The Compass

Sanjula Jain, Ph.D. | May 5, 2024Analyzing the Wide Range of Value for High-Volume Outpatient Preventive Procedures

Key Takeaways

- Outpatient colonoscopy is the highest-volume surgical procedure in the U.S. but negotiated rates and quality outcomes vary widely across states and markets. For instance, the median state-level professional negotiated rate varies 2.3X nationally, ranging from $368 in Hawaii to $837 in Alaska, with a median rate of $535. Despite this variation, we found no consistent correlation between price and quality.

- The dynamics influencing market-level price and quality in healthcare, especially in colorectal cancer screening, highlight increasing consumer choices for care. With the proliferation of noninvasive alternatives and evolving provider competition, the future of colonoscopies will require careful consideration of value for both patients and payers.

- Compass+ Exclusive: Identifying and Comparing Lower-Value Care Settings to Higher-Value Care Settings in Dallas-Fort Worth-Arlington, TX

You are currently viewing the public version of The Compass.

To unlock additional analyses, upgrade your subscription to the Compass+ library.

Value in the health economy exists at the intersection of quality and price, but there is no observed correlation between quality and price in healthcare services at the national level. Healthcare pricing is influenced by competition, payer dynamics, patient demographics and regulatory frameworks, among other variables. Much of our research on the value of healthcare services has focused on acute services and conditions (e.g., pneumonia, heart failure). Because healthcare value equations are dynamic, understanding value for elective or choice-based services, especially high-volume recommended procedures such as cancer screenings, is different from emergent and acute services.

Background

The United States Preventive Services Task Force (USPSTF) favorably recommends colorectal cancer screening for adults ages 45 to 75, or 116M Americans.1,2 Because the USPSTF recommendations are graded a “A” for ages 50 to 75 and “B” for ages 45 to 49, patients receiving colorectal cancer screening do not incur out-of-pocket costs, per coverage requirements afforded by the ACA.3 However, the more than 40% of people ages 50 and older with precancerous polyps in the colon or those that require unplanned follow-up care often face additional out-of-pocket costs.4,5

Employers and employees theoretically have aligned interests with respect to utilizing high quality colorectal screening for early detection of disease, whether a colonoscopy, stool-based test or capsule endoscopy. While the patient does not have any out-of-pocket financial responsibility for certain preventive screenings, the employer is still concerned with value – the intersection of quality and price – and thus is incentivized to steer patients towards high-value providers.6 Although the exact costs of diagnostic procedures are not easily accessible, health plan price transparency data paired with quality data can empower employers and employees to make informed decisions when deciding their path to screening. Because outpatient colonoscopy is the highest-volume surgical procedure in the U.S., we were interested in analyzing the rate and quality differences for this routinely recommended screening procedure.

Analytic Approach

We leveraged Trilliant Health’s national health plan price transparency dataset and the Centers for Medicare and Medicaid (CMS) QualityNet to examine the relative value delivered by facilities performing outpatient colonoscopies. We analyzed commercial in-network UnitedHealthcare state-level median negotiated rates for screening colonoscopies (CPT 45378) and commercial in-network BlueCross BlueShield of Texas PPO negotiated rates for diagnostic colonoscopies (CPT 45380) at ambulatory surgery centers (ASCs) in Dallas-Fort Worth-Arlington, TX. Using CMS QualityNet, we analyzed the ASC-12 measure, or rate of unplanned hospital visits within seven days of an outpatient colonoscopies at ASCs, both nationally and at facilities in Dallas-Fort Worth-Arlington, TX as an illustrative competitive market.

