Key Takeaways

-

Understanding consumer psychology is an important and often underappreciated aspect of patient loyalty, but it is increasingly important in a market with abundant – and inexpensive – new care options, from major retailers to telehealth. Psychographics – the individual attitudes, values and personalities of consumers – can explain why individuals make certain healthcare decisions.

-

No single psychographic profile dominates the American population, but Willful Endurers and Self Achievers represent sizable segments.

-

There has been a notable shift from Priority Jugglers to Willful Endurers, potentially driven by the impacts of the COVID-19 pandemic, including a crisis of confidence in the healthcare system, worsening patient acuity and rising healthcare costs.

-

Compass+ Exclusive: How Can Stakeholders Use Psychographic Data to Inform Strategy?

In one of the earliest editions of The Compass, we explained that “healthcare providers that understand the psychology underlying the consumer’s decision-making process will be better positioned to earn the loyalty of healthcare consumers with abundant choices.”1 With more large retailers like Amazon and Walmart, each with large and loyal customer bases, now providing low-acuity healthcare services in a “closed-loop” system with a wide variety of care settings, every health economy stakeholder should prioritize understanding consumer psychology about in order to remain competitive.2 Unlike demographics (e.g., age, gender, income) and patient medical history, which can be useful in understanding what healthcare consumers do, psychographics (i.e., the individual attitudes, values and personalities that motivate healthcare decisions) can help explain why healthcare consumers make certain choices. Psychographic segmentation – grouping consumers based on their shared attitudes, values, behavior patterns, etc. – allows health economy stakeholders to understand healthcare consumer motivations and thus anticipate future demand for services, increase patient retention and maintain loyalty. The rapid evolution of many aspects of the U.S. healthcare system that were catalyzed by the COVID-19 pandemic prompted us to examine how and why the national psychographic distribution has evolved.

Background

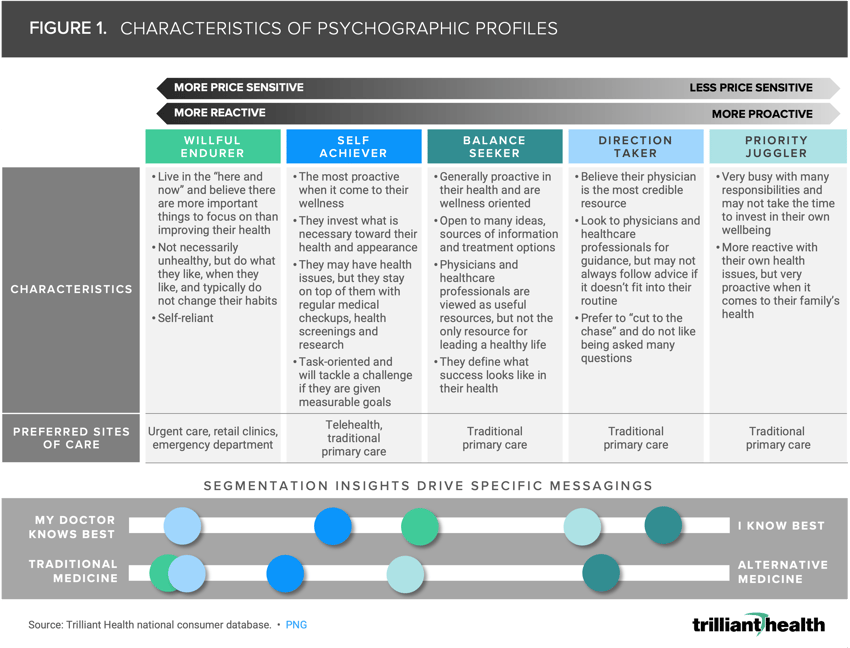

Psychographics transcend demographics, meaning consumers of all ages, ethnicities, pay types (e.g., commercial, Medicaid, Medicare), income levels and geography are represented within each psychographic profile. Healthcare consumers can be segmented into one of five psychographic profiles – Willful Endurers, Direction Takers, Priority Jugglers, Balance Seekers and Self Achievers – based on their view of and approach to personal health, wellness and the structural aspects of care delivery (Figure 1). For example, Willful Endurers characteristically live in the “here and now” and tend to seek care from providers only when absolutely necessary. In contrast, Self Achievers are characterized by their proactivity in seeking healthcare services and medical advice. Reflecting some aspects of both Willful Endurers and Self Achievers, Priority Jugglers are highly proactive when it comes to the health of their family and loved ones but invest less time in their own health status.

