The Compass

Sanjula Jain, Ph.D. | March 20, 2022How Soon Will Too Much Telehealth Supply and Too Little Demand Reach a Low-Yield Equilibrium?

To complete our “deep dive” into the Telehealth Trends Report over the last few weeks, we decided to look beyond what has happened and focus on what will happen. Applying predictive probability models to historic telehealth utilization and analyzing those forecasts through the economic principles of supply, demand, and yield offers insights for future telehealth adoption and longevity.

Telehealth is not a new phenomenon (remember Teladoc was founded in 2002), and much of the forced adoption observed at the height of the COVID-19 pandemic is not predictive of post-pandemic norms. As stakeholders across the health economy consider the evolution of telehealth, the following realities should inform future strategy considerations:

- While certain changes in utilization are more sustainable (i.e., behavioral health telehealth), most observed telehealth utilization behaviors were temporary due to exogenous factors stemming from the COVID-19 pandemic.

- When forecasting telehealth demand without the pandemic, the difference between future projections of demand absent the pandemic and projections incorporating the pandemic spike are stark.

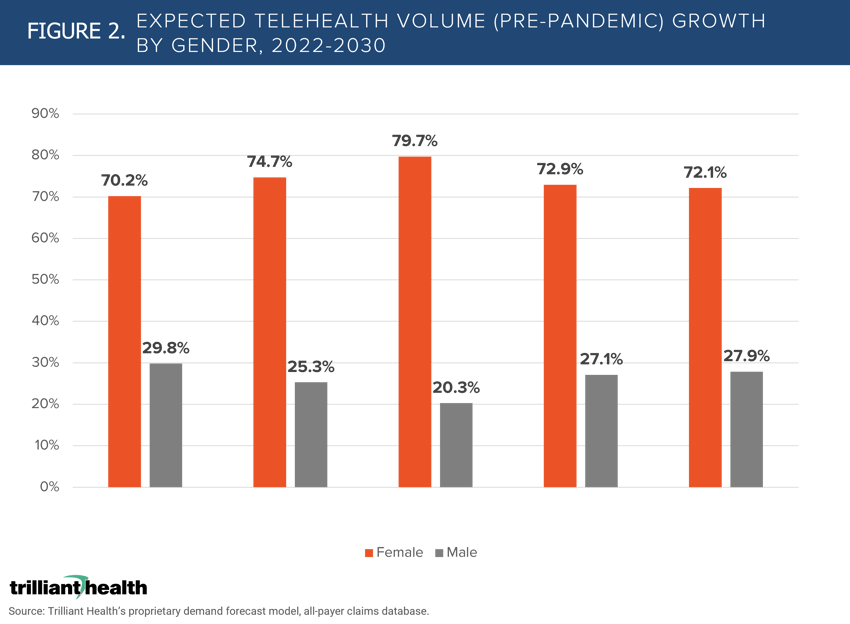

- Pre-pandemic forecasts anticipated that telehealth would be utilized more frequently by females, which pandemic utilization confirmed.

- Demand has already tapered and is projected to continue to decline even as supply continues to increase.

