The Compass

Sanjula Jain, Ph.D. | August 20, 2023Virtually Enabled New Entrants Are Disintermediating the Traditional Healthcare Journey

Key Takeaways

-

While direct-to-consumer telehealth providers, such as Amazon Clinic, increase access—for specific patient populations—to certain low-acuity services, their closed loop model disintermediates traditional patient care journeys originating with primary care physicians, in turn creating fragmentation for traditional providers.

-

One underappreciated downstream implication of siloed care is increased friction costs for patients, both in time and money.

-

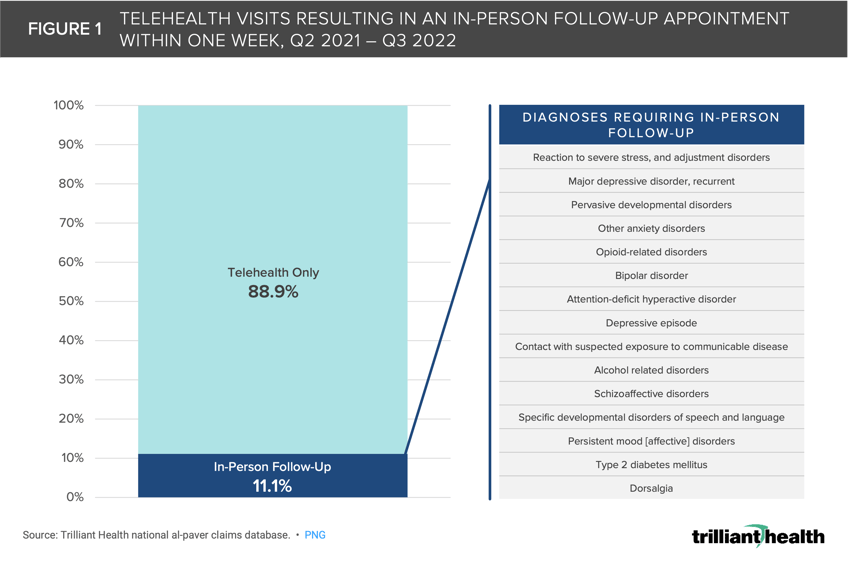

Between Q2 2021 and Q3 2022, 11.1% of telehealth visits nationally resulted in an in-person follow-up visit for the same clinical reason within one week, with behavioral health diagnoses and select chronic conditions accounting for most duplicate visits.

Earlier this month, Amazon announced the expansion of its direct-to-consumer (DTC) offering to all 50 states and Washington D.C. with Amazon Clinic, a video and message-based (in select states) virtual care service.1 As the DTC and retail provider market expands, it is important to understand the ripple effects of these new care providers on the longitudinal patient journey.

Background

Amazon has steadily expanded its presence in the national DTC healthcare arena through a series of strategic program launches. Following its acquisition of PillPack for $753 million in 2018, Amazon launched Amazon Pharmacy in 2020, covering all 50 states. It further expanded its presence in the pharmacy realm with the introduction of RxPass, a subscription service for specific prescription medications.2 Additionally, Amazon introduced Amazon Care, a comprehensive primary care service designed to provide virtual, in-person, and home-based care within select U.S. markets. Although Amazon Care was initially piloted in 2019, it was later discontinued in 2022.3 However, the core objectives of Amazon Care were realized this year with Amazon's acquisition of the primary care chain, One Medical.4

The rollout of Amazon Clinic in August 2023 establishes a "virtual storefront" offering consumers out-of-pocket virtual care services that are not covered by insurance. In essence, Amazon Health has crafted a proprietary "closed loop system" for a limited set of services. This model allows Amazon to engage directly with consumers, thereby disintermediating traditional patient care journeys originating with primary care physicians. Not surprisingly, this approach leverages Amazon's substantial scale and focus on eliminating every intermediary between Amazon and the American consumer. As a result, Amazon's scale enables them to provide primary care services in a transactional manner, like the transactional nature of ambulatory surgery and diagnostic imaging.

The disintermediation of the traditional doctor/patient relationship by Amazon and other retail healthcare providers creates fragmentation of the patient journey for traditional healthcare providers.