When using psychographic segmentation to understand healthcare decision making, it is important to consider that:

-

Consumers do not always fit neatly into a single profile and can possess attributes of all five psychographic profiles, but generally have a dominant profile with secondary and tertiary profiles. For example, a person may primarily align with the Balance Seeker profile, but when faced with exogenous factors like a stressful professional or personal development, display attributes of Priority Jugglers.

-

An individual’s psychographic profile is fully formed by age 18, with that mindset persisting in their consumer behaviors throughout their life – with a few rare exceptions for specific diagnoses like cancer.

Because a consumer’s psychographic profile is both complex and yet highly persistent, changes in the national psychographic distribution provides valuable information for stakeholders hoping to understand shifts in healthcare behavior and the implications of a national distribution shift.

Analytic Approach

Leveraging our national consumer database, we analyzed the 2023 national psychographic distribution. We then compared the current psychographic distribution with the distributions from the past four years to capture how the distribution has evolved and varies by geography.

Findings

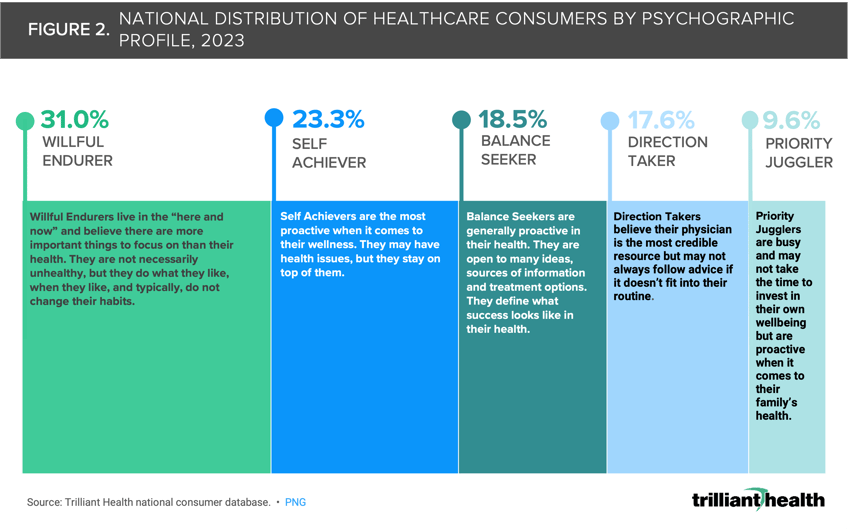

While no single psychographic profile dominates the American population, the dominant profiles are Willful Endurers and Self Achievers (Figure 2). Willful Endurers and Self Achievers comprise 31.0% and 23.3% of American consumers, respectively, followed by Balance Seekers (18.5%), Direction Takers (17.6%) and Priority Jugglers (9.6%). In recent years, the national psychographic distribution has shifted, with Willful Endurers consistently representing the largest share of Americans, but increasing in share from 2021 to 2023.3 Notably, the proportion of Priority Jugglers shrank the most from 2021 to 2023. Typically, the secondary profile for Priority Juggler is Willful Endurer, suggesting that a small yet meaningful percentage of Priority Jugglers are more influenced by their secondary profile.

The shift of more Americans from Priority Juggler to Willful Endurer since the COVID-19 pandemic has been influenced by several factors, reflected in declining confidence in the American healthcare system amidst worsening patient acuity and rising patient deductibles and co-pays.

While Americans’ trust in the U.S. healthcare system has been declining for years, the response to the COVID-19 pandemic (e.g., conflicting guidance from national institutions, untested treatments reported in research publications, concerns about political interference in public health) led to a significant decline in consumer confidence from 2020 to 2021, particularly in physicians and hospitals.4,5 The factors that underlie an individual’s trust in the healthcare system – and thus their response to declining trust – are unique and complex. However, it is possible that Priority Jugglers were more likely to question the necessity of seeking healthcare services as they lost trust in the system, given their lack of proactivity. To what extent did exogenous factors lead Priority Jugglers to become more inclined to adopt a reactive approach like Willful Endurers?