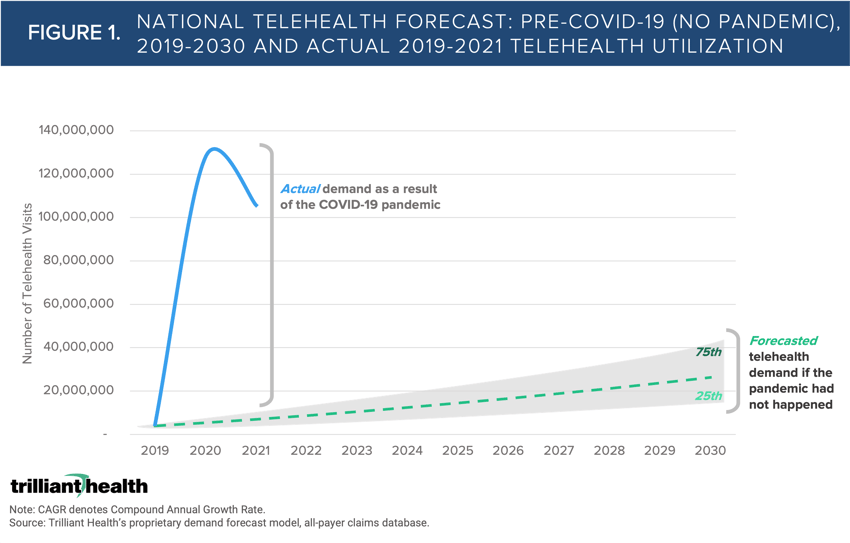

Longitudinal analysis of telehealth utilization with consideration for pandemic vs. “no pandemic” trajectories is crucial for navigating the telehealth economy following the end of the public health emergency. Telehealth volumes are stabilizing well below pandemic peaks, regressing closer to “no pandemic” projections. While national claims-based volume of telehealth services was projected to reach just 3.6M without the existence of the pandemic, actual volumes in 2020 exceeded 120M visits (Figure 1).

In the “no pandemic” forecast model that assumes the pandemic did not happen, females were expected to drive 2.5X more demand than males (Figure 2). In five CBSAs with the highest forecasted growth in telehealth volumes between 2022 and 2030, females were projected to drive over 70% of telehealth demand during that timeframe. Given females were consistently the highest of telehealth patients among all utilization groups during the pandemic, the “no pandemic” projections align with actual and likely future trends.

The fact is telehealth suppliers are competing for a smaller share of the population than was originally anticipated. Both traditional health systems and new retail entrants must not only discern who their current users are in order to retain patient volume but also identify consumer segments they have not yet reached. Connecting with those patients will require concerted efforts to understand whether those patients opt against telehealth due to knowledge, awareness, preference, price, or something else.

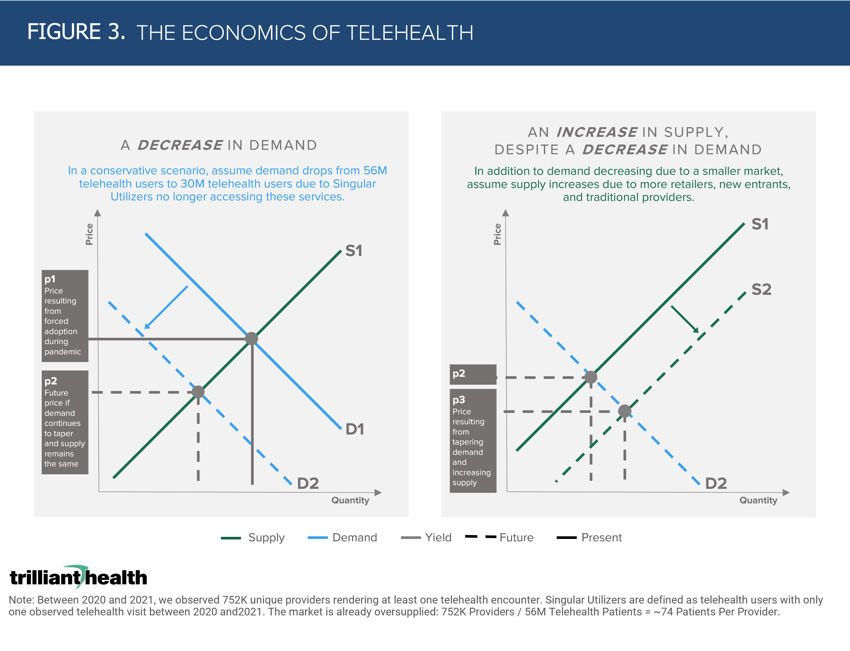

Telehealth supply continues to exceed demand. While investments in tele-enabled companies will continue to grow and the number of niche suppliers increase, demand in the overall telehealth market continues to shrink (Figure 3).

Simply plotting the potential future supply and demand scenarios can allow stakeholders to understand how changes in telehealth supply and demand will impact price, cost of delivery, and total addressable market for telehealth to define the long-term telehealth economy and reach an eventual post-pandemic equilibrium.

Thanks to Kelly Boyce and Katie Patton for their research support.

- Virtual Care

- Cost of Care

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+ Professional.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study, subscribe to Compass+ Professional for $199 per year.

Sign Up for Compass+