The Compass

Sanjula Jain, Ph.D. | November 7, 2021Most Health Systems Lack Strong Consumer Loyalty

It is a commonly held misconception that patients, who are consumers, are loyal to their provider. The reality, however, is that healthcare consumers "split" where they receive care across an average of 4.2 provider networks. Contextualized differently, U.S. healthcare consumers are 60% loyal to consuming services within a single provider brand or network.

Over the last few months, we have analyzed consumer loyalty at the market level and by consumer demographics such as age and gender. As consumers continue to have abundant choices for healthcare services – ranging from longstanding providers (e.g., health system) to new virtual and primary care players to new retail entrants (e.g., Walmart and CVS) – earning the consumer’s loyalty will become increasingly difficult for every provider brand.

We classify healthcare consumers into one of three categories: loyal, not loyal, and splitters.

- Loyal: More than 70% of a patient’s care is attributed to a single provider network

- Splitter: 30-70% of a patient’s care is attributed to a single provider network

- Not Loyal: Less than 30% of a patient’s care is attributed to a single provider network

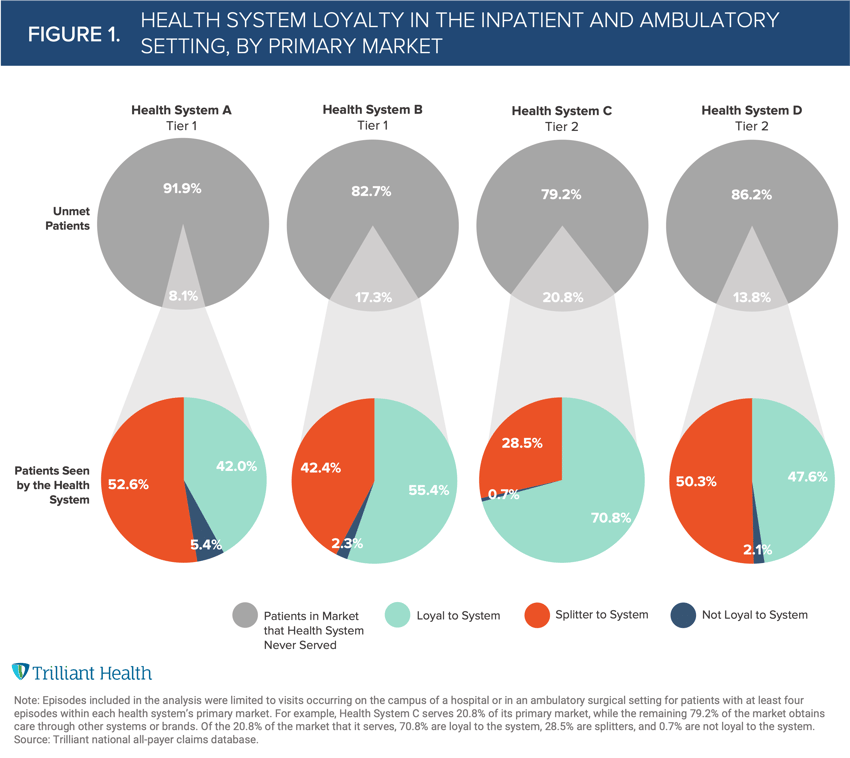

To understand the impact of new suppliers of healthcare services, we conducted an analysis of consumer loyalty to health systems. For our analysis, we selected a sample of four health systems: two “Tier 1” systems (annual revenue >$12B) and two “Tier 2” systems (annual revenue <$12B). The health systems vary in terms of geography and competition in the markets they operate. For each health system’s primary operating market, we classified consumers as loyal, not loyal, and splitters from those patients treated within the network with four or more episodes of care in a year between 2018 and 2021. Loyalty was calculated using episodes limited to care delivered on the campus of a hospital or in ambulatory surgical centers (i.e., not including outpatient/primary care services rendered by the health system).

Notably, no system delivered care to more than 21% of the consumers in their market (Figure 1). Among the patients treated, Health System C earned the strongest loyalty for its patients (70.8%). In contrast, Health System A served only 8.1% of the individuals in its primary market, and only 42% of its patients are considered loyal to the health system. Given the historic challenges that health systems’ face to maintain high loyalty for core services (e.g., inpatient care), competing for the consumer for primary care and outpatient services in a market heavily dominated by retail players and other provider brands will likely be even more difficult.

Inevitably consumers will seek healthcare services based on a multitude of factors (e.g., convenience, brand recognition, severity of illness, transportation, cost, network limitations). Every healthcare provider can improve consumer loyalty by developing evidence-based strategies that match provider supply and asset footprint with the needs and preferences of the individuals at the market level. We will continue to explore aspects of consumer loyalty throughout the health economy in future research.

Thanks to Kelly Boyce and Katie Patton for their research support.

- Healthcare Consumerism

- Patient & Provider Loyalty

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+