An increasingly unhealthy American public may also have influenced the shift of some Priority Jugglers to Willful Endurers. The COVID-19 pandemic, both directly through its nature as a contagious disease, and indirectly through its negative impact on healthcare utilization (in particular primary and preventive care), precipitated a downward spiral in the physical and mental health status of Americans.6,7 Between 2019 and 2022, primary care volumes decreased by 8.4%, while cancer mortality and early-onset cancers for younger Americans increased.8 Changes in the health status of Americans, particularly if the population became generally sicker, could have influenced Priority Jugglers to shift towards the more reactive approach of Willful Endurers. Did Priority Jugglers become discouraged by the overwhelmed healthcare system and opt for a more reserved approach to seeking care?

Rising costs are another factor that must be considered in examining the evolution of the national psychographic distribution. Since 2010, family and individual deductibles have increased by 31.4% and 33.4%, meaning that each year, Americans are spending more and more on healthcare.9 We know that rising costs have impacted all Americans, becoming the primary driver of forgone care and skipped medication doses.10,11 However, rising costs may have disproportionately impacted Priority Jugglers, prompting them to reassess their proactive healthcare behaviors. Have rising costs made it more challenging for Priority Jugglers to afford the proactive healthcare practices they were accustomed to?

Simultaneously, large retailers such as Amazon and Walmart have entered healthcare to provide Americans with lower-cost, more-convenient access to select healthcare services. In theory, the predominance of Willful Endurers should work in the favor of retail providers – particularly given their preference toward urgent care settings – but the data suggest otherwise. Is it possible that Willful Endurers, in addition to other profiles, perceive the quality of care among retail providers to be different from – or worse than – other settings of care? Similarly, while Self Achievers are favorably inclined towards telehealth, telehealth utilization has declined consistently since the height of the pandemic.

Compass+ Exclusive: How Can Stakeholders Use Psychographic Data to Inform Strategy?

You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? (Figure 3). You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization?

You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? (Figure 4).

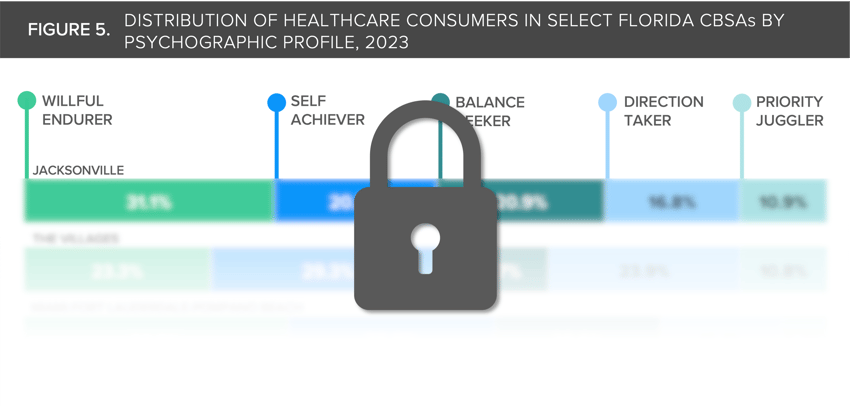

You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? (Figure 5).

Compass+ subscribers can access a 50-state breakdown to elevate their understanding of national psychographic variation.

Access here.

In contrast to a few temporary shifts due to forced adoption (i.e., increased telehealth volumes, increased primary care utilization by women aged 20-49), the impact of COVID-19 on healthcare demand is seemingly more permanent.12,13,14,15 As the health economy undergoes significant transformation, understanding consumer psychology in the context of healthcare decision-making is essential for providers looking to grow market share in an era of increasingly convenient and lower-price alternatives. Stakeholders on the supply side of the health economy must dynamically measure these changes and develop targeted strategies to influence decision making.

Thanks to Sarah Millender and Austin Miller for their research support.

- New Entrants

- Healthcare Consumerism

- Patient & Provider Loyalty

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)