Findings

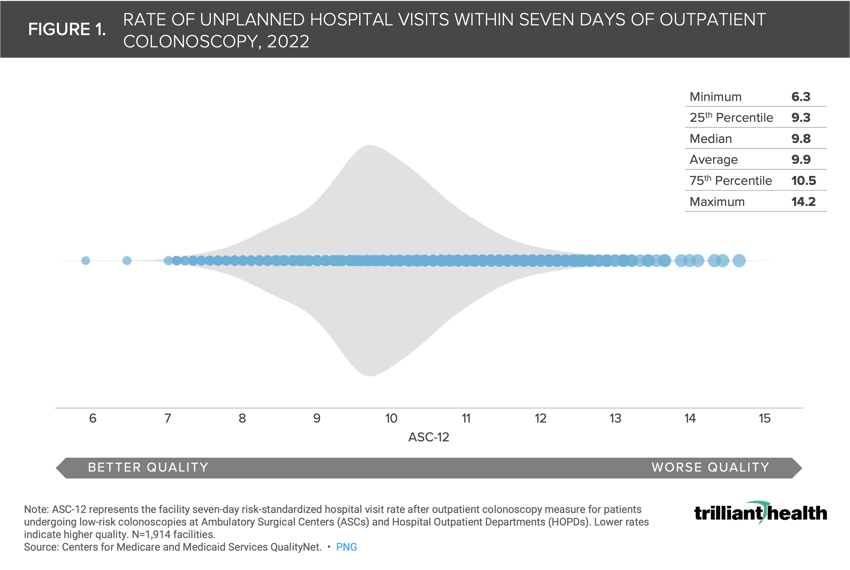

We examined the range of seven-day unplanned hospital visits after outpatient colonoscopy (ASC-12) nationally. The hospital visit rates ranged from 6.3 (lower is better) to 14.2 (Figure 1). However, the median and average rates are 9.8 and 9.9, respectively.

The average ASC-12 rate varies across states, ranging from 9.1% in Maine to 12.0% in Oklahoma (Figure 2). Eighteen states, including West Virginia, New York and Maryland, and the District of Columbia have average rates at or below the national average of 9.9%. In contrast, 32 states, including Iowa, Oregon and Florida, have average ASC-12 rates above (i.e., lower quality) the national average.

In addition to a wide range of quality for colonoscopy nationally, negotiated rates for the procedure vary widely within and among markets. The median state-level professional negotiated rate for screening colonoscopies varies 2.3X nationally, ranging from $368 in Hawaii to $837 in Alaska, with a median rate of $535 (Figure 3).

Consistent with our prior research focused on higher-acuity inpatient procedures, there is no observed correlation between the state-level median negotiated rate (i.e., price) and average ASC-12 rate (i.e., quality). For example, Alaska has the highest median negotiated rate ($837), but its average ASC-12 rate is above the national average (Figure 4). In another outlier scenario, Oklahoma has a relatively lower median negotiated rate compared nationally, but the worst average quality with an average ASC-12 rate of 12.0. Hawaii and Maine represent higher-value states for outpatient colonoscopy, given the comparatively low median rates and above-average quality results. However, while state-level descriptive statistics can provide a benchmark for value performance, the prices and quality delivered will inevitably vary in each local market and at each individual outpatient facility.

Compass+ Exclusive: Identifying and Comparing Lower-Value Care Settings to Higher-Value Care Settings in Dallas-Fort Worth-Arlington, TX

Unlock the complete analysis with Compass+

Conclusion

Our analysis reveals significant variation in negotiated rates and quality outcomes for outpatient colonoscopies across different states and markets. Consistent with past research, we found no consistent correlation between price and quality, emphasizing the need for informed decision making by patients and employers alike, afforded by price transparency data.

The dynamics that influence the market-level spread of price and quality in healthcare are contingent on several factors, many of which converge in the case of colorectal cancer screening. More than ever, patients have choices when it comes to cancer screening. Even for preventive screening available without out-of-pocket expenditures, many consumers are hesitant to initiate screening at all. With primary care utilization down 8.4% from 2019 to 2022 and declining rates of colorectal cancer screening, it is more critical than ever for patients not to feel hesitation when receiving recommended screenings.7 For those that are screening for cancer, they weigh the option of more frequent, yet noninvasive stool-based screening modalities or less frequent, yet invasive screening colonoscopies. With such a high-volume procedure that many providers rely on for financial stability, the future trajectory of and competition among providers colonoscopies will face the convergence of growing patient options, provider-level value being revealed, and noninvasive procedures proliferating as a substitute good.

Our findings underscore the importance of transparency in healthcare pricing and the potential for employers to drive value by steering employees towards higher-quality, lower-cost providers. Furthermore, as the landscape of colorectal cancer screening evolves with the emergence of alternative modalities and evidence that screening colonoscopies do not provide significant reduction in mortality, it is crucial for payer policies to support comprehensive screening approaches to ensure patients receive timely and effective care.8

Thanks to Matt Ikard, Jason Nardella and Katie Patton for their research support.

To learn more about pricing dynamics and more, check out Chapter 4 of Trilliant Health’s Field Guide, an essential resource for health economy stakeholders to compete seriously in healthcare’s negative-sum game.

- Cost of Care

- Quality & Value

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+