Studies Archive

2023 Policy Outlook: Healthcare Spending, Affordability, and Price Transparency

January 8, 2023Key Takeaways

-

Last year, CMS released its analysis of national health expenditures, revealing that the health economy increased from $4.1T in 2020 to $4.3T in 2021 (i.e., an increase of $12,914 per American).

-

For the third year in a row, Congress prevented Medicare physician payment cuts from taking effect, reducing the previously finalized 4.5% Medicare physician pay cut by CMS to 2% beginning this month.

-

The CBO recently published a framework for how Federal legislation might address high commercial prices, estimating that a 1% decrease in prices could lead to a decline in total spending on commercial health insurance premiums by $13B by 2032.

The 118th Congress has stumbled into the New Year, as the swearing-in of new House members was delayed amid the House Speaker voting stalemate. This impasse might be a harbinger of how challenged the Congress will be in addressing substantive healthcare policies between now and November 2024. However, affordability, price transparency and antitrust issues will remain in focus for legislators on both sides of the aisle and may be prominent on the 2024 campaign trail. For now, it is likely that state houses and federal regulators will be the only policymakers positioned to enact meaningful change in healthcare.

Unsustainable Growth in National Health Expenditures

At the end of 2022, the CMS Office of the Actuary released its analysis of national health expenditures, revealing that the health economy increased from $4.1T in 2020 to $4.3T in 2021 (i.e., an increase of $12,914 per American).1,2 The decline in federal expenditures in 2021—primarily due to the 2020 pandemic spike—was accompanied by 9.6% growth in private insurance spending on medical goods and 10.4% growth in out-of-pocket healthcare spending, the largest jump since 1985.

2023 Medicare Physician Payment Updates

For the third year in a row, Congress prevented Medicare physician payment cuts from taking effect. The spending bill signed into law on December 29, 2022 decreases the previously finalized 4.5% Medicare physician pay cut by CMS to 2% beginning this month, with an additional 1.25% cut scheduled to be implemented in 2024.3 In light of increasing strain on the physician workforce and hospitals struggling to maintain positive operating margins, the provider lobby believes that any reduction in CMS’s physician fee schedule is inappropriate. While temporary delays and assistance are effective in the near-term, how will this Congress (or the next) address the dual issues of increasing patient financial responsibility and decreasing provider payments?

Continued Focus on Affordability and Transparency

January 1, 2023, also marked a milestone in ongoing transparency efforts, with one of the most consumer-focused initiatives taking effect, requiring most commercial health insurers to provide an online price comparison tool allowing an individual to estimate of their cost-sharing responsibility for a specific item or service from a specific provider or providers—limited for 500 items and services until 2024.4

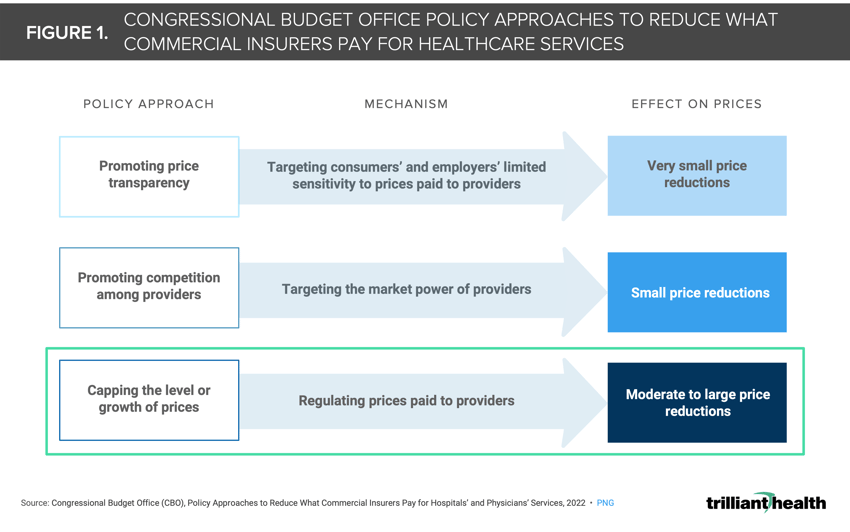

Healthcare spending accounts for almost 20% of U.S. GDP. The prices that commercial health insurers pay are much higher and increasing more quickly than the prices paid by public health insurance programs. Last year, the Congressional Budget Office (CBO) published an analysis of how Federal legislation might address high commercial prices, which result from negotiations between private health insurers and hospitals or physician groups.5 While two of the three policy options (i.e., promoting price transparency and provider competition) are familiar to health economy stakeholders, the CBO’s consideration of the impact of implementing a cap on commercial prices is one that would dramatically impact every stakeholder (Figure 1). CBO estimates that a 1% decrease in prices could lead to a decline in total spending on commercial health insurance premiums by $13B by 2032.6 While it is unlikely that a policy of this nature would materialize during the 118th Congress, CBO’s report is foreboding for the private sector.

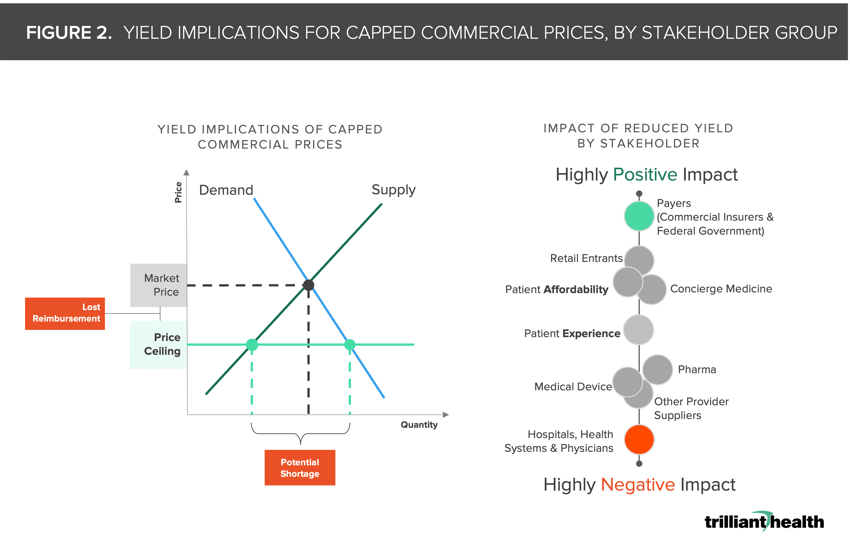

Healthcare is not a “free market economy” in classic economic terms given numerous constraints imposed by Federal and state legislators and regulators, and price controls would represent a significant increase in government control of the U.S. health economy. If implemented, a commercial price ceiling would definitely reduce the per episode reimbursement received by hospitals and providers, and it might lead to increased patient demand in select services. In a scenario where commercial prices could be capped by the federal government, every stakeholder must consider and prepare for the implications of reduced yield in the years to come (Figure 2).

During the 2022 midterm elections, inflation was the #1 issue nationally, and the cost and affordability of healthcare is a meaningful contributor to those broad inflationary and affordability concerns. With increasing predictions of a recession in 2023, it is difficult to imagine that healthcare affordability and price transparency will not be a significant issue in the 2024 election cycle.7

The converging realities of 1) unsustainably growing healthcare expenditures, 2) reduced margins for providers and health systems, 3) a persistent healthcare staffing shortage and 4) widespread delayed healthcare in a population emerging from a global pandemic may be the catalyst that forces legislators to address the cost and affordability of healthcare through increased controls. The timeline and reality of that remains to be seen.

Thanks to Katie Patton for her research support.

- Health Reform

- Cost of Care

- Private Insurance

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)