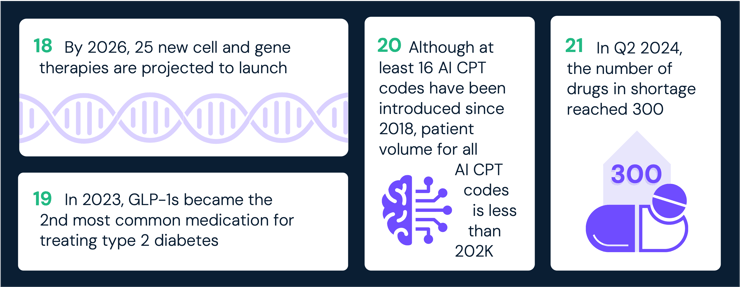

Technological advancements – ranging from AI-enabled tools to novel therapies – hold immense potential to transform care delivery. However, actual utilization of some novel technologies like AI remains limited, while affordability and accessibility issues persist for novel and curative therapeutics. What policy changes or incentives could help life sciences manufacturers deliver greater value? How can concerns about safety, access and affordability be addressed to ensure trust and equitable benefit? How can life science organizations work with other stakeholders to address gaps in access and affordability to therapeutics?

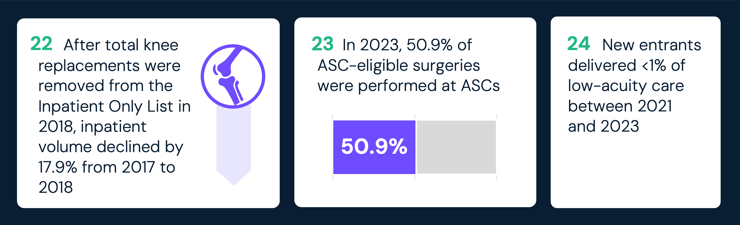

Lower-cost care settings, such as retail clinics, ambulatory surgery centers (ASCs) and virtual care platforms, are more affordable and convenient alternatives to traditional healthcare settings. While these options address consumer demand for convenience, their growing use highlights systemic challenges like care fragmentation and uncertainties about long-term cost-effectiveness. What factors should guide decisions about which services are best suited for these settings? What barriers hinder their expansion, and how can they be overcome? How can employers and health plans encourage the adoption of lower-cost care settings to maximize their potential benefits?

Conclusion

2025 will be significantly influenced by the change in Administration and shift in power in Congress, which will have significant implications for the health economy. I look forward to guiding our readers with more data stories and premium insights in the year ahead.

Upgrade to Compass+ to continue reading the full study.

- Women's Health

- Primary Care

- New Entrants

- Social Determinants of Health

- Virtual Care

- Behavioral Health

- Health Reform

- Cost of Care

- Life Sciences

- Executive Perspectives

- Featured

- Healthcare Consumerism

- Healthcare Investments & Partnerships

- Patient & Provider Loyalty

- Private Insurance

- Healthcare Workforce

- Medicare & Medicaid

- Quality & Value

- Disease Burden

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+