Given our own telehealth research findings and Amazon Health’s recognition that "virtual care isn’t right for every problem”, consider a scenario wherein a patient opts for a telehealth visit with a provider like Amazon Clinic.5,6,7 After incurring the fee and initiating the visit, the patient is informed by the provider that their complaint is too complex for treatment via the Amazon Clinic platform. In turn, that patient must start over and seek care from a traditional care pathway (e.g., their primary care provider). Alternatively, if the provider can help with the patient’s complaint, but their care requires an in-person visit, again, the patient may choose to start over and seek out care from another provider (i.e., Amazon Clinic users may not necessarily convert to One Medical members). In both situations, the patient incurs friction-related costs, rather than receiving actual treatment.

To examine the extent to which virtual-care providers are increasing friction and disrupting care coordination, we studied the frequency of telehealth visits resulting in in-person follow-up visits.

Analytic Approach

Using our national all-payer claims data, we examined the percentage of patients who utilized telehealth and then had an in-person follow-up visit for the same clinical reason within one week. Of those visits, we identified the clinical reasons most commonly resulting in the in-person follow-up visit.

Findings

Our analysis revealed that between Q2 2021 and Q3 2022, 11.1% of telehealth visits nationally resulted in an in-person follow-up visit for the same clinical reason within one week (Figure 1). Although behavioral health diagnoses (e.g., adjustment disorder, major depressive disorder) accounted for most of these duplicate visits, chronic conditions like diabetes and back pain also frequently led to in-person treatment following a virtual visit. Due to scheduling difficulties and provider supply in the health economy, it is logical that the proportion of follow-up visits would be even greater if data over a longer period (i.e., 2-4 weeks) were examined (a consideration we will explore in future research).

While telehealth is often used to treat low-acuity conditions (e.g., bacterial infections, allergies), it is increasingly utilized for treatment of chronic conditions (e.g., diabetes, high cholesterol and major depression), which typically require long-term care management. DTC telehealth providers like Amazon Clinic are limited in their ability to maintain an established relationship with the patient or provide any type of ongoing monitoring or treatment that does not result in a prescription.

Notably, DTC providers are deliberately isolated from the broader healthcare delivery system, particularly with their captive pharmacy divisions that are well-equipped to address low-acuity diagnoses commonly managed with medication-based treatments. In contrast, traditional providers, notably hospitals and health systems, not only fail to understand the objectives of DTC providers but also lack the scale to treat low-acuity primary care as transactional.

Many patients require a high-touch approach, including long-term treatment and monitoring by an established provider, to achieve ideal health outcomes. Even for patients needing one-time prescriptions, siloed care provided by a DTC model could exacerbate existing issues in the healthcare system (e.g., over-prescribing of antibiotics and pain management medications).8,9,10,11

While DTC healthcare does cater to select consumer preferences and increases access to certain low-acuity services, these new entrants have created more silos of care that are resulting in friction costs, whether the patient’s time, patient spend or the total cost of care of that individual to the delivery system. While telehealth platforms may offer accessible avenues for immediate care, the fundamental challenge lies in their ability to provide comprehensive, long-term care. While many of these new entrants intend to make care more coordinated, as one healthcare CEO recently told me, “If everyone is coordinating care, then nobody is coordinating care.”

Primary care in the U.S. is already splintered, and the pandemic further exacerbated this reality with declines in routine screenings and other necessary services.12,13 The state of the U.S. health economy is already struggling with the current level of fragmentation that exists between providers within the same network, and DTC providers have introduced more pathways that patients can take that don’t connect to one another.

In summary, the efficiencies that the DTC providers offer through their approach should be measured against the waste that they produce when a patient’s illness cannot be addressed inside those closed DTC systems. Business models rooted in maximizing transactions with individual consumers are seemingly ill-equipped to assist patients with chronic care needs, and yet DTC providers have no financial incentive to coordinate care that they cannot deliver. Absent a truly transformational transaction – for example, Amazon’s acquisition of UnitedHealth Group or HCA – that is unlikely to change.

For now, every health economy stakeholder must realize that these data findings are just one dimension of the magnitude of friction and fragmentation that now exists. While the positives of “consumerism” may be realized to an extent, there are also significant implications for both how other stakeholders adapt to a more distributed care model and how patient healthcare behaviors will change over a longer period. Future research will continue to examine the effects of disintermediation on the health economy.

Thanks to Sarah Millender and Austin Miller for their research support.

- New Entrants

- Virtual Care

- Cost of Care

- Healthcare Consumerism

- Quality & Value

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+