The Compass

Sanjula Jain, Ph.D. | July 10, 2022Machine Learning Reveals Precisely How Local Healthcare Really Is

Most healthcare veterans know that healthcare is local and, therefore, “know” that demand for healthcare services varies between markets. Despite this, health executives across the country make decisions based on "best practices" from "highly ranked" leaders, with the leaders established based on metrics such as size (e.g., HCA largest by revenue), quality (e.g., Intermountain), or overall "ranking" (e.g., U.S. News ranks Mayo Clinic as #1 best hospital). While there is value in learning from aspirational peers like HCA, Mayo Clinic or Intermountain, benchmarking to develop evidence-based strategies requires an algorithmic approach.

To enable evidence-based benchmarking, we leveraged our SimilarityEngine™ to generate the SimilarityIndex™ | Markets Report published last week, as well as an accompanying interactive tool, which is the first application of our ongoing SimilarityIndex™ benchmarking series.

Background

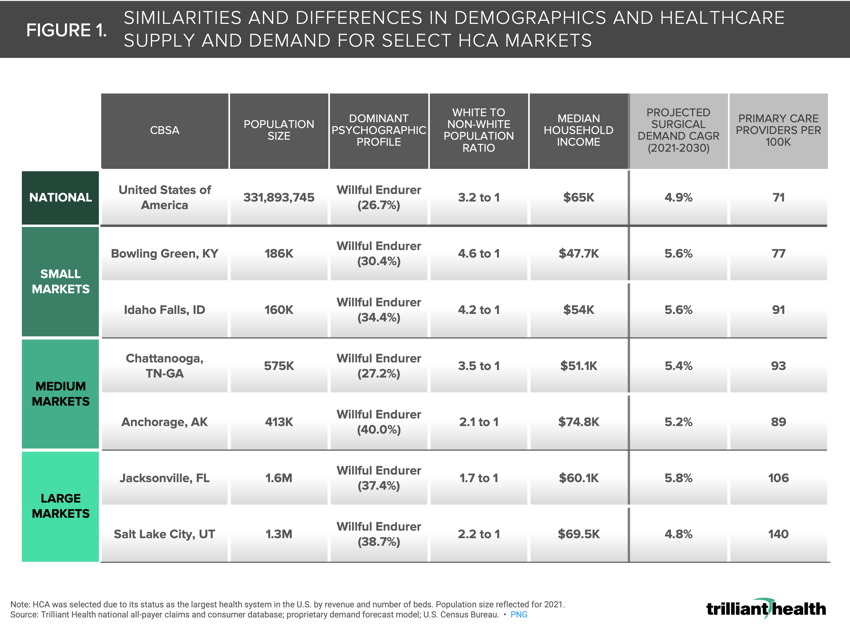

While resources such as the Dartmouth Atlas of Health Care have attempted to highlight local variation through specific data points, the health economy has rarely operationalized these insights into strategic plans. Although national or even state-level incidence rates can indicate the health status of a population generally, incidence rates within a locality (e.g., ZIP Code, county, CBSA) more precisely reflect healthcare demand in an individual market. Said another way, applying a national benchmark to an individual CBSA is inherently misleading, sometimes dramatically so. For example, applying national primary care supply numbers (71 per 100K) to Salt Lake City, where the provider rate is nearly double (140 per 100K) that of the national average, would be incorrect by a factor of 2X.

As a result, evidence-based strategic initiatives (e.g., physician staffing, therapeutic distribution) must consider inter-market differences to effectively meet the care needs and preferences of individual healthcare consumers in each market.

Analytic Approach

As an illustrative example, we identified three pairs of similarly sized CBSAs where HCA Healthcare, the largest health system in the U.S., has a market presence. HCA’s presence in 21 states provides ample opportunity to assess unique markets with varying levels of demand for healthcare services. We identified two of HCA’s larger markets (Jacksonville, FL and Salt Lake City, UT) with populations greater than 1M; two medium markets (Chattanooga, TN and Anchorage, AK) with populations between 350-750K; and two small markets (Bowling Green, KY and Idaho Falls, ID) with similar populations under 200K.

Findings

While markets can be characteristically similar, they can have vastly different healthcare demand and supply. Despite being geographically dispersed, many HCA markets are similar in population size, demographics, and consumer psychographics (Figure 1). Even so, there is dissimilarity in supply (e.g., rate of primary care providers) and demand (e.g., projected surgical demand growth) across these HCA markets. Not every health system can be like HCA or Cleveland Clinic; in fact, almost none can be. However, every health system (or health plan, life sciences company, etc.) can more effectively meet the needs of patients they serve by applying successful strategies in similar patient populations.

Machine learning and similarity modeling enable healthcare stakeholders to identify similar markets and true peers accurately, thus informing evidence-based decision making. How will your strategy change knowing that the current market you are benchmarking against is more dissimilar to your own than originally thought? Will this help your organization identify why certain markets in your portfolio are performing better than others? Identify partnership opportunities? Develop strategies to address health disparities? Where to prioritize public health resources? How to design value-based networks?

Machine learning and similarity modeling enable healthcare stakeholders to identify similar markets and true peers accurately, thus informing evidence-based decision making. How will your strategy change knowing that the current market you are benchmarking against is more dissimilar to your own than originally thought? Will this help your organization identify why certain markets in your portfolio are performing better than others? Identify partnership opportunities? Develop strategies to address health disparities? Where to prioritize public health resources? How to design value-based networks?

Improving U.S. healthcare outcomes and affordability requires an exponentially better approach to decision making. Now is the time to modernize benchmarking, the foundation for developing evidence-based strategies.

- Healthcare Consumerism

- Quality & Value

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+