The Compass

Sanjula Jain, Ph.D. | May 8, 2022Continuing Excess Mortality Accelerates the Decline in the Commercially Insured Population in the Post-Pandemic Economy

Over the past few editions of The Compass, we have discussed the increasing burden of disease signaled by life sciences investments and further evidenced by probability-based forecasts.1,2 Our analysis revealed the growth in demand for cardiovascular care for patients ages 25-44, an age segment that also has seen a distinctly disproportionate amount of excess mortality since the summer of 2021.

During the COVID-19 pandemic, the 25-44 age cohort has experienced the largest average percent change in excess deaths (26.5%).3 What are the short-term and long-term implications of the excess mortality in this age group?

Background

From an economic perspective, societal losses resulting from these excess deaths will impact life expectancy, education levels, years in the labor force, earning potential, etc.4 For example, the average American works 42 years, with retirement at 64.5 Therefore, the excess deaths among the 25-44 age cohort result in societal contribution losses ranging from 20-39 years in the labor force per excess death. Additionally, 13.1% of American adults over age 25 hold an advanced degree.6

From a health economy perspective, the commercially insured population (which includes the majority of the 25-44 age cohort) is the lifeblood of the U.S. hospital and health system business,7 and as a result, this cohort is an important customer for provider, payers, medical device, life sciences, and other stakeholders. The pandemic has accelerated the decline in the commercially insured population, the competition for which is further intensifying.8

Analytic Approach

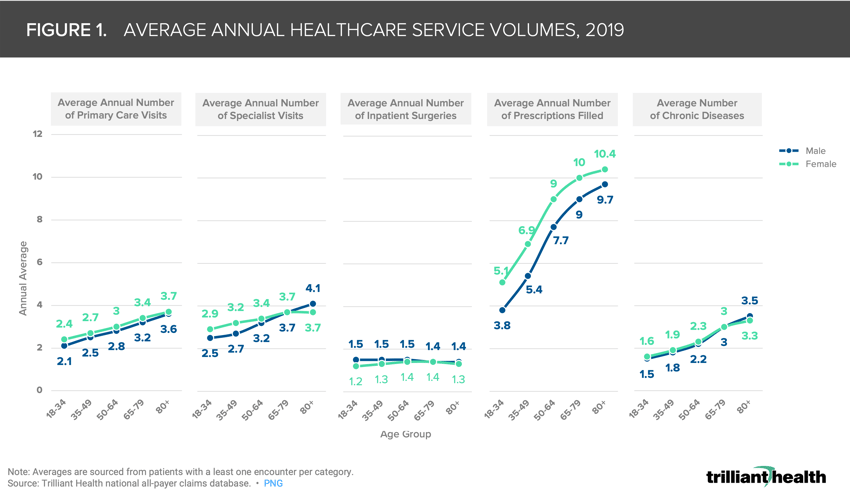

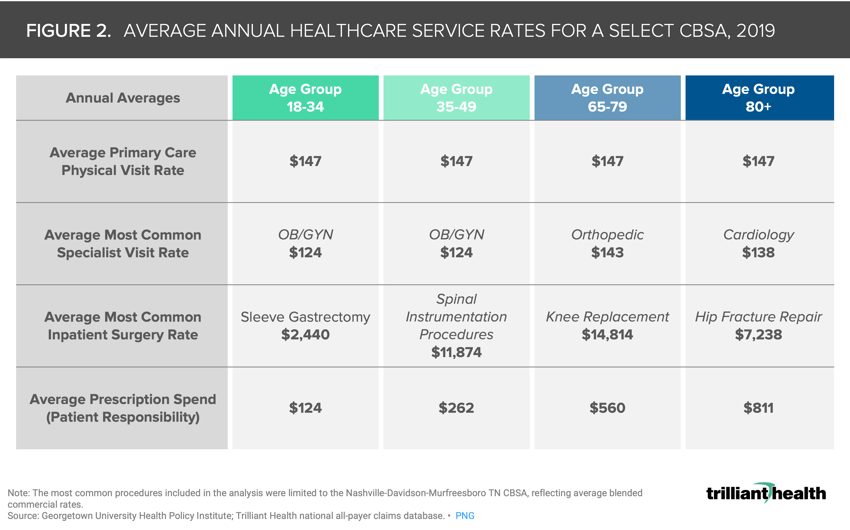

This disproportionate increase in excess deaths among a younger age cohort is likely to have a significant long-term impact on the health economy (i.e., reduced care utilization). To quantify this impact, we examined healthcare utilization across an adult’s lifetime by calculating average healthcare utilization and disease burden metrics for individuals 18+, segmented by age band, gender and pay type. We calculated averages using 2019 data to exclude care disruptions caused by the COVID-19 pandemic. To establish costs for select services, we identified the most common visit or procedure type in the Nashville-Davidson-Murfreesboro, TN CBSA (as an example) for each age group and determined the average blended commercial rate for each service.

Findings

On average, male healthcare consumers between ages 65-79 have 3.0 diagnosed chronic conditions, leading to an annual average of 3.2 primary care visits, 3.7 specialist visits, 1.4 surgeries, and 10 prescriptions filled. As an illustrative example, a single excess death of a 35-year-old male could result in a loss of 100 primary care visits, 108 specialist visits, and 216 prescriptions filled between the ages of 35 and 75, the average life expectancy.9 From January 1, 2020 through April 30, 2022, there have been 120,367 excess deaths in the 25-44 age cohort.10 Extrapolating the projected utilization of a single 35-year old male to the approximately 120K excess deaths in this age cohort over the past 28 months, as a conservative estimate we would expect an aggregate reduction of 12M primary care visits and ~13M specialist visits over the next 40 years.

Reduced utilization inherently results in the loss of associated revenues. To contextualize this loss, we identified the most common visit or procedure types for each age group. The roughly 120K excess deaths for individuals aged 25-44 over the past 28 months also equates to, at minimum, $1.76B in lost reimbursements for average primary care visits alone (Figure 2).

In addition to the accelerated decline in the number of commercially insured individuals as a result of excess deaths, stakeholders in certain some markets must also address decreased demand resulting from population migration in the 45-64 age cohort.11 What are the stakeholder-specific implications as a greater loss of patients ages 25-44 equates to a disproportionate loss of commercially insured individuals? What is the impact of the net outmigration of the 45-64 age cohort from certain markets throughout the country? How will demand for healthcare services change at the national and market level? How will it change at the service line level? Will certain service lines, such as oncology, see patients with more complicated pathology? Effective post-pandemic strategies will be those that factor in the excess loss of life over the past two years, both COVID- and non-COVID-related, population migration, and changes in disease burden resulting from healthcare disruptions throughout the pandemic.

Thanks to Kelly Boyce, Jim Browne, and Katie Patton for their research support.

- Primary Care

- Specialty Care

- Cost of Care

- Private Insurance

- Disease Burden